Posthaste: Canadians jump into variable mortgages, bet on ‘short-term pain for long-term gain’

Spring real estate season starts early as homebuyers look to take advantage of lower prices

Article content

Article content

January is usually a pretty quiet month for homebuying. Not so this year as sales have surged well ahead of the spring home hunting season.

One Bay Street economist, bemused by the early activity, took a stab at figuring out why that’s happening. What Bank of Nova Scotia‘s Farah Omran came up with is that potential homebuyers are trying to take advantage of still-falling home prices, while at the same time choosing variable-rate mortgages on the assumption that the “short-term pain” of higher rates will be worth it for the “long-term” gain of lower rates when the Bank of Canada finally makes its cuts.

Advertisement 2

Story continues below

Article content

“The housing market has seen a surge in sales in recent months, even though the Bank of Canada has not yet started cutting its policy rate or even signalled that a cut is imminent as many have been expecting,” she said in a note on Feb. 14. “This surge in activity is sooner than we expected, particularly as it well precedes the spring season, which is typically a hot season for the housing market.”

Canadian home sales rose 22 per cent in January, signalling a possible “turnaround” in the sector, according to the Canadian Real Estate Association (CREA). The jump came on the heels of an 8.7 per cent increase in December. Despite the increase in activity, national benchmark prices in January fell 1.2 per cent from the month before, with CREA noting that prices continued to drop in areas where sales rose the most.

Omran said she believes more Canadians are taking out variable-rate mortgages and swallowing higher interest rates in the early going on the assumption that the Bank of Canada will cut rates later this year. Variable rates rise and fall with the prime rate, which is based on the central bank’s benchmark overnight lending rate.

Article content

Advertisement 3

Story continues below

Article content

Variable-rate mortgages, currently sitting at roughly seven per cent, had been out of favour. During the five-year period from January 2018 to December 2023, new originations for variable-rate mortgages slumped to a low of 4.6 per cent in July 2023. The picture has drastically changed. In December 2023, such mortgages accounted for 20 per cent of new originations, according to Scotiabank.

“Buyers are pricing in a sure increase in house prices once cuts begin and are therefore choosing variable mortgages now, betting that the cuts will be significant enough to offset the higher initial payments and reduce the overall cost of the mortgage over the long term,” Omran said.

The second part of her theory has to do with the price of housing. She said homebuyers are jumping on lower prices now on the expectation that prices will rise as more people flood into the market once interest rates start to drop.

Certainly, past consumer behaviour has borne that out.

The housing market took off when Bank of Canada governor Tiff Macklem signalled a “conditional pause” in interest rate hikes in early 2023. From February to early June, when Macklem restarted his hiking campaign, the average national home price rose 10 per cent, according to CREA data, as people rushed to take advantage of lower mortgage rates.

Advertisement 4

Story continues below

Article content

“Given the widespread expectation, of everyone from the BoC to CREA to most economics shops, that rate cuts will eventually lead to an uptick in activity and prices, this is a reasonable bet on the part of buyers,” Omran said.

Of course, rate cuts are the key, but stronger-than-expected inflation and jobs data have forced economists to revise their expectations of when they will happen.

Some had called for the first rate cut to come in April, which would start undoing the cycle of 10 increases that lifted rates to five per cent. Now, many economists forecast a first cut in either June or July. Scotiabank is calling for the first cut late in the third quarter, Omran said in an email, and 75 basis points of cuts compared with the bank’s initial call for cuts totalling 100 basis points starting in the second quarter.

“However, what seems to have brought this process forward is buyers’ willingness to put up with some short-term pain for long-term gain,” she said.

Posthaste is taking a break Monday for Family Day. We’ll be back in your inbox on Tuesday, Feb. 20.

Sign up here to get Posthaste delivered straight to your inbox.

Advertisement 5

Story continues below

Article content

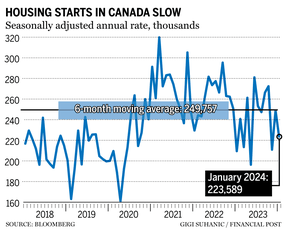

Canada Mortgage and Housing Corp. says the annual pace of housing starts in January fell 10 per cent compared with December.

The national housing agency says the seasonally adjusted annual rate of housing starts came it at 223,589 units for the first month of the year compared with 248,968 for December 2023.

The decrease came as the annual pace of urban housing starts fell 11 per cent to 208,119 units, with the pace of multi-unit urban starts down 14 per cent at 164,789 units and single-detached urban starts up 0.08 per cent at 43,330 units.

The annual rate of housing starts in Toronto were up 179 per cent, boosted by an increase in multi-unit starts; however, Montreal fell 28 per cent and Vancouver dropped 55 per cent due to drops in multi-unit starts.

The annual rate of rural starts was estimated at 15,470.

The six-month moving average of the monthly seasonally adjusted annual rates of housing starts in January was 244,827, down two per cent from 249,757 units in December 2023.

— The Canadian Press

- Commissioner of Competition v. Cineplex Inc. hearing before the Competition Tribunal regarding the competition bureau’s deceptive marketing practices case against the theatre chain.

- Canadian Radio-television and Telecommunications Commission hosts a five-day hearing for its review of the wholesale high-speed internet access framework

- Today’s data: Statistics Canada releases data on wholesale sales and international securities transactions for December; U.S. Census Bureau releases data for housing starts and building permits for January.

- Earnings: Air Canada, TC Energy Corp.

Advertisement 6

Story continues below

Article content

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Recommended from Editorial

Relying on the Canada Revenue Agency’s Auto-fill can be costly as this tax case over missing income shows. Read tax expert Jamie Golobek’s column here.

***

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at [email protected] with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 7

Story continues below

Article content

McLister on mortgages

Flummoxed by the mortgage market? Robert McLister is here to help. Today, the Financial Post is launching a new column by the mortgage strategist that will help our readers navigate the complex sector, from the latest trends to complex financing opportunities they won’t want to miss. To kick it off, Rob runs down the 10 things he’ll be watching most closely this year, from the rate-cut waiting game to the rise of the six-month mortgage and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments