People are flocking to the reopened Obamacare marketplace — and finding deals

National Review

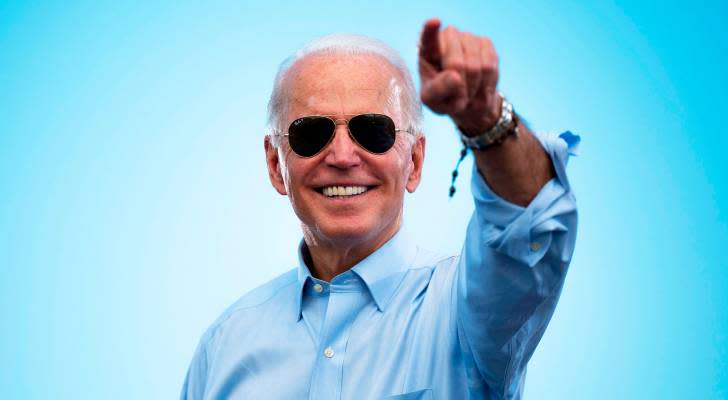

‘Stuffing Their Mouths with Gold’ — Selling the Biden/Yellen Tax Cartel

At the time of the establishment of Britain’s National Health Service, Aneurin Bevan, Labour’s Health Minister, faced serious opposition from, among others, top doctors unenthusiastic at the prospect of having to rely solely on the state for their income, a potentially dangerous challenge to the nascent NHS. To calm them, he agreed that they could continue seeing private patients alongside those from the new health service. As Bevan put it, “I stuffed their mouths with gold.” Which brings me to the proposals first floated by Treasury secretary Yellen (and later confirmed by President Biden) that the administration would work with other nations to agree a global minimum corporate-tax rate. As I wrote in Wednesday’s Capital Note: Cartels generally operate in predictable ways. One of those predictable ways is that they attempt to keep prices high. Part of the price of government is tax. It is unsurprising, therefore, that Janet Yellen has floated the “bold” (NPR’s adjective, not mine) idea of a global minimum corporate tax, in the wake of what is planned to be a substantial increase in America’s corporate-tax burden. I also wrote this: So, is there any prospect that the G20 will go along with this? No. For years now, there have been steps to take steps toward corporate-tax-rate harmonization within the EU, with some support, shockingly, from greedier governments such as those in Berlin and Paris. But they have gone almost nowhere. Many EU states, notably (but not only) those in the bloc’s poorer east, regard low corporate-tax rates as a source of competitive advantage, and they have been correct to do so. They have no interest in throwing that asset away. But this issue should not be reduced to one of securing a commercial edge. Different EU member-states have different views on the right balance between the private sector and the public, and, for that matter, on what the “right” level of taxation (where “right” can mean many different things) and spending should be. Above all, perhaps, they regard issues of taxation and sovereignty as inextricably intertwined. If the EU, a reasonably close-knit grouping, cannot agree on a minimum corporate-tax rate, the thought that the G20 would be able to come to any such agreement is absurd. Instead, the EU and other U.S. competitors will regard the corporate-gains-tax increases (if enacted), as merely the latest stage, in the wake of the president’s green agenda, in a helpful American effort to hobble itself. We can be sure that quite a few of them will do their best to make the best of the business opportunity that will arise as a result. I added that if the U.S. tries to bully other nations into compliance (part of the proposed package includes higher taxes on the U.S. subsidiaries of countries that do not play along) it would add diplomatic fiasco to the economic stupidity that is the corporate-tax hike. Charlie Cooke observed in Capital Matters: This provides a nice little example of how incapable progressivism is of leaving room for genuine diversity of practice. Not only must progressives ride roughshod over the 50 American states in order to make their plans workable, but, ultimately, they must ride roughshod over every other country, too. We hear this “race to bottom” language all the time in a domestic context when, say, Florida or Texas decides to lower taxes or cut regulations or diminish spending. Now, we’re seeing it used globally, as an unashamed means by which to stamp out the dissenters and prevent them from competing with America. The “race to the bottom” is, as the Tax Foundation has shown, something of an illusion. Corporate-tax rates fell sharply after the 1980s, but over the last decade or so, they have (roughly speaking) plateaued. Back to Charlie: I like the fact that the world is full of nations that do things different from one another, and I wish to keep it that way. But, leaving that to one side, I am slightly confused as to how this fits in with another tenet of the progressive worldview: that the United States is a bully. For many smaller nations — nations that have less economic clout and fewer people — lowering taxes to encourage investment is a primary means of gaining a competitive advantage. What right does the United States have to try to take that away so that Joe Biden can pay for a set of “infrastructure” plans that don’t benefit them in the slightest? Indeed. Not only is this whole bullying thing not going unnoticed, there’s also a possibility, highlighted by Ben Wright in The Daily Telegraph, that it may backfire, not just diplomatically (as I suggested above), but in a way that would be much more profound. Taking a different view from me, Wright argues that the U.S. might be able to force this through: The US certainly has a big enough stick with which to coerce other countries. The US dollar is used in 88pc of all international foreign-exchange trades, according to the Bank for International Settlements. The US demands banks give it access to these cross-border currency movements. Fail to comply and they can be shut out of the dollar-clearing