ETFs In Retirement Portfolios

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article is by Craig Israelsen, Ph.D., creator of the 7Twelve portfolio, consultant to 7Twelve Advisors, LLC and executive-in-residence in the Financial Planning Program at Utah Valley University.

Are ETFs suitable for use in retirement portfolios? The short answer is “yes, of course.” Let’s explain that answer.

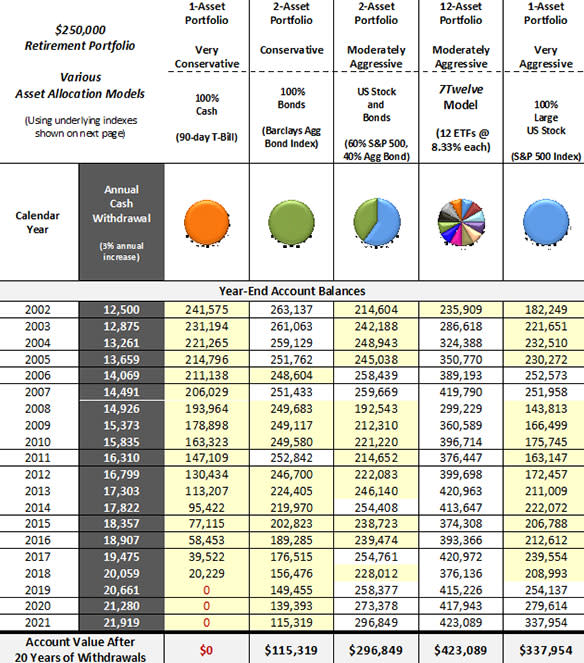

Shown in the table below are the results of a retirement portfolio survival test over the 20-year period 2002-2021. The starting balance was $250,000 with a 5% first-year withdrawal ($12,500), and the remaining 19 end-of-year annual withdrawals were inflated by a 3% cost of living adjustment (COLA). Thus, a total of $335,880 was withdrawn by the retiree over the 20-year period.

The first model was a 100% cash retirement portfolio (using the performance of 90-day T-bills over the 20-year period). This simplistic portfolio was included as a benchmark for the other retirement portfolios.

As can be seen, a retirement portfolio that invests solely in cash failed by year 17. It’s far too conservative, as seen by the fact that it went “underwater” (i.e., end-of-year balance went below the starting balance) after year 1, and never resurfaced. In the table, the yellow highlighting indicates a portfolio balance below the starting balance in year 1.

The next column in the table demonstrates an all-bond portfolio (using the returns of the Bloomberg Barclays Aggregate Bond Index). This portfolio survived the entire 20-year period and had an ending balance in year 20 of $115,319. Over the course of the 20-year period, it went “underwater” 14 times.

The next retirement portfolio was a mix of 60% large cap U.S. stock (S&P 500 Index) and 40% U.S. bonds (Barclays Aggregate Bond Index)—which is typically referred to as a “balanced portfolio.” It was rebalanced each year.

The 60/40 portfolio was underwater in 13 of the 20 years, but it finished intact, with an ending balance of $296,849. It’s rather amazing to start with $250,000, withdraw a total of $335,880, and finish with more than you started with.

Next, we examine a multi-asset retirement portfolio that included 12 different ETFs representing 12 asset classes in equal portions (8.33% each). The multi-asset portfolio (known as the 7Twelve Portfolio) was rebalanced annually. The asset classes included large U.S. stock, midcap U.S. stock, small cap U.S. stock, non-U.S. developed stock, emerging stock, real estate, natural resources, commodities, U.S. bonds, U.S. TIPS, non-U.S. bonds, and cash.

The 12-ETF 7Twelve retirement portfolio went underwater in year 1, but never again after that. It finished the 20-year period with an ending balance of $423,089—or 42% more than the 60/40 portfolio. This outcome is all the more impressive considering that the ETFs in this analysis have expense ratios and the other four retirement models are based on index returns—which don’t have an expense ratio.

Finally, a retirement portfolio consisting of 100% large cap U.S. stock (S&P 500 Index) was analyzed. It was underwater 15 times over the 20-year period. Even so, it survived intact and had an ending balance of $337,954.

That’s all fine and good after the fact. But the lived experience for the retiree over the 20-year period was less than comfortable. How could they know at the end of 2008 when the portfolio’s balance had eroded to $143,813 that it would recover and be comfortably above the starting balance by the end of 2021?

The “investor experience” along the way really matters.

This brief analysis demonstrates that retirees stand to benefit from more, rather than less, diversification in retirement. Broadly diversified portfolios are easily built using a wide variety of ETFs. And cheaply too. The overall expense ratio for the ETF-based 7Twelve portfolio in 2022 is 26 basis points.

20-Year Retirement Portfolio Survival Test (2002-2021)

(For a larger view, click on the image above)

$250,000 starting balance on January 1, 2002 with annual rebalancing

5% initial withdrawal and 3% annual COLA

Total 20-year withdrawal of $335,880

Shaded area indicates account is “underwater” (less than starting balance of $250,000)

7Twelve® is a registered trademark belonging to Craig L. Israelsen. The multi-asset portfolios were rebalanced at the start of each year. Raw data source: Steele Mutual Fund Software, calculations by author.

Recommended Stories