Iron ore price stable while China prepares for ‘possible storm’

The officials said local-level government agencies and state-owned enterprises have been instructed to step in only at the last minute should Evergrande fail to manage its affairs in an orderly fashion, the WSJ reported.

China’s second-biggest property developer has $83.5 million in dollar-bond interest payments due on Thursday on a $2 billion offshore bond and a $47.5 million dollar-bond interest payment due next week.

Both bonds would default if Evergrande fails to settle the interest within 30 days of the scheduled payment dates.

Iron ore futures pared Wednesday’s gains as sentiment picked up following Evergrande deal to settle interest payments on a domestic bond.

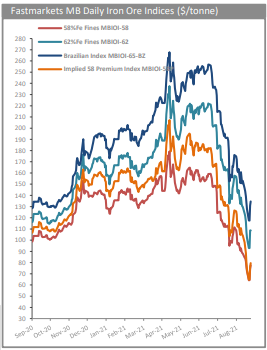

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $108.67 a tonne.

Dalian’s January iron ore closed 3.9% higher at 667 yuan ($103.33) a tonne, after earlier hitting 685.50 yuan ($106.20), its loftiest since Sept. 16.

Rebar rose 1.3% on the Shanghai Futures Exchange, while hot-rolled coil slipped 0.8%. Stainless steel gained 1%.

“The rise in steel rebar futures highlights that China’s steel production cuts are having an outsized impact on China’s steel market,” Commonwealth Bank of Australia analyst Vivek Dhar said.

“These cuts remain the key risk to further drops in iron ore prices.”

(With files from Bloomberg and Reuters)