system, which effectively means being shut out of world trade. This has allowed the US to develop a variety of financial techniques against terrorist groups, organised criminals and enemy states such as Syria, North Korea and Iran. So far, so fair enough. But in recent years, “dollar weaponisation” has been used to more prosaic ends. In 2010, the US started demanding that global banks reveal which of their clients were American citizens with more than $50,000 in investments. In effect this law (called the Foreign Account Tax Compliance Act) forced foreign banks to act as the long arm of the IRS. However: The G20 is quite a disparate collection of countries. Many will want to play nice. Those that don’t like the sound of Yellen’s proposals may think about accelerating their plans for whittling down that big stick. China, for example, has already made huge strides in developing a central bank digital currency. The digital yuan is primarily designed to allow Beijing to better monitor its population and economy. But, as a handy by-product, it would allow the development of an alternative international payments system beyond the prying eyes of the US. And China is far from alone. Of the 60 central banks surveyed by the Bank for International Settlements last year, nearly two thirds said they were looking at creating their own CBDCs. The more cross-border transactions that are conducted with these new digital currencies, the weaker the US hold over the global financial system and the less effective its sanctions. The dollar has seen off plenty of challengers in the past. But if Biden’s plans accelerate the development of alternative financial systems and undermine the greenback’s hegemony even slightly, it would have to go down as one of the most spectacular economic own goals of all time. Yes, it would, especially given the amount of debt the U.S. is running up. If the dollar’s reserve status starts eroding, the cost of persuading investors to lend to Uncle Sam is going to rise. The effects of that will not be pretty. The Biden administration, however, is clearly aware that its attempt at fiscal imperialism may well be poorly received, and so (via the Financial Times), it has now proposed a “grand bargain”: Leading advanced economies would get the power to raise corporate tax from US tech giants and other large multinationals, and in return a global minimum corporate tax would be introduced, enabling the Biden administration to raise significant additional revenue from US-headquartered companies to finance its infrastructure programme. Specifically, the US is offering to give all countries the power to tax a slice of the global profits generated by around 100 of the world’s largest companies; the amount each country can raise would be based on companies’ sales in that country. Many of these companies are based in the US, so it would have to surrender part of its current taxing rights in order to meet what its proposal called “popular concerns in all our countries about mega-corporations”. In exchange, the US said it would expect other countries to drop digital taxes they had unilaterally proposed. It also specified that the new regime would not focus only on digital businesses or US companies. The FT’s writer notes complaints that most of the money divvied up under such a scheme would go to the U.S. and Europe, rather than to the poorer parts of the world. But those who are complaining are missing the point. To go back to Bevan and the doctors, it was, above all, the most qualified that he needed to satisfy. It was their mouths he stuffed with gold. Equally, if the administration’s global minimum tax rate is to find some sort of acceptance, it is the Europeans that Biden and Yellen will need to win over. And by the Europeans, I don’t mean the EU’s bureaucracy, which has, predictably, welcomed the idea of a global minimum, but the countries that make up the EU, as well as others such as the U.K. and Switzerland, some of which, as noted above, may not be inclined to support this American move. Thus the promise of “gold.” And thus calculations of the type being reported in another Telegraph report here: The proposal is a significant move to free up what has been called a “logjam” in international relations over tax, but would cover all large businesses rather than just tech companies. It raises the risk that British and European firms with significant intellectual property – often in the form of powerful consumer brands – will end up paying more to the US. As a result, British officials are understood to be keen to calculate the likely end result of tax flows in both directions across the Atlantic to make sure it is in Britain’s interests to back the new plan . . . According to campaign group Tax Justice UK, the proposals could raise £13.5bn for the Exchequer. If enough larger countries will only agree to Biden’s proposal on the basis that they will make money out of it, that will mean that U.S. taxpayer funds will be used to build a tax cartel designed to protect a raid on . . . U.S. taxpayers. Oh, and consumers and workers, too. And, yes, this is a raid on all U.S. taxpayers, not just “greedy corporations.” As Ryan Young noted in an article for Capital Matters this week: Corporations do not pay any corporate tax — individuals do. That is because