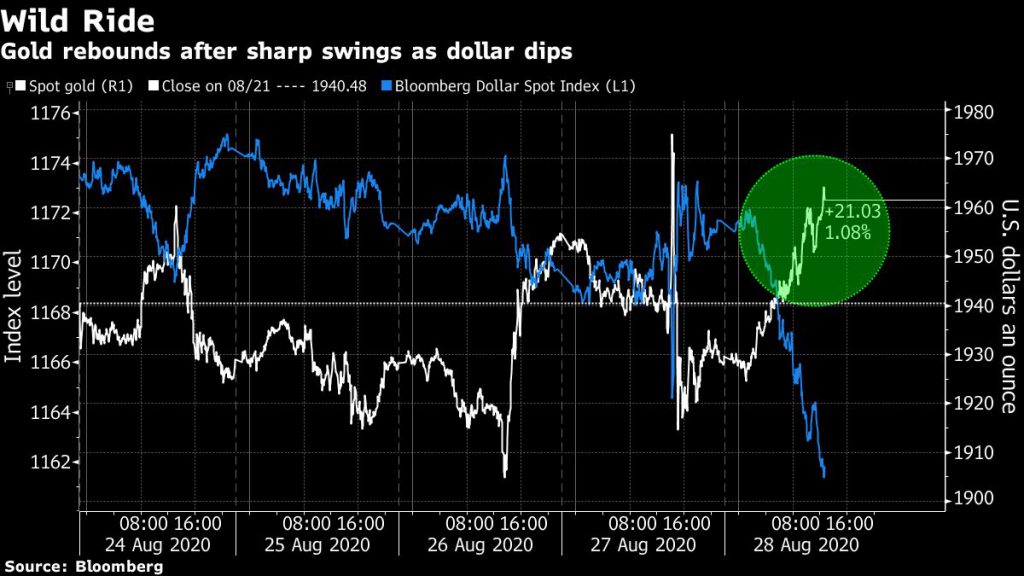

Comments from Federal Reserve Chair Jerome Powell sent bullion on a roller-coaster ride in the previous session — with prices seesawing between a 1% gain and a 2% decline — after he signaled the central bank will stay accommodative for longer, with a more tolerant approach on inflation.

“The announcement by Powell that the Fed will likely tolerate some inflation above the 2% target is indicative that monetary policy will remain dovish, which should provide support for gold,” National Australia Bank economist John Sharma told Reuters.

“Higher inflation tolerance and low interest rates should see US real yields fall in the medium-to-longer term, which is supportive for gold,” Vivek Dhar, an analyst at Commonwealth Bank of Australia, said in a Bloomberg interview.

“Still, the fact that the Fed will also act if there are inflationary pressures adds doubt to how high US 10-year inflation expectations can reach,” he added.

Gold traditionally benefits from lower interest rates as they decrease the opportunity cost of holding the non-yielding bullion and weigh on the dollar. On Friday, the Bloomberg Dollar Spot Index sank to its lowest since May 2018.

“Gold should continue to advance in most equity-market scenarios,” Mike McGlone, a commodity strategist at Bloomberg Intelligence, wrote in a note.

“The rising stock tide is increasing diversification demand and declining equity prices would encourage more quantitative easing, the primary force supporting the metal.”

Mike McGlone, commodity strategist at Bloomberg Intelligence

Ole Hansen, head of commodity strategy at Saxo Bank, who had been bullish on gold for most of the year, believes “Fed’s shift to let inflation and employment run higher may signal that policy makers will keep interest rates low for years to come, lifting the appeal of non-interest-bearing gold.”

“There’s still room for bullion to set new all-time highs, although that may take time,” Hansen said.

(With files from Bloomberg and Reuters)