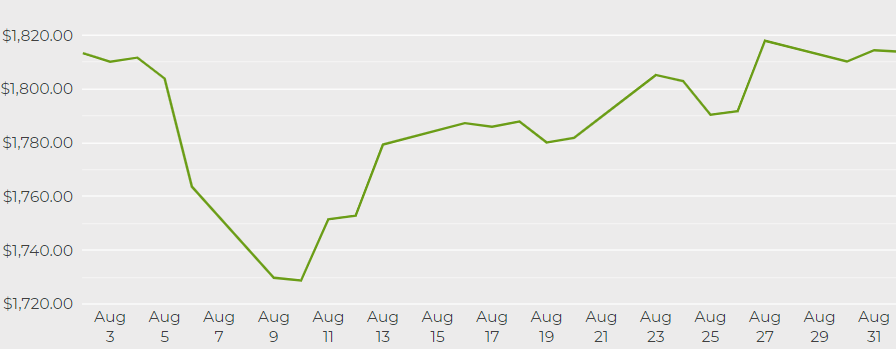

Gold price rises to 4-week high on US jobs data miss

[Click here for an interactive chart of gold prices]

Data on Friday showed the US added 235,000 jobs in August, the fewest in seven months and well below economists’ estimates. The US dollar fell after the report, boosting gold, though the metal pared some of its gains as Treasury yields climbed.

Bullion has struggled this year amid a global economic rebound from the pandemic, which has raised the prospect of central banks reining in massive monetary stimulus. The latest US jobs print eases those concerns and may reflect growing fears about the rapidly spreading covid-19 delta variant.

The “headline miss, especially given the decline in contribution from leisure and hospitality, fits with disruptions from delta,” Marcus Garvey, head of metals strategy at Macquarie Group, wrote in a note to Bloomberg.

“Gold’s initial reaction makes sense, but if yields don’t reverse, it’ll struggle to hold onto the gains,” he added.

“Gold received a welcome boost from a much weaker (jobs) report,” Saxo Bank analyst Ole Hansen told Reuters, adding:

“But the fact that gold has failed to break above resistance at $1,835 could indicate some scepticism about whether this means peak growth and delayed taper.”

The focus now turns to economic data to be released ahead of the Fed’s meeting later this month. Any more indications that the recovery is stuttering may give the central bank cause to delay tapering its asset purchases.

Fed Chair Jerome Powell said last week a reduction in monthly bond purchases could begin this year, with the labor market making “clear progress.”

(With files from Bloomberg and Reuters)