companies pass on their costs. Some of the tax is paid by consumers, who pay higher prices. Company employees pay some of the tax through lower wages. And investors’ retirement accounts pay some of the tax through lower returns. So, while it might be good politics to stick it to big corporations — or at least to posture that way in front of voters and television cameras — a corporate tax-rate hike would not accomplish its intended goal. Instead, taxes are paid by individuals who then get less for their money, receive smaller paychecks, and have a harder time saving for retirement. In a 2020 study by Scott R. Baker of Northwestern University, Stephen Teng Sun of City University of Hong Kong, and Constantine Yannelis of the University of Chicago estimate that 31 percent of the cost of an increase in corporate taxes is borne by consumers, 38 percent by workers, and 31 percent by shareholders, or about a third each. Other studies have found different ratios. A 2020 Tax Policy Center study, a joint effort between the Urban Institute and the Brookings Institution, estimates an 80–20 split between investors and labor. The Tax Foundation’s Stephen J. Entin estimated in 2017 that labor pays 70 percent or more of the corporate tax. Differences aside, these studies share a common conclusion: Ultimately, corporations themselves pay no corporate tax. It is also worth paying attention to this part of the Telegraph’s report: Meanwhile business groups are concerned that a global minimum rate could make it difficult for governments to use tax breaks to incentivise desirable behaviour such as extra investment. That is a fair point. If the proposed global minimum tax is to work it has, one way or another, to be binding, but it is hard to see foreign governments agreeing to any pact that is so rigid that they cannot run their fiscal policy with the flexibility — tax breaks and so on — that they may believe their economies require at any given time. But if they are “allowed” to retain that flexibility, however, it is easy to see how it could be used to make a mockery of the Biden/Yellen tax cartel’s rules. And there’s something else. I mentioned above how notions of tax-raising power and sovereignty are inextricably intertwined. An essential element in the assertion or maintenance of sovereignty is a nation’s ability to change its mind. In a democracy (and it is, for various reasons, democracies that are most likely to sign up for the Biden/Yellen proposals), nations change their mind through the ballot box. One government may find that the Biden/Yellen proposals are acceptable. Its successor may not. If these proposals, based on the specific circumstances of a specific country (the U.S.) at a specific point, are indeed binding (if not, they are pointless) they will, under certain circumstances, act as some sort of brake on the ability of voters — including those in the U.S. — to decide on the tax policy they want for their own country. If Biden and Yellen are comfortable with associating themselves with a policy that, at least to a degree, is opposed both to national self-determination and, for that matter, democracy, well . . . For now, the administration is proposing that this global minimum tax should be set at 21 percent. That could come down a bit in negotiations (I’ve seen the number of 17 percent mentioned), but that would still be cold comfort to, say, Ireland (12.5 percent) and Hungary (9 percent), countries that use a low corporate-tax rate to create a competitive advantage (and why not?). Competition, I thought, was meant to be a good thing. From NR’s editorial on Thursday: As antitrust enforcers eye Big Tech, the Biden administration talks up the virtues of competition, but when it comes to tax, different rules, it seems, apply. They should not. Tax competition is healthy, and it often gives a boost to countries that need it. It also acts as a brake on governments that are too greedy for their people’s good, a feature that, to Biden and Yellen, is a bug. My best guess continues to be that the idea of a global minimum tax will be sunk by the refusal of enough countries to play along. There’s also the little matter of Congress. This story has a long way to run. The Capital Record We recently launched a new series of podcasts, the Capital Record. Follow the link to see how to subscribe (it’s free!). The Capital Record, which appears weekly, is designed to make use another medium to deliver Capital Matters’ defense of free markets. Financier and NRI trustee David L. Bahnsen hosts discussions on economics and finance in this National Review Capital Matters podcast, sponsored by National Review Institute. Episodes feature interviews with the nation’s top business leaders, entrepreneurs, investment professionals, and financial commentators. In the twelfth episode David Bahnsen continued last week’s discussion with economist and leading financial writer, John Mauldin, on the economy, the market, the challenges investors now face, and what to make of all the bad news. And the Capital Matters week that was . . . In addition to the commentary by Charlie Cooke and Ryan Young on a global minimum tax mentioned above, there was plenty more to read in Capital Matters. Another Ryan, Ryan Mills, reported on the plight of small-time landlords hit by the