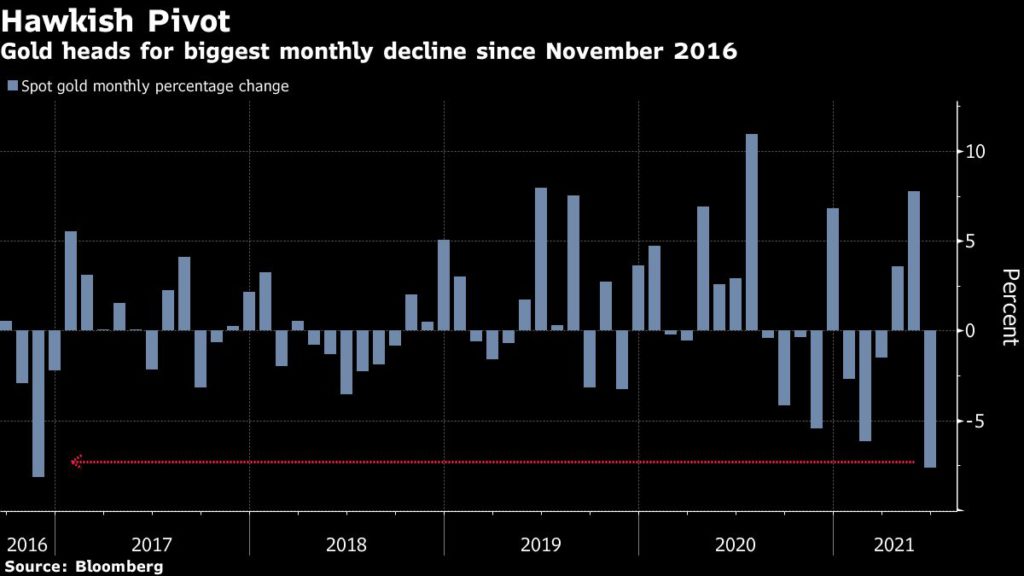

Gold price to see worst month in over four years

[Click here for an interactive chart of gold prices]

Nevertheless, the precious metal is still trading near the lowest since April after the Fed pulled forward its forecasts for interest rate hikes.

A stronger dollar has added much of the pressure, with the currency on course for its best month since March 2020, and investors have trimmed holdings in bullion-backed exchange-traded funds.

Traders will now focus on economic data and comments from Fed officials for more clues on the timing of stimulus tapering.

Richmond Fed President Thomas Barkin said Tuesday he wants to see much more US labor market progress before taking action, while Governor Christopher Waller said economic performance warrants thinking about pulling back on some stimulus.

“Looming asset purchase tapering putting upward pressure on real rates and the US dollar brings downside risk for gold” through the second half of the year, Morgan Stanley wrote in a note to Bloomberg. The bank now forecasts gold to drop just below $1,700 an ounce over the next six months, while also flagging the possibility of a sharp downturn through 2022.

Investors are also weighing the fallout from the more contagious Delta variant of covid-19 and broader economic data. Euro-area economic confidence has climbed to the highest level in more than two decades, and US consumers are more upbeat than at any point since the pandemic began.

“Precious metal markets simply can’t find a gear with the stronger dollar and strong economic data weighing on the market,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

“Gold once again has its back against the wall. However judging from previous lows, that is what gold needs in order to stabilize, reverse and eventually squeeze the shorts back out of the market.”

(With files from Bloomberg)