PBOC Injects $14 Billion as Evergrande Debt Woes Roil Market

(Bloomberg) — China boosted its injection of short-term cash into the financial system in a sign the authorities are seeking to soothe market nerves frayed by concern over quarter-end funding needs and China Evergrande Group’s debt crisis.

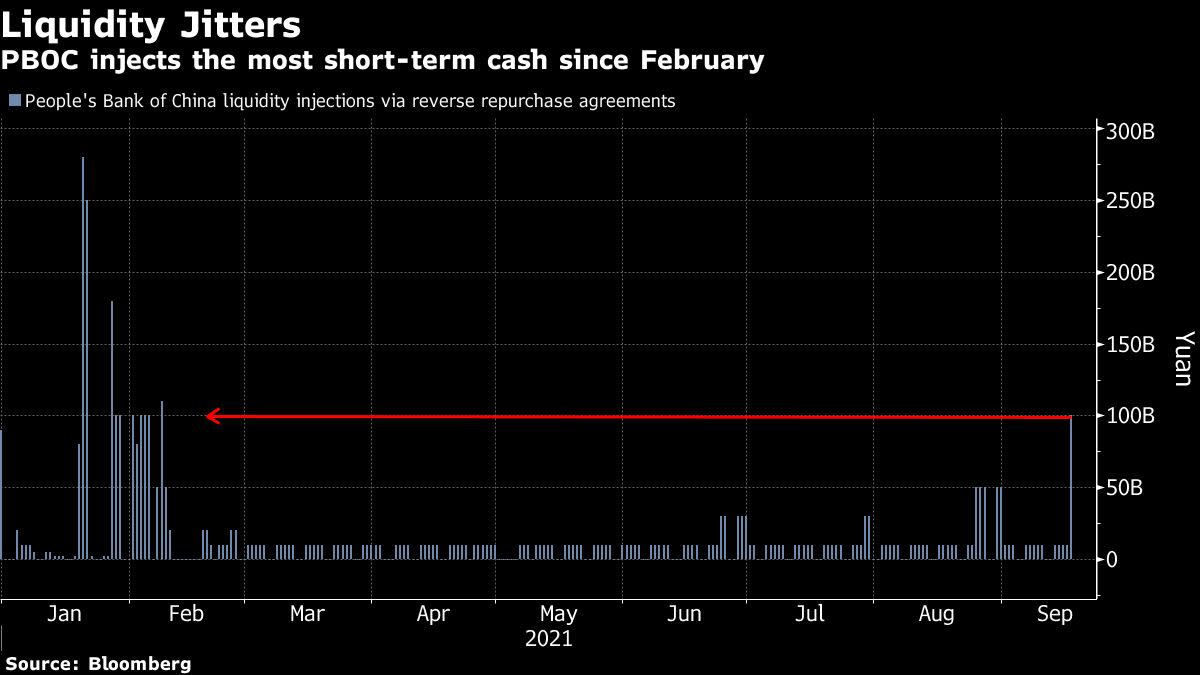

The People’s Bank of China injected 90 billion yuan ($14 billion) of funds on a net basis via seven-day and 14-day reverse repurchase agreements on Friday, the most since February. Today was the first time this month the authorities added more than 10 billion yuan of short-term liquidity into the banking system on a single day.

The operation comes as the crisis facing Evergrande fuels concern over the health of the nation’s real estate and credit markets. Adding to the stress is a seasonal spike in demand for cash as banks become less willing to lend toward quarter-end as they prepare for regulatory checks. Liquidity also tends to diminish at this time of year in the run-up to a one-week holiday at the start of October.

“Avoiding a systemic liquidity squeeze is the absolute priority for the PBOC and it has means to do so,” Societe Generale SA economists led by Wei Yao wrote in a research note. “A Lehman-style financial-market meltdown is not our top concern, but an extended and severe economic slowdown seems more probable.”

Concern over Evergrande comes at a time when China’s economy is already slowing. Aggressive movement controls put in place to curb Covid-19 outbreaks have hurt retail spending and travel, while measures to cool property prices have also taken their toll. On Wednesday, the country reported a slowdown in retail sales in August, along with weaker growth in industrial production and fixed-asset investment.

The PBOC is seeking to strike a balance between stimulating the economy and making sure its cash injections don’t result in asset bubbles. Since July, the PBOC has refrained from pumping in additional medium-term liquidity into the financial system as policy loans come due.

On Friday, the central bank injected 50 billion yuan through its seven-day reverse repos, and another 50 billion yuan via 14-day contracts, which haven’t been used since February. Some 10 billion yuan came due Friday.

“It’s fair to say that the Evergrande situation and its repercussions on the broader property market will have a far greater direct impact on Chinese growth than any of the other regulatory crackdowns,” said Alvin Tan, head of Asia foreign-exchange strategy at Royal Bank of Canada in Hong Kong. “I would not be surprised that the PBOC is acting to contain the fallout in the money markets.”

The uncertainty over Evergrande is spurring China watchers to game out potential worst-case scenarios as they contemplate how much pain the Communist Party is willing to tolerate. Pressure to intervene is growing as signs of financial contagion increase.

Still, the PBOC’s operations have yet to push money-market rates lower. The seven-day repo rate, an indicator for interbank borrowing costs, jumped 12 basis points Friday to 2.39%, the highest level since July.

“The PBOC again proves to the market it will be supportive, but only if there is a need,” said Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp in Singapore.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.