Cornish Lithium raises over $8m to boost UK projects

Cornish Lithium, led by former Investec banker Jeremy Wrathall, opened on Monday the opportunity to pre-registered investors, reaching its target within 15 minutes.

Additional funding will be used to continue the progress towards the company’s goal of creating a battery metals hub for the UK

“The additional funding will be used to continue the progress towards our goal of creating a battery metals hub for the UK,” Wrathall, who is the founder and CEO, said in the statement. “We have made significant advances since our last fundraising on Crowdcube, on both our geothermal and hard rock workstreams.”

He added that the acquisition of the Lepidico licence at the end of 2020 had allowed the junior to unlock the significant potential of its Trelavour hard rock lithium project.

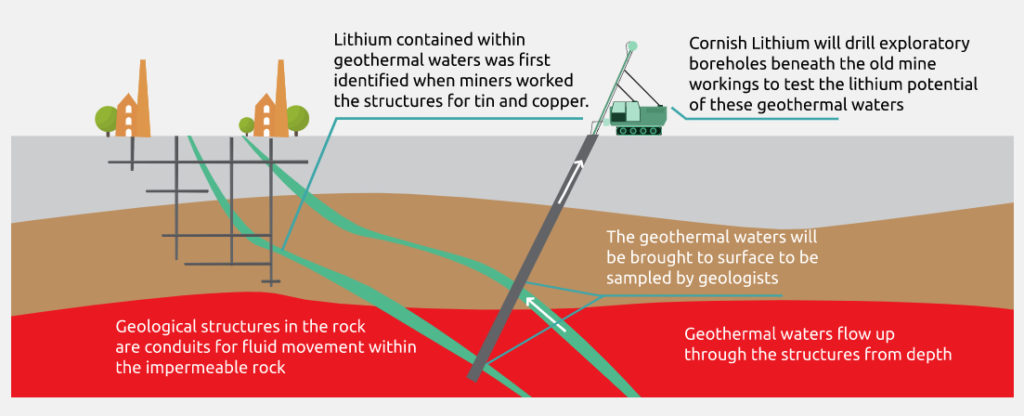

Cornish Lithium, , which announced the discovery of “globally significant” lithium grades in hot springs within the project last year, aims to apply commercially unproven technologies to produce lithium from geothermal waters and from mining in Cornwall.

The company has made significant progress towards that goal. In December, it announced it had successfully produced nominal battery grade lithium hydroxide using Lepidico’s proprietary technologies on lithium mica samples. Following these test results, the company acquired an exclusive licence to use Lepidico’s processing technology covering the St Austell region.

Cornish has now completed its second drilling campaign at the Trelavour project and work is now under way to define a Joint Ore Reserve Committee resource for the project, which will ultimately define the scale of the project.

The company is simultaneously advancing it United Downs project. Earlier this month, it announced the completion of the construction of the geothermal water test site and demonstration plant, which will be used to trial direct lithium extraction (DLE) process technologies.

Well-timed

The European Union is currently rebuilding automotive supply chains around battery metals, and incentivizing the adoption of electric vehicles (EVs).

European Commission Vice President Maros Sefcovic has said that, by 2025, large-scale battery plants currently under construction will produce cells to power at last six million electric vehicles.

British carmakers have an additional pressure — in only three years, they will have to source local electric car batteries as set by the Brexit free trade deal inked last year.

Under the agreement, all European trade in cars and parts will continue to be free of tariffs or quotas after the Brexit transition period ended on December 31, as long as they contain enough content from either UK or EU factories.

In only three years, British carmakers will have to source local electric car batteries as set by the Brexit free trade deal inked in 2020.

Batteries will at first be allowed to have up to 70% of materials from countries outside the EU. From 2024 onwards, that requirement will tighten to 50%.

Some car giants, including Nissan, are in advanced negotiations with the UK government to build their own electric car battery plant.

In September 2019, the UK government launched the Faraday Battery Challenge as part of the Industrial Strategy Challenge Fund (ISCF), to spur research and innovation.

Li4UK (Securing a Domestic Lithium Supply Chain for the UK) was one of the projects to secure financial backing from the pioneering program, soon to open a fifth round.