Live updates: Why did the Bank of Canada hold and what’s next?

Check here for the latest news and analysis as the Bank of Canada and the U.S. Federal Reserve announce decisions today

Article content

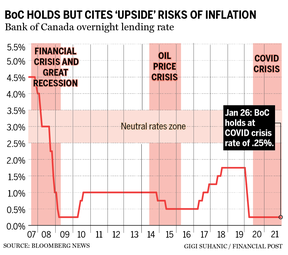

The Bank of Canada defied market expectations today and held its rate at 0.25 per cent. The U.S. Federal Reserve announces its decision at 2 p.m. We will have full coverage of the decisions, the press conferences and the market reactions right here.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

11:00 a.m.

Watch the press conference on now

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

10:51 a.m.

‘Policy misstep’

Simon Harvey, senior analyst at Monex Europe:

“The decision, in our view, is a policy misstep from the Governing Council and is one that could prove costly later down the line. By effectively loosening financial conditions at today’s meeting, the BoC risks emboldening near-term inflation expectations and flaming the fire underneath the housing market. This could result in lift-off taking the shape of a 50bps hike at March’s meeting should inflation expectations continue to rise and labour market metrics remain resilient to Omicron impacts in Q1. In analogous terms, should the data continue to print in a similarly robust fashion to Q4, the Bank has effectively swapped out a soft landing for the Canadian economy in favour of cutting the strings and reaching for the emergency parachute. With a 25bps hike unlikely to have caused too much damage to the economic recovery even at a time of activity restrictions in Ontario and Quebec, the Bank now runs the risk of having to put the genie back in the bottle with regards to inflation expectations. With real rates in negative territory, core inflation at a 30-year high, and financial markets giving the BoC a free pass, the question is why didn’t they take it? Governor Macklem will have a lot of explaining to do in what is set to be his hardest press conference to date.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Kevin Carmichael

10: 47 a.m.

The press conference with Bank of Canada Governor Tiff Macklem and Carolyn Rogers, senior deputy governor, is up next at 11 a.m. Watch it here and get live analysis from Kevin Carmichael.

10:40 a.m.

Tu Nguyen, economist at RSM Canada:

“Amid a strong recovery with robust demand, striking labour shortages, and inflation at 30-year high, a rate hike in March will be all but necessary to tame inflation and inflation expectations.

“Demand for labour is at the highest level in two decades, and the economy is well on track to achieve maximum sustainable employment. While wage gains still trail inflation for now, they are picking up rapidly across industries.

“Increased economic activity and geopolitical concerns will increase the demand for energy at a time of limited supply, and as a result, the Canadian dollar will remain strong.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“In a world still plagued by the pandemic and uncertainties, the Bank of Canada proves to still favour an orderly and gradual approach in its monetary policy. ”

— Kevin Carmichael

10:30 a.m.

The Bank of Canada could lift interest rates as soon as its next meeting in March, said Capital Economics senior economist Stephen Brown.

“The Bank of Canada kept policy unchanged today but now judges that the conditions to start raising interest rates have been met, suggesting that it will hike its policy rate at the next meeting in March,” he wrote in a client note.

Markets had placed bets that the central bank would lift rates today as inflation soars, gross domestic product appears stronger than expected and the labour market has now recovered to the point where it’s tightening and adding wage pressures.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Policy-makers also telegraphed they expect inflation to run above the bank’s two per cent target in 2023, which could suggest a faster pace of hiking. Some economists expect the bank to lift rates as much as six times in 2022.

— Bianca Bharti

10: 28 a.m.

Bond yields immediately took a dip following the Bank of Canada announcement after the central bank kept the overnight lending rate unchanged at 0.25 per cent.

The 5-year bond fell by over 0.060 per cent from 1.632 per cent in the minutes following the announcement while the 10-year bond fell over 0.040 per cent from the 1.794 per cent rate it held this morning.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

10:11 a.m.

The Bank of Canada has gone against market expectations and held its benchmark rate at 0.25 per cent. But it set the stage for a hike in coming meetings saying that economic slack has been absorbed and forecasting that inflation will remain higher than expected.

