Aluminum price sinks on China’s move to sell state reserves

[Click here for interactive aluminum price chart]

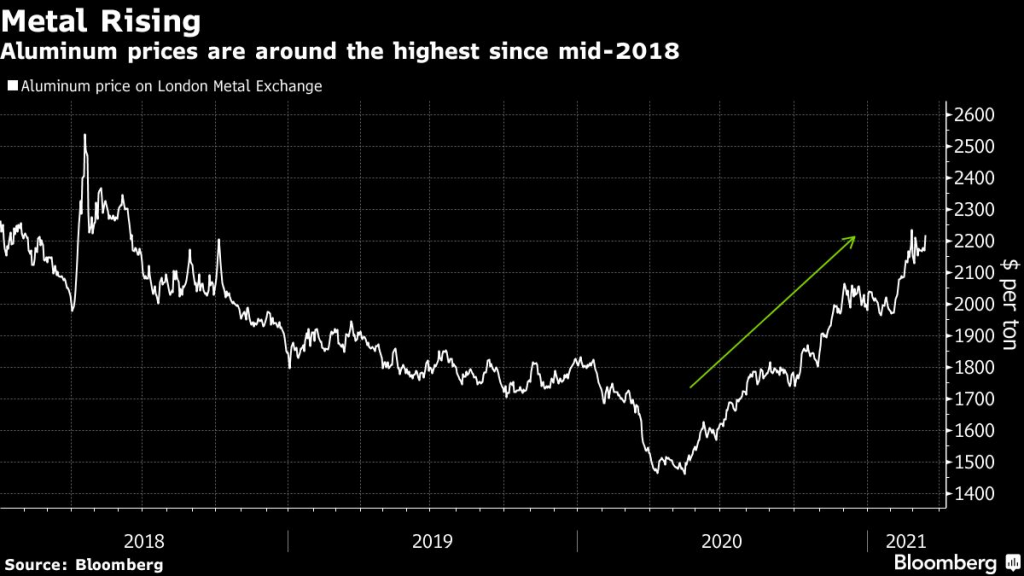

The most-traded May aluminum contract on the Shanghai Futures Exchange dropped as much as 6% to 16,480 yuan ($2,531.33) a tonne, its lowest since Feb. 22. It pared some of the losses later in the session to close 2.6% lower at 17,085 yuan a tonne.

Three-month aluminum on the London Metal Exchange declined 1.6% to $2,236 a tonne by 0716 GMT, after dropping as much as 3.6% to $2,190.50 earlier in the session.

China is considering selling about 500,000 metric tonnes of aluminum from state reserves, according to Bloomberg, in a move that would help cool the market and meet the Asian nation’s emissions objectives.

Aluminum inventories have been climbing in LME and ShFE warehouses, while China’s aluminum imports in the first two months of 2021 rose 150.7% from a year earlier.

“As of late March, primary aluminum margins have increased to the highest on record. It is no surprise that production growth has risen robustly, incentivised by the strong margin,” ING analyst Wenyu Yao told Reuters.

“Robust Chinese domestic production combined with strong imports suggest an ample supply in this (China) market, and the underlying demand strength is set to face a reality check in the next couple of months,” she said.

Aluminum had climbed to its highest price in a decade in Shanghai earlier this month after Inner Mongolia, a major coal-fired production hub in northern China, said it’ll stop approving new projects following a reprimand from Beijing for failing to control its energy consumption.

(With files from Reuters and Bloomberg)