eviction moratorium: Graves is one of the millions of landlords and property owners in the U.S. struggling through the COVID-19 pandemic, providing an essential service — housing — while regularly getting painted as heartless by the mainstream media and slimed by progressive lawmakers and advocates who want to #CancelRent. At one of Graves’s complexes, 14 of her 22 tenants are behind on rent. Some residents haven’t paid a cent since last June, and she said she’s been forced to tap into her personal savings to keep the business afloat. “The utilities, all those things, payroll, is coming out of my pocket,” she said. Her opportunity to start collecting from her non-payers was pushed back again last week, when the Centers for Disease Control and Prevention extended its ban on evictions through at least June . . . To many rental property owners and landlords, the eviction moratorium is not only putting them in financial jeopardy, but also encouraging residents to amass large and likely un-payable debts. It’s also harming the greater effort to build up the nation’s affordable housing stock. With Georgia (but not only Georgia) on his mind, Jim Geraghty discussed the increasing involvement of the C-suite in political action: No one elected these CEOs to any public or government office. You can love or hate the laws [in question]. But they were legally enacted through the procedures laid out under their respective state constitutions. Freely and fairly elected state legislators passed the legislation, and freely and fairly elected governors signed it into law. All of those public officials can be held accountable by voters in those states the following election. If there’s a compelling argument that those laws violate the U.S. Constitution, they can be struck down by the U.S. Supreme Court. Governments are accountable to the whole public in a way that corporations are not . . . And it’s not like the American political world lacks opportunities for corporate executives to support particular candidates and causes – direct donations, political action committees, Super PACs, trade associations, and so on. But American CEOs are never supposed to “hit the phase” of becoming “actual lawmakers and rule-shapers” or “become the fourth branch of government.” If you want to be a lawmaker in a state or in the country, earn that state power by running for office and winning the vote from your fellow citizens. Don’t exercise an off-the-books veto with behind-the-scenes pressure campaigns and threats. It is worth adding that these CEOs have crossed not one, but two lines. Previously executives’ involvement in politics (the PACs and so on) has generally been focused on improving or protecting their employers’ bottom-line, and, as such, it was part of the job they had been hired to do. This, however, is something else. Philip Klein approached this issue from a different angle: Many conservatives have been itching to go to the mattresses against corporate wokeness for years. For others who weren’t quite there yet, the Georgia fiasco was the last straw. So there is now a large contingent of conservatives who are out for blood. Republicans have begun to respond to this sentiment and seek out ways to punish companies who use their influence as a hammer against the cultural Left. Woke mobs will use all forms of intimidation to pressure companies to do their bidding, the argument goes, so now it’s time for Republicans to use all the tools at their disposal to fight back. As an example, Georgia’s House of Representatives voted to strip Delta of a special tax break. Though largely symbolic, because the state senate did not take up the measure before adjourning, it was a sign of where things are heading. Senate minority leader Mitch McConnell also released a statement ominously warning that, “Corporations will invite serious consequences if they become a vehicle for far-left mobs to hijack our country from outside the constitutional order.” If Republicans were to get serious about ending special favors for corporations in general, it would be a positive development. . . . However, as tempting as it may feel, it is not appropriate to target specific corporations on the basis of taking political stances, however obnoxious and ill-informed those stances may be. Corporations and their executives have every right to weigh in on political questions. And MLB can hold their baseball game wherever they want. The tax break against Delta is either good or bad, but policy should not be based on the company’s role in the cultural war. To seek retribution against companies that express a particular viewpoint is also likely to invite constitutional challenges. So, if there is increasing anger against corporations, it would be productive for Republicans to use this as the opportunity to reexamine the relationship between big government and big business in a broader sense rather than to retaliate against specific companies after the fact. Speaking of frustration with some of the more woke corporations, Jessica Melugin considered a recent concurrence by Justice Thomas “in which he laid out how to regulate social-media platforms as common carriers or public accommodations in order to restrict the platforms’ rights of exclusion”: The new regime would be something akin to digital forced