Read the Bank of Canada’s official statement here

Here are the highlights from the Bank’s quarterly report on the economy:

Key paragraph: “While the upside and downside risks to the bank’s inflation projection are viewed as roughly balanced, the upside risks are of greater concern. Until inflation moves significantly lower, there is an elevated risk that Canadians will start to believe that inflation will stay high over the long term. Higher inflation expectations could in turn lead to more pervasive labour costs and inflationary pressures could become embedded in ongoing inflation.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Inflation outlook: The Bank of Canada sees year-over-year increases in the consumer price index (CPI) averaging 5.1 per cent in the first quarter, and then settling down over the rest of the year. The two-year outlook sees CPI inflation of 4.2 per cent this year and 2.3 per cent in 2023. The central bank’s target is two per cent.

The growth outlook: The Bank of Canada cut its forecast for economic growth in 2022 to four per cent from an estimate of 4.3 per cent in October. The change was mostly the result of plugged revised historical data into the central bank’s models. Policy-makers actually feel pretty good about the state of the economy. They concluded that the labour market has fully recovered from the damage caused by the COVID recession, and they described exports and investment intentions as “robust.” They predict the economy will push through the headwinds caused by the fifth wave of COVID-19 and grow at an annual rate of two per cent in the first quarter. Their calculations suggest gross domestic product accelerated to annual rate of growth of 5.8 per cent in the fourth quarter, much better than the four-per-cent rate they were anticipating in the fall.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Output gap closes: One of the ways the Bank of Canada assess whether inflationary pressures are building is its estimate of the “output gap,” which is the difference between actual economic output and the level of GDP that the central bank associates with the economy’s non-inflationary speed limit. Policy-makers reckon the gap has now closed, putting the estimate at something between -0.75 per cent and 0.25 per cent.

China stumbles: The Bank of Canada slashed its outlook for Chinese economic growth this year to 3.8 per cent from a previous estimate of 5.3 per cent — a huge drop from 8.1 per cent in 2021. Canada’s central bankers anticipate that the correction in China’s property markets will result in some of the weakest growth the country has experienced in decades.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Kevin Carmichael

10 a.m.

It’s a hold!

9:28 a.m.

Money markets this morning see a roughly 65 per cent chance the Bank of Canada will boost the overnight rate to 0.5 per cent from the current record low 0.25 per cent. Analysts surveyed by Reuters are less certain, with 77 per cent seeing the central bank holding until at least March.

9:18 a.m.

The era of ultra-low pandemic interest rates, which has helped drive Canadian home prices to all-time highs, could end today. That could put Canadians, one of the most indebted populations, at risk.

Just how significant of an effect higher rates will have will depend on how quickly the central bank moves.

Mortgage expert Rob McLister told the Financial Post that those holding variable-rate mortgages will be hit first, with the costs passed along between one day and one week following a rate hike.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

McLister added that a 0.25 per cent rate increase, which is the amount the market is expecting as a first hike, would have no impact on qualifying for a mortgage since the minimum qualifying rate is already more than 235 basis points over five-year fixed rates.

“For prospective prime borrowers, discounted five-year fixed rates would have to jump over 36 basis points for borrowers to start facing qualification challenges. And it would only be an issue for more highly indebted mortgage applicants (I’d estimate roughly 1 in 5 mortgage applicants),” McLister wrote in an e-mail.

Stephanie Hughes’ breaks down how homeowners will fare during the hiking cycle.

9:03 a.m.

What will higher interest rates do to Canada’s already lacklustre business investment?

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Some might call Canada’s business investment disastrous, especially since oil prices collapsed in 2014. Company spending on machinery, software and non-residential property, like factories, was under 10 per cent of Canada’s $2-trillion gross domestic product (GDP) in the third quarter, down from 13 per cent in 2014.

In the U.S. it’s nearly 15 per cent.

The pandemic hasn’t helped, with executives remaining more fiscally conservative amid the chaos. As the Bank of Canada moves to tame price pressures by raising borrowing costs, there’s a risk that higher interest rates could dampen investment intentions.

