The bullish sentiment was defined by Goldman Sachs, which called the metal the “new oil” in a May report.

Meanwhile, the biggest copper mining project in decades began production in May. In a turbulent year, here are the top copper stories of 2021.

#1 Chile

The world’s top producer decided to rewrite its Pinochet-era constitution that underpinned nearly three decades of mining growth in the South American nation.

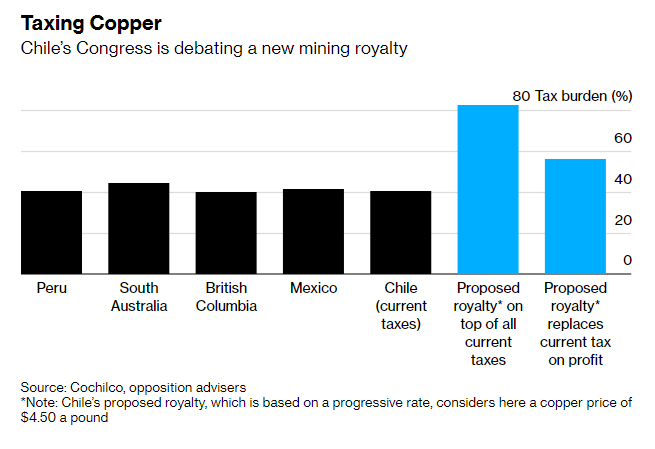

A new taxes and royalties bill already approved by the Senate could, if unaltered, put at risk some 1 million tonnes of annual output, representing around 4% of global copper supply.

The legislation, which faces multiple procedural hurdles, would impose a royalty as high as 75% on sales of copper to pay for social programs.

Companies including BHP say the bill as it stands — with sales tax brackets that increase as metal prices rise — would derail investments.

With the election of leftist president Gabriel Boric in December, the bill could become law.

Boric, a 35-year-old former law student, vowed during his campaign to bury Chile’s “neo liberal” economic model. Although he later softened his message, he has kept the idea of giving the State a more active role in the sector, as well as higher royalties.

During his victory speech, Boric reiterated he would oppose mining initiatives that “destroy” the environment, particularly the controversial $2.5 billion Dominga copper and iron ore project that was approved this year.

“Destroying the world is destroying ourselves. We do not want more ‘sacrifice zones’, we do not want projects that destroy our country, that destroy communities and we exemplify this in a case that has been symbolic: No to Dominga,” he said.

Chile’s copper output sank to a seven-month low in September, on the back of labour disruptions, including an almost one-month strike at Codelco’s Andina mine near the capital Santiago.

#2 Peru

Neighboring country Peru, the second-largest producer of copper in the world also saw the rise of a new left-wing leader.

In June, socialist Pedro Castillo won a long and tense presidential election battle.

Castillo says he wants to increase spending on healthcare and education by raising the funds from mining tax hikes, redistributing profits to Andean communities like those around the huge Las Bambas project, owned by China’s MMG.

The promises are now being tested, with protests and blockades at Las Bambas in the country’s south straining government negotiators, a reflection of wider tensions between indigenous communities and the key mining sector.

The government and one local community agreed on a temporary truce last week after a three-week-long road blockade of a key transport road in the region of Chumbivilcas almost led to a shutdown of the mine that produces some 2% of global copper.

But tensions remain high, with threats of further blockades as critics say the leftist government has not lived up to its promises to voters in mining regions, who bolstered his campaign.

Chile and Peru together constitute close to 40% of the world’s copper production.

# 3 Kamoa-Kakula

While top producer South America saw turbulence in 2021, Canada’s Ivanhoe Mines (TSX: IVN) announced the beginning of operations at its massive Kamoa-Kakula project in the Democratic Republic of Congo (DRC) months ahead of schedule.

Kakula, the first mine planned at the concession, is initially forecast to generate 3.8 million tonnes of ore a year at an average feed grade “well in excess of 6% copper” over the first five years of operation, the company said.

Ivanhoe founder Robert Friedland believes the project will become the world’s second-largest copper mine and also the one with the highest grades among major operations.

