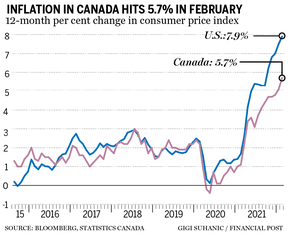

Inflation surges to 5.7%, adding pressure on Bank of Canada to accelerate rate hikes

Kevin Carmichael: The latest CPI numbers will stoke speculation that the Bank will play catch-up and raise its rate by half a point in April

Article content

Inflation in February accelerated from a rate that was already way too fast, adding to the pressure on Bank of Canada governor Tiff Macklem to take a steeper path to higher interest rates.

Advertisement 2

Story continues below

Article content

Statistics Canada’s consumer price index increased 5.7 per cent from February 2021, the most since August 1991, the agency said on March 16. The January increase was 5.1 per cent.

The central bank appears to have misjudged the upward pressure on prices, as it predicted in January that the consumer price index would average year-over-year increases of 5.1 per cent in the first quarter. The average over the first two months is 5.4 per cent, an alarming number for a country that had grown used to inflation being a non-story.

Most of the heat in February came from familiar places. Gasoline and food prices surged again, while Statistics Canada’s measure of shelter costs rose at its fastest year-over-year pace since August 1983.

Advertisement 3

Story continues below

Article content

There was more evidence inflation was spreading, as Statistics Canada’s measure of inflation, excluding gasoline, increased 4.7 per cent from February 2021, the most since the agency created the gauge in 1999. The previous record was set a month earlier, when the index increased 4.3 per cent.

The Bank of Canada aims to keep the index advancing at an annual rate of about two per cent, the midpoint of a comfort zone of one per cent to three per cent. Inflation, as measured by the CPI, which bundles hundreds of goods and services to come up with a broad cost of day-to-day living, has been outside the high end of the Bank of Canada’s range since April, an unusually long stretch of time to be so far off target.

Policy-makers at the central bank think most of the inflation is the result of factors over which they have little control. The global economy recovered from the initial shock of the pandemic faster than most expected, causing a mismatch between supply and demand. Drought and other extreme weather in major agricultural regions led to poor yields, driving up the cost of food. Now, war in Europe is stoking oil and other commodity prices anew.

Advertisement 4

Story continues below

Article content

Higher interest rates won’t do anything about those things. But they should cool demand, which, if not the major driver of inflation, is nonetheless strong. Employment fully recovered from the recession in the autumn, and the jobless rate fell to 5.5 per cent last month, one of the lowest rates on record. Gross domestic product returned to the level the Bank of Canada estimates is consistent with non-inflationary growth at the end of 2021, implying that stimulus is no longer needed.

“The economy is now in a place where moving to a more normal setting for interest rates is appropriate,” Macklem said in a speech on March 3, a day after he and his deputies lifted the benchmark interest rate a quarter point to 0.5 per cent, the first increase in more than three years.

Advertisement 5

Story continues below

Article content

A benchmark interest rate of 0.5 per cent is still extraordinarily low. Some on Bay Street, including Jean-François Perrault, the former Finance official who now leads Bank of Nova Scotia’s economics department, think the central bank has fallen behind the curve and is in danger of losing its grip on inflation.

The latest acceleration in inflation will stoke speculation that the Bank of Canada will play catch-up when it next meets to consider policy in April, and raise the benchmark rate a half-point, instead of the typical quarter-point move.

“Price growth has now exceeded the Bank of Canada’s target range for 11 consecutive months, and the central bank is widely expected to hike rates again on April 13, with another five increases to follow over the course of the year,” Karl Schamotta, chief market strategist at Cambridge Mercantile Corp., said in a note to clients.

• Email: [email protected] | Twitter: CarmichaelKevin

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Advertisement

Story continues below