access; social-media companies’ First Amendment right to regulate or remove speech on their private platforms would be eliminated or curtailed. From a legal perspective, however, the precedents for imposing speech restrictions on private entities may not easily translate to the way that social-media companies operate, or the markets that they serve . . . To justify government regulation, Thomas mistakenly claims that there is insufficient competition in the social-media space. He writes, “That these companies have no comparable competitors highlights that the industries may have substantial barriers to entry.” In reality, these platforms are constantly having to compete with new market entries. Examples include Snapchat, Clubhouse, TikTok, and many more. The next generation of social media, much of which has yet to be invented, will likely be decentralized and even less akin to entities that have been regulated as common carriers in the past. Beyond comparable social-media-platform alternatives to Twitter and Facebook (both of which have banned former President Trump) there still exists television, radio, and the rest of the Internet. The practical reality of forcing social-media companies to carry speech to which they object might not be the panacea that conservative critics imagine . . . And for more on woke capital, Dan McLaughlin on the railroading of Papa John: If you get asked in a corporate setting to “role play” or to have an honest conversation about “diversity” or racism, make sure you have your own recording or transcript. Or, better yet: Don’t play along. That is one lesson from the continuing saga of John Schnatter, the founder and “Papa John” of Papa John’s Pizza. Schnatter is still trying to rebuild his reputation after what increasingly looks like a vindictive smear campaign three years ago engineered by the ad agency hired by his own company. Only now, after a court order unsealing evidence in Schnatter’s lawsuit against the ad agency, can the public review a recording and transcript of the private conference call that sank Schnatter’s career and destroyed his good name. With the newly released evidence, we can now get an inside look at a saga of culture clash and betrayal. This is a story of corporate cancel culture run amok, and the only thing that makes it different is that the target was a guy big enough to fight back. If Schnatter were anything but the founder, chairman of the board, and largest shareholder of the company, what chance would he stand? . . . Kyle Smith pondered the lunacy of New York’s latest proposed tax hikes: The most affluent New Yorkers can expect to pay 13.53 to 14.78 percent income tax on top of all their other tax bills. Legislators envision raising another $4.3 billion in revenue this way; perhaps they forget that highly affluent people are also highly mobile. That’s especially true in Anno Domini 2021, when Midtown and Downtown Manhattan remain largely deserted by the white-collar professionals whose income taxes fund the city and state. If California looks affordable compared with New York City, why would anyone who can afford to live elsewhere stick around in this shambles of a city? New York State and City are unusually dependent on high earners; in the city, the one-percenters paid 42.5 percent of all income taxes in 2018. Meanwhile, the nightlife and performances that have long been the city’s principal attractions to affluent people remain mostly shut down. The streets are messier than they’ve been in decades, restaurants are operating at half capacity, homeless encampments are everywhere, and crime is way up. How does it make sense to raise taxes at a moment when the metropolis would seem increasingly familiar to Snake Plissken? It doesn’t. What does make sense is that Cuomo is in the mood to give the left wing of his party everything its lawmakers want in hopes that they’ll forget about impeaching him for his well-documented history of sexual harassment. He’s hoping to buy his way out of a jam using the AmEx cards of the most successful New Yorkers . . . However, is Chuck Schumer (sort of) trying to help them out? Brad Polumbo: Local business leaders and wealthy residents of the Empire State are lobbying the senator to restore their favorite tax subsidy in its entirety, and he’s certainly doing his best. Along with his fellow New York senator, Kirsten Gillibrand, he has introduced legislation to repeal the cap on the SALT deduction altogether. And his latest efforts to see repeal included in infrastructure legislation are just the culmination of his protracted campaign to restore the loophole. The hypocrisy here is galling. Senator Schumer has harshly criticized the GOP tax-reform package — under which two-thirds of Americans directly received a tax cut — as a disgraceful giveaway to the rich. “In my long career in politics, I have not seen a more regressive piece of legislation, so devoid of a rationale, so ill-suited for the condition of the country, so removed from the reality of what the American people need,” he said at the time of its passage. “Corporations and the very wealthy are doing great. There is no reason for rushing through a tax break for millionaires and billionaires, paid for by pilfering the pockets and the healthcare of middle-class Americans.” Yet could there be