See how Kamoa-Kakula fares among the world’s top 10 biggest copper mines:

The Vancouver-based company has also vowed to produce the industry’s “greenest” copper, as it works to become the first net-zero operational carbon emitter among the world’s top-tier copper producers.

# Chinese investment

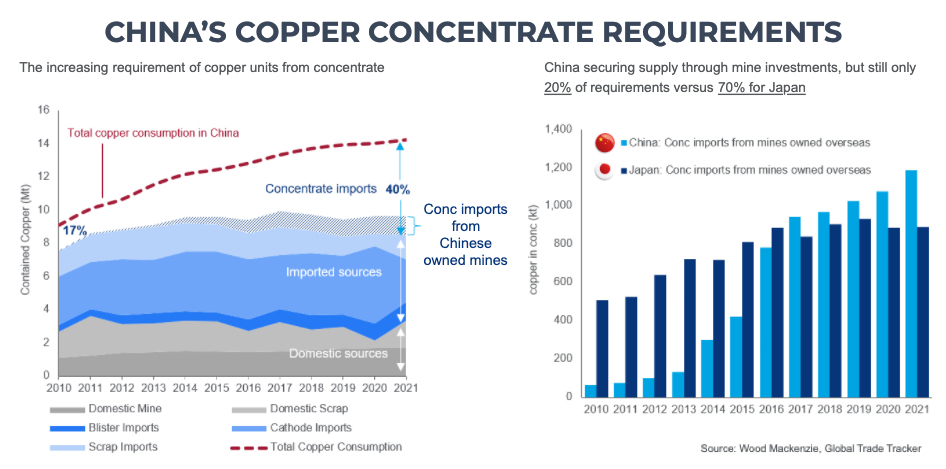

China consumes nearly 14 million tonnes of copper each year – more than the rest of the world combined. But domestic supply last year was only around 2m tonnes, including scrap, and mined output has been stagnant for years.

In a presentation at the Wood Mackenzie LME Forum, Nick Pickens, research director for copper markets, showed two graphs that put China’s significant copper supply challenges in perspective.

Imported concentrate, including from roughly 30 Chinese-owned mines in Africa and elsewhere, now supplies 40% of the country’s needs, a share that has more than doubled over the past decade as imports set fresh records every year.

Over and above direct foreign investment in mining projects around the world, China has splashed more than $16 billion on buying overseas copper companies and assets since 2010.

Glencore’s disposal, under some duress, of Las Bambas in Peru to a Chinese consortium, China Moly’s 2016 acquisition of the Tenke Fungurume mine from Freeport for $2.65 billion and Zijin Mining’s joint venture with Ivanhoe Mines on the Kamoa-Kakula mine, both in the Congo, are three high-profile examples.

#2022

Higher supplies and softer demand are expected to cool copper prices next year.

Expectations of slower demand growth in China and rising supplies from operations such as Anglo American’s Quellaveco mine in Peru are likely to keep prices subdued next year.

“Long-term prospects for copper remain bullish, but the market looks set to be on pause next year compared to this year,” said Karen Norton, senior base metals analyst at Refinitiv, who expects a modest copper surplus next year.

Goldman Sachs sees fears of China’s property slowdown as overblown, saying gains from EVs, renewables and electrical network investment outweigh the policy-moderated drag from property and machinery.

Mine supply is expected to rise 3.9% to nearly 22 million tonnes next year, according to the International Copper Study Group, which expects a surplus of 328,000 tonnes in the refined market.

Bank of America expects demand to hold firm next year and only sees a surplus in 2023. It forecasts prices to average $9,813 a tonne next year and $8,375 a tonne in 2023.

Demand for copper from efforts to decarbonise will intensify, with JPMorgan forecasting it will account for more than 40% of overall demand growth next year in the 25-million-tonne market.

JPMorgan forecasts total copper demand from energy transition rising from 1.8 million tonnes this year, to more than 3 million tonnes by 2025.

(With files from Reuters and Bloomberg)