Small-cap stocks are getting crushed this week — here’s what it means

The reflation trade giveth and the reflation trade taketh away.

That’s been the case for U.S. small-cap stock-market investors since last fall, with the recent emphasis on the taking away.

The small-cap benchmark Russell 2000 RUT,

That play began to stall out in the spring and has suffered since. A rally in long-term Treasurys has pushed the yield on the 10-year note down significantly from its peak near 1.80% to trade as low as 1.25% last week, flattening the yield curve and benefiting large-cap shares seen as more sensitive to interest rates.

The Russell 2000 remains up 10.5% for the year to date, but now lags behind the large-cap Russell 1000 RUI,

The large-cap benchmark S&P 500 index SPX,

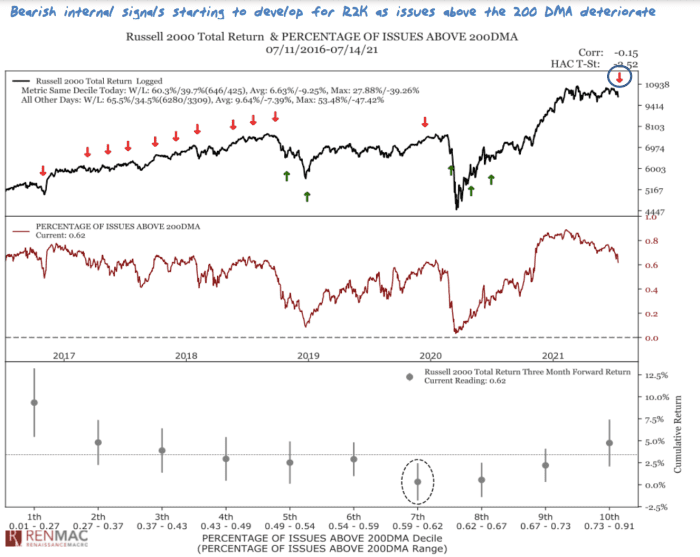

So just how bad is it? Damage has been done — the Russell 2000 hit a year-to-date low relative to the Russell 1000 on Wednesday — but it isn’t a total washout, said Kevin Dempter, analyst at Renaissance Macro, in a Thursday note.

The recent weakness in small-caps has pushed the firm’s Russell 2000 trend model into neutral territory, “which represents our take on the index” as well, he wrote.

Since peaking in March, the index remains above an uptrend line drawn from the 2020 lows and remained above its 200-day moving average. But internally, trends have weakened, Dempter said, with just 62% of issues in the Russell 2000 trading above their individual 200-day moving average as of Wednesday, he said, versus 80% in the Russell 1000 (see chart below).

So what would it take to turn outright bearish? Dempter said it would take further internal deterioration and a break below absolute support.

“Until then, the way we would be playing this neutral outlook in small-caps is by focusing on owning relative breakouts and leadership while cutting loose relative breakdowns,” he wrote, adding that there may also be opportunities to pair-trade large-cap longs versus small-cap shorts.