a better description of Schumer’s efforts to repeal the SALT cap than “rushing through a tax break for millionaires and billionaires, paid for by pilfering the pockets . . . of middle-class Americans?” Mario Loyola is no fan of the SALT deduction either: The federal deduction for state taxes represents a core commitment of progressive government going back to its inception, namely the drive to negate the vital competition between state governments. Rich progressive states banded together in Congress to impose their uncompetitive levels of regulation and taxation on everybody, so we could all be uncompetitive together. It was a device that uncompetitive progressive states deployed to eliminate the competitive advantage of poorer states, and had the purpose and effect of keeping those states poorer for longer than they would have been otherwise. That, in a nutshell, was Franklin D. Roosevelt’s New Deal, the whole point of which was to cover state cartels and monopolies, in agriculture and labor, with a blanket of protection. It was also the driving force behind the deduction for state tax payments . . . Daniel Pilla weighed in on a possible new twist to the capital-gains-tax rules (spoiler: it’s not good news), specifically Biden’s “vows to eliminate the so-called ‘stepped-up basis’ rule for inherited property”: Suppose your parents own a home worth $200,000. They purchased the home decades ago for, say, $50,000. If they gift the home to you prior to their passing, your basis in the home is the same as theirs: $50,000. That means if you sell the home for its current value of $200,000, you must pay capital gains tax on the profit of $150,000 — the difference between basis and sale price. By contrast, if you inherit the home after their death, your basis is equal to the fair market value of the property as of the date of death — in this example, $200,000. See: Code §1014(a)(1). Now if you sell the property for $200,000, there is no capital-gains tax because there’s no gain (sale price minus basis equals gain). This is what we refer to as “stepped-up basis.” And the rule absolutely does not apply only to “rich people.” The operation of Code §1014 is not controlled by one’s annual income, the value of the inherited asset, or the total value of one’s estate. It applies across the board. Every American taxpayer enjoys the benefit of stepped-up basis on inherited property . . . The president would like that to change. Oh yes, the infrastructure bill. David Harsanyi: I’m relatively certain the last time the word “infrastructure” was uttered without “crumbling” was before I was born. In 1986, the New York Times editorialized that “our crumbling infrastructure” was a “national disgrace.” By 1992, numerous publications were lamenting the nation’s “crumbling” infrastructure. Bill Clinton warned that the infrastructure was “crumbling.” Barack Obama said we had “crumbling infrastructure.” Donald Trump also said infrastructure was “crumbling.” And until all of us are riding high-speed bullet trains to our union jobs assembling solar panels for the common good, the infrastructure shall continue to crumble. In Pittsburgh last week, Biden rolled out his $2 trillion “American Jobs Plan” — which will be coupled with another reportedly $2 trillion effort to fix our health care system, again — to fix the “crumbling infrastructure.” Biden does a lot of big thinking with your grandkids’ money. Two problems: One, the infrastructure bill has as much to do with traditional infrastructure as his COVID-relief bill had to do with the pandemic — which is to say, if we’re being generous, about 7 percent of its spending. Two, we already “invest” a ton of money on our infrastructure, which is, despite perceptions, in pretty good shape. Robert VerBruggen examined the administration’s claims that the infrastructure package will create “19 million jobs” (and doubts about such claims), but then asked this: The deeper question, of course, is how much stock we should put into anyone’s guess as to what will happen when you have the government funnel 13-figure sums into infrastructure projects while dramatically hiking business taxes to cover the cost. I am not overly confident in such work. With good reason. But, if the president gets his way, there will be yet more spending increases to come. Here’s Robert on the president’s proposed new budget: In some ways this is a predictably boring document. It doesn’t have anything to do with the major entitlement benefits that we’ll eventually need to reform — Social Security, Medicare, etc. — as those are considered “mandatory” rather than discretionary spending. And as a one-year funding request, it also doesn’t include Biden’s longer-term domestic-spending goals, such as those laid out in the recent infrastructure proposal, or his plans to hike taxes. It’s chiefly about funding for federal agencies, including defense. But it does emphasize some Biden priorities. Restraining spending is, of course, not one of them: Nondefense spending rises an incredible 16 percent. Meanwhile, defense spending grows 1.7 percent, a hike that only offsets inflation — an apparent concession to the left wing of the Democratic Party that might land poorly in Congress. Elsewhere, the request throws lots of money around in the service of liberal