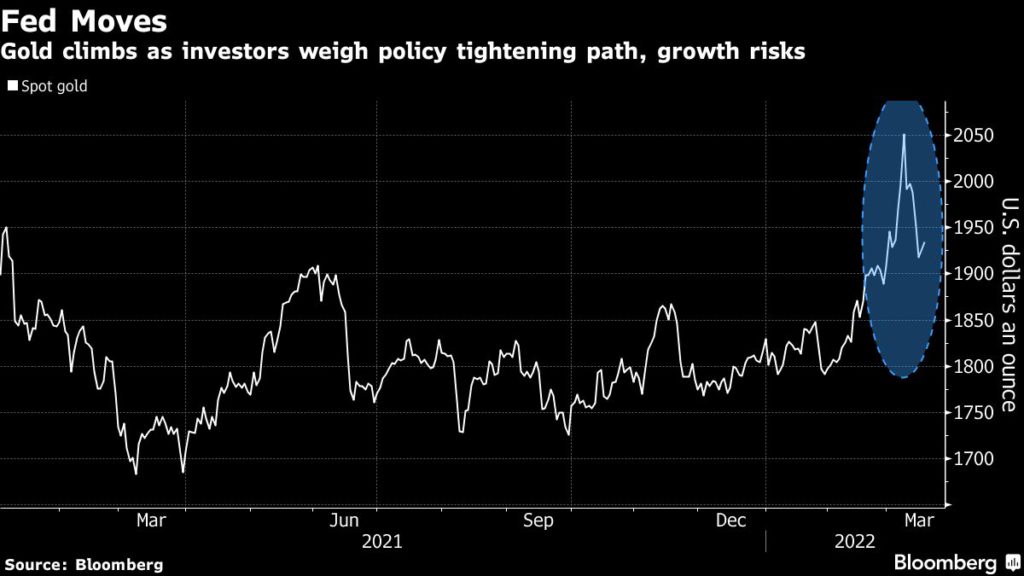

Gold price shakes off Fed rate hike, back towards $1,950

[Click here for an interactive chart of gold prices]

The precious metal quickly turned around after dropping to a two-week low Wednesday following the US central bank’s move to raise interest rates by a quarter percentage point.

While officials signaled hikes at all six remaining meetings this year, Fed Chair Jerome Powell played down the risk of a recession and declared the economy strong enough to withstand tighter policy.

Although higher rates tend to weigh on the non-interest-bearing bullion, demand for the haven asset is being underpinned by concerns over the economic fallout from Russia’s invasion of Ukraine. Also supporting gold is the decades-high inflation that the Fed is attempting to contain without causing a slowdown.

A section of the Treasury curve — the gap between five-and 10-year yields — inverted for the first time since March 2020, potentially indicating oncoming growth pains, according to Bloomberg.

“A glance at previous rate hike cycles shows that gold tended to gain once the cycle begins,” Commerzbank AG analyst Carsten Fritsch said in a Bloomberg note.

“The same appears to be happening this time too, though comparisons with past rate hike cycles are difficult in view of the war in Ukraine. After all, this is an additional factor that points to increased demand for gold,” Fritsch added.

Investors continue to seek a store of value amid the uncertainty, with initial data compiled by Bloomberg showing an addition of 11 tonnes to gold-backed exchange-traded funds Wednesday.

ETF inflows have been “persistently robust” and since the start of the Ukraine war total 117 tonnes, Fritsch said.

“With a weaker dollar and the Ukraine situation still in the background, people have started piling into gold,” said Miguel Perez-Santalla, head of trading sales and marketing at Heraeus Metal Management in New York.

“Gold is going to continue to try to test higher, it’s got a lot of demand behind it and a lot of concerns. We could over $2,000 again,” Perez-Santalla told Reuters.

(With files from Bloomberg and Reuters)