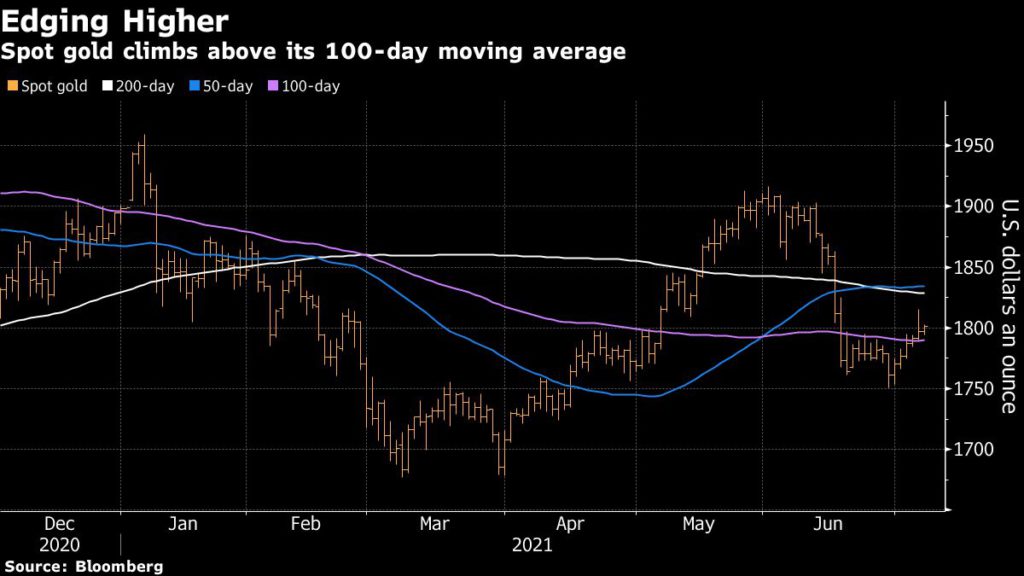

Gold price rises past $1,800 on lower bond yields, dollar

[Click here for an interactive chart of gold prices]

Meanwhile, both European stocks and US futures rebounded Wednesday, after slipping in the wake of weaker-than-expected figures on the American services sector. The yields on 10-year treasuries continued to decline, while the dollar weakened, lending support to bullion.

Minutes from the Fed’s June gathering will be combed for more clues on the bank’s thinking around rates, bond purchasing and the economic outlook.

The US central bank pulled forward its forecasts for tightening monetary stimulus last month in a move that rippled through markets.

Gold has had a volatile year and is coming off its worst monthly performance since 2016 as the dollar strengthened following the Fed’s hawkish shift.

Since then, there have been tentative signs of a rebound, aided by softer inflation-adjusted treasury yields, which boost the appeal of the non-interest bearing metal.

“Following recent economic updates, monetary policy is expected to remain loose as concerns about inflation and rapid economic growth fade,” Naeem Aslam, chief market analyst at Ava Trade Ltd., wrote in a Bloomberg note.

This is also one of the reasons for the decline in bond yields and the scenario may persuade institutional investors to hold gold, which could cause the price to rise above $1,900, he added.

(With files from Bloomberg)