goals. Climate-change initiatives get $14 billion. The Centers for Disease Control, which lately has been focused on the public-health impact of racism, gets about $9 billion “to restore capacity.” Schools get a billion bucks to provide mental-health aid to the students they messed up by shutting down. The Internal Revenue Service gets a boost too. Central America gets hundreds of millions of dollars in the hopes of discouraging out-migration . . . But again: None of this binds Congress in any way. The Senate is evenly divided, so, at minimum, Democratic moderates will have to get on board with the final budget. Meanwhile, Joe Manchin is still opposed to weakening the filibuster and overusing the reconciliation process, so Republicans should have some leverage too. This is just a sort of window into the administration’s big-spending desires. It’s also, though, an interesting contrast to some of Biden’s other proposals. The entire request here — not just the 16 percent increase to non-defense spending, the whole request — is $1.5 trillion. That’s enough to keep funding the federal agencies for a whole year and to give money to Biden’s proposed new pet projects. It amounts to roughly $4,500 for each person living in the U.S. (In 2019, the whole federal budget — including the mandatory spending on entitlement programs — totaled about three times that.) . . . Jerry Bowyer took on Ramesh Ponnuru over inflation concerns sparked, in particular, by one specific metric: [This] is calculated by subtracting the yield of an inflation-protected five-year Treasury note from that of a regular five-year Treasury note. This metric has been rising and, as of Ramesh’s writing, was above the Fed’s target rate for CPI. Ramesh argues (Bowyer relates) that: [This] metric is not reliable, because the Fed buys Treasury securities, which distorts the rate. So that factor can mislead users of that metric as to how much inflation fear there is among real investors (as opposed to central bankers, who buy these bonds as a policy instrument, not an investment). . . . The Fed knows about this problem, so it recalculates the spread to reflect this reality. . . .As of March 3 of this year, the day before Ponnuru’s article was published, the adjusted inflation risk had fallen to 1.67 percent — lower than before the COVID scare. Now, we get into a highly technical area, but (in brief) Bowyer wonders why we are depending only on one market in order to build the case against inflation, while ignoring other markets. I like the TIPS spread, and, for the record, I think the adjusted version is a real improvement, but there are other market signals to look at. Gold is a market. So is silver. So are currency markets. When many in the supply-side movement were pushing the Fed to hike higher and higher in 2006, they pointed to gold markets but ignored bond markets. I argued at the time that all market indicators needed to be listened to, not just the ones that fit our outlook. Data are a gift (literally in Latin, “things given”); let’s open all the gifts to get our insights . . . And now you will have to read the whole thing. Ramesh replied, and this was his conclusion: Common methods of accounting for liquidity are not foolproof. On this point, too, we agree. That’s why one of my conclusions (we didn’t have more reason to worry about inflation at the end of February than we did in late 2019) was conditional on the soundness of the method. The other conclusion (the unadjusted difference doesn’t itself give us a reason for worry) stands. The Fed has produced new estimates for inflation expectations, adjusting for liquidity, through the end of March. Those expectations rose a bit during March and are now a tick above where they were at the end of 2019. The late-March projection was for an average increase of 1.83 percent in the Consumer Price Index over the next five years. That’s still below the expectation on any day from the start of 2017 through the middle of 2019. Whatever other reasons we may have for worrying about high inflation in the next few years, the difference in yields between inflation-indexed and unindexed Treasury bonds isn’t giving us one. William Levin, meanwhile, argued that the government has a “persistent bias to underestimate inflation”: Social-security payments are indexed to the CPI, with tax brackets automatically adjusting for inflation. An increase in inflation would raise already-ballooning entitlement costs. Then there is the cost of rising interest payments on public debt. A permanent 2 percent increase in measured inflation, if translated directly into rates, would more than double the government’s interest expense from $350 billion to $750 billion, consuming almost 60 percent of all federal discretionary outlays and exceeding total spending on national defense. So the government has an undeniable incentive to underestimate inflation. But an incentive to misbehave is not the same as proof of misbehavior. For that discussion, multiple sources of underestimation bias bear attention. Statisticians within the Bureau of Labor Statistics (BLS) continuously adjust the basket and methodology for comparing cost, quality, and substitutability of goods and services in the CPI. Sounds fine, except for the inherent opportunity to manage the process. An independent