Greenland-focused Greenroc IPOs on the AIM

GreenRoc raised £5.1 million ($6.9 million) in its IPO, issuing 111.2 million shares at 10p each, implying a market capitalization of £11.1 million ($15.21 million).

In its IPO, GreenRoc raised £5.1 million ($6.9 million). It issued 111.2 million shares at 10p each, implying a market capitalization of £11.1 million ($15.21 million).

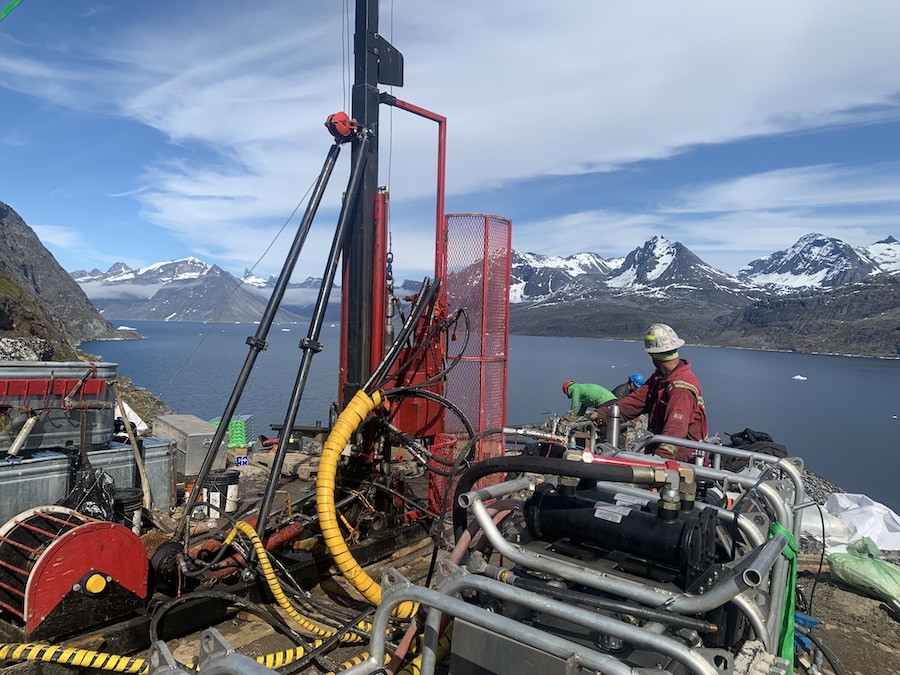

GreenRoc’s assets include the Thule Black Sands ilmenite project, the Amitsoq graphite project (considered one of the highest-grade graphitic carbon projects globally), the Melville Bay iron project and the Inglefield multi-element project.

Of particular focus for GreenRoc are the graphite and titanium markets, which are designated as critical minerals by the EU and the USA. Company data suggests demand for graphite increasing by 2,500% by 2040, driven by the emerging electric vehicles sector.

Alba will retain a 54% shareholding in the company.

“With today’s IPO, we can offer investors an opportunity to gain exposure to a diversified mix of high-grade commodities designated as critical minerals by the EU and the USA, in a jurisdiction which is both strategically located for multiple end-markets and which remains supportive of sustainable resource development,” commented CEO Kirk Adams in the company’s first day of trading report.

According to Adams, the objective is to fast-track exploration supported by the newly topped-up treasury, add value to its core assets, and move them towards development. He said management was currently “carefully” planning a 12-month work program at the priority Amitsoz graphite and Thule ilmenite projects.

There is enormous interest in Greenland at the moment, given the success of Bluejay Mining (LON: JAY) and the fact Jeff Bezos and Bill Gates are backing minerals exploration in Greenland. MINING.COM reported early in August that KoBold Metals, a start-up supported by Gates and Bezos, has partnered with Britain’s Bluejay Mining to explore for critical materials used in electric vehicles in Greenland.