Wheaton president and CEO hailed the deal for adding to the company’s metals stream. For five years beginning in 2021, attributable silver production is forecast to average 820,000 oz. per year.

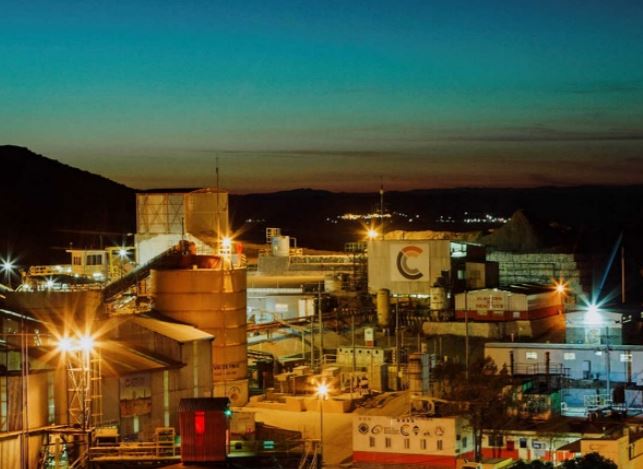

For Capstone, the deal is “transformational,” said chief executive Darren Pylot. It gives the company “one of the lowest debt positions amongst base metal producers at a time when we are expecting significant copper production and cash flow growth. The $150 million for 50% of Cozamin’s silver is a strong validation of the ultimate mine life potential we expect to demonstrate through further resource to reserve conversion and ongoing exploration.”

For five years beginning in 2021, attributable silver production is forecast to average 820,000 oz. per year

Capstone will use the fresh funding to pay down net debt to zero. The company will also lower its cost of capital and increase free cash flow potential. It also has plans to build a paste backfill plant at Cozamin and an Eriez HydroFloat coarse particle circuit at the Pinto Valley project.

Wheaton will pay $150 million to Capstone upon closing of the agreement, expected in January 2021. It will then make ongoing payments equal to 10% of the silver spot price per ounce upon delivery. The agreement is effective Dec. 1, 2020.

Other projects at Cozamin include the on budget and ahead of schedule completion of a one-way haulage ramp to debottleneck underground traffic earlier this month. A prefeasibility study for pillar extraction is due for release in the first quarter of next year. The results of drilling both east and west of the Main footwall zone should also be available about that time.

Capstone share price rose 13 cents to C$2.11 when news of the streaming arrangement was released yesterday.

(This article first appeared in The Northern Miner)