calculation of inflation based on prior methodologies reveals the potential for abuse, equal on one measure to a persistent 2 percent annual inflation undercount. Even if the methodology changes are truly neutral, a look inside the index reveals imbedded distortions . . . Stephen Walters wrote on the impact of an increase in the minimum wage on low-skilled workers: Kicking one of every six unskilled workers to the curb in order to raise the incomes of the rest is, however, a terrible trade-off economically, socially, and morally. The discarded — assuredly the least skilled, least educated among us — will suffer grievous harm. And there is, in fact, an alternative policy to improve the living standards of the working poor without costing any of them their jobs. When I think back to my diner days (or to my later summer job in a tin-can factory), I can remember quite a few people who would have been collateral damage in an earlier Fight for $15. They were decent and hard-working; all were proud to be pulling their weight. None deserved to have their sense of self-worth shredded by a well-meaning but misguided public policy. While an ever-expanding welfare state might support the newly idle, the emotional toll of separation from meaningful work can be devastating. If we want more “deaths of despair” among the less skilled, pricing them out of the labor market will make it happen. And we can enjoy an omelet here without breaking any eggs: We just have to expand the Earned Income Tax Credit program instead of distorting labor markets with an arbitrary wage control. Under current law, a single mother of one earning $9 an hour in full-time work gets a federal credit of $3,628, an effective raise of 19 percent. In a state with its own EITC like Maryland, she’d get an additional credit of $1,814, raising her after-tax hourly wage 29 percent, to $11.62. If, instead, her employer is required to pay her $15, her job is very likely to disappear. It’s certainly arguable that the EITC can be improved in order to better reward work and reduce income inequality. What’s inarguable is that it provides a path to higher living standards for low-skilled workers without endangering their jobs — and that’s a true win for social justice. Charlie Cooke was unimpressed by the response of the Retail, Wholesale and Department Store Union to the Alabama Amazon union vote: There is no point in having these votes if the results aren’t respected. When the Retail, Wholesale and Department Store Union says that it wants to “hold Amazon accountable,” it means that it wants the National Labor Relations Board to overturn the decision and demand a revote. Why? Apparently, because Amazon’s workers in Alabama, who rejected unionization in a landslide, were tricked by the existence of a . . . mailbox: “One area on which the union probably will focus: Emails among U.S. Postal Service employees in January and February show that Amazon pressed the agency to install a mailbox outside the warehouse, a move the union contends is a violation of labor laws. The union has complained about the mailbox, which the Postal Service installed just before the start of mail-in balloting for the union election in early February. It has argued that the mailbox could lead workers to think Amazon has some role in collecting and counting ballots, which could influence their votes.” Nobody really believes this — although many will pretend to, and it may be sufficient to gain the RWDSU a sympathetic audience with the NLRB. It is patently absurd. It is conspiracy theory–level thinking. It is hyper-legalism, of the strain that has led the NLRB to go after Ben Domenech for making a joke. It is sore-loserism. It is pathetic. The union lost this drive by two-to-one. It did not do so because one of the voting options included the use of a USPS mailbox. In and of itself, the claim is ludicrous. But it is especially ludicrous when one notes that the Retail, Wholesale and Department Store Union supports “card check,” which means that its institutional position is that the use of a mailbox for mail-in votes constitutes intimidation but that the abolition of the secret ballot does not. Alexander William Salter warned about confusing accounting for economics: Accounting is a useful tool. We couldn’t do economics without it. But accounting and economics have fundamentally different purposes. You can’t rely on the former to do the work of the latter. Reasoning from an accounting identity involves sneaking in an economic theory, and usually snuck-in theory is bad theory. And when the analysis is politically motivated, as is all too common, the whole thing is worthless. Don’t let partisan hacks get away with this trick. When they do this to economics, it cheapens public debate. Finally, we produced the Capital Note, our “daily” (well, Tuesday–Friday, anyway, except this week Thursday’s Note mysteriously went astray). Topics covered included: the pandemic’s best stock pickers, the Archegos shakeout, bearishness in U.S. Treasuries, a justification for active management, Biden’s tax plans go global, the return of the doom loop, Germany’s green new dud, robots and jobs, problems with index funds, the semiconductor shortage, funds considering new prime brokers, Amazon workers say no to union, and a look at the capital cycle.