But economists said that Bank of Canada Governor Tiff Macklem probably can avoid a negative shock to business sentiment by communicating clearly and ratcheting up borrowing costs slowly.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

8 a.m.

What?

The Bank of Canada’s first interest-rate announcement of 2022 .

When?

The Bank of Canada will release its policy statement and quarterly economic report at 10 a.m. Ottawa time . Keep an eye on financialpost.com for real-time coverage throughout the day.

Who?

Bank of Canada Governor Tiff Macklem took over from Stephen Poloz in June 2020. By then, the central bank had done about all it could to reverse an epic recession. It had dropped the benchmark interest rate to 0.25 per cent from 1.75 per cent at the start of year. It had pledged to swap hundreds of billions of dollars worth of financial assets for cash. It had begun creating money to buy government bonds, Canada’s first experiment with quantitative easing, or QE. But there was still one weapon left in the arsenal that Macklem liked. He used his first interest-rate announcement to pledge to keep the benchmark rate near zero until sometime in the second half of 2022, conditional on the outlook for inflation. Central banks typically avoid making explicit promises of that nature. Among the reasons, as Macklem has experienced in recent weeks: the future is hard to predict.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Who else?

Carolyn Rogers , the former international financial regulator who was appointed senior deputy governor last year and started her job officially in mid-December, participated in her first round of policy deliberations. For the first time, Governing Council has seven members instead of the usual six. That’s because in July Macklem appointed Sharon Kozicki as a deputy governor to add some diversity to an all-male group as he waited for Rogers to finish her work at the Basel Committee on Financial Supervision in Switzerland. Macklem opted to leave a team of seven in place until one of his deputies resigns, at which point Governing Council will return to its typical roster of five deputies and one governor.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Why all the excitement?

The consumer price index (CPI) surged 4.8 per cent in December from a year earlier, the most in more than 30 years. The Bank of Canada’s agreement with the government requires it to keep the CPI advancing at an annual rate of about two per cent, the midpoint of a comfort zone of one per cent to three per cent. Inflation has been outside the high end of that band since April. That’s a long time to be so far off target. Prices of financial assets linked to short-term interest rates suggest that most traders anticipate an interest-rate increase today to keep inflation from getting even more out of hand. The biggest worry at the central bank is probably that consumers and suppliers will begin demanding higher wages and more money for the goods and services , respectively, because they think current price spikes are permanent. That’s how inflationary spirals start. The central bank probably wants to break that psychology.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Why aren’t Bay Street expectations of a rate increase universal?

One hundred and eighty-nine people died of COVID-19 on Jan. 24 , pushing total deaths since the start of the pandemic to 32,786. The health crisis isn’t over and Macklem might dislike the optics of raising interest rates while much of the country is in a state of semi-lockdown. There’s also his and the central bank’s reputations to consider . Remember that promise to keep the benchmark rate at 0.25 per cent until the second half of 2022? The Bank of Canada has already backtracked once; last fall, revised forecasts showed the economy was on track to reach its non-inflationary speed limit sooner than expected, and policy-makers advanced the timing of the first interest-rate increase since the start of the pandemic to the “middle quarters” of this year. The Bank of Canada’s next two policy announcements are March 2 and April 13. Would waiting another couple of months really make that much difference, especially when the central bank’s credibility could be at stake? Economists at Royal Bank of Canada, the country’s biggest lender, are among the minority of holdouts who think Macklem will wait until the spring. Much of the inflation is coming from supply-side factors such as China’s zero-tolerance policy for COVID-19 infections, which disrupts factory production and has forced the temporary closure of ports, and terrible weather in important agricultural regions. Higher interest rates in Canada will do nothing about any of that.

Where will interest rates be at the end of the year?

Higher than they are now , that’s for certain. Even the economists who think it would be a mistake to panic reckon the benchmark rate will need to rise by at least one percentage point this year. The jobless rate fell below six per cent in December , a rate many economists associate with full employment. Monetary policy is currently is set for an economic emergency and the emergency is over.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.