How to find the most promising SPACs and dodge the hidden dangers

Investing great Charlie Munger thinks the world would be better off without SPACs, saying this week that “this kind of crazy speculation” is a sign of an “irritating bubble.”

That’s a little harsh. SPACs have a lot of pitfalls, as I wrote about here.

But in the right hands, they offer an easier path to market than the traditional IPO route for solid companies. They can make for good investments. The key is you have to know how to separate the wheat from the chaff.

Here is a guide to what to look for in SPACs, or special purpose acquisition companies, which are known as blank-check companies that come public with the intention of merging real companies into them.

SPAC tactic No. 1: Look for winners in the mix.

The SPAC EOS Energy Enterprises Inc. EOSE,

EOS Energy is probably more of a hold now, but here’s a new SPAC that looks attractive.

In biotech, I always like to take a close look at what Perceptive Advisors is doing, because like Riley, they have a good record. Perceptive is sponsoring a new biotech SPAC called ARYA Sciences Acquisition IV ARYD,

It’s also a bullish sign that this SPAC has top-tier investment banks handling the initial public offering (IPO), in Goldman Sachs Group Inc. GS,

SPAC tactic No. 2: Look for SPAC sponsors that have good records.

This is a variation on the tactic above, but here you focus on a specific track record just in SPACs. One that stands out is FS Development Corp. II FSII,

Also consider Alpha Healthcare Acquisition Corp. AHAC,

AHAC popped above $14 in February, but it’s now down close to $12. Alpha Healthcare will soon trade under the ticker HUMA.

That Perceptive Advisors SPAC ARYA Sciences Acquisition IV that I mentioned above also fits in here. Perceptive’s record in SPACs? Its Arya Sciences Acquisition Corp. III ARYA,

SPAC tactic No. 3: Favor SPACs sponsored by professional investors who manage a lot of money.

In their research paper “A Sober Look at SPACs,” SPAC experts Michael Klausner, Michael Ohlrogge and Emily Ruan at Stanford University and New York University School of Law define “quality” SPACs as those sponsored by investors who manage a lot of money. Their cut off is $1 billion, but any sizeable investment shop fits the bill. The assumption is that if sponsors have attracted a lot of money, they probably have a good investing track record and a respectable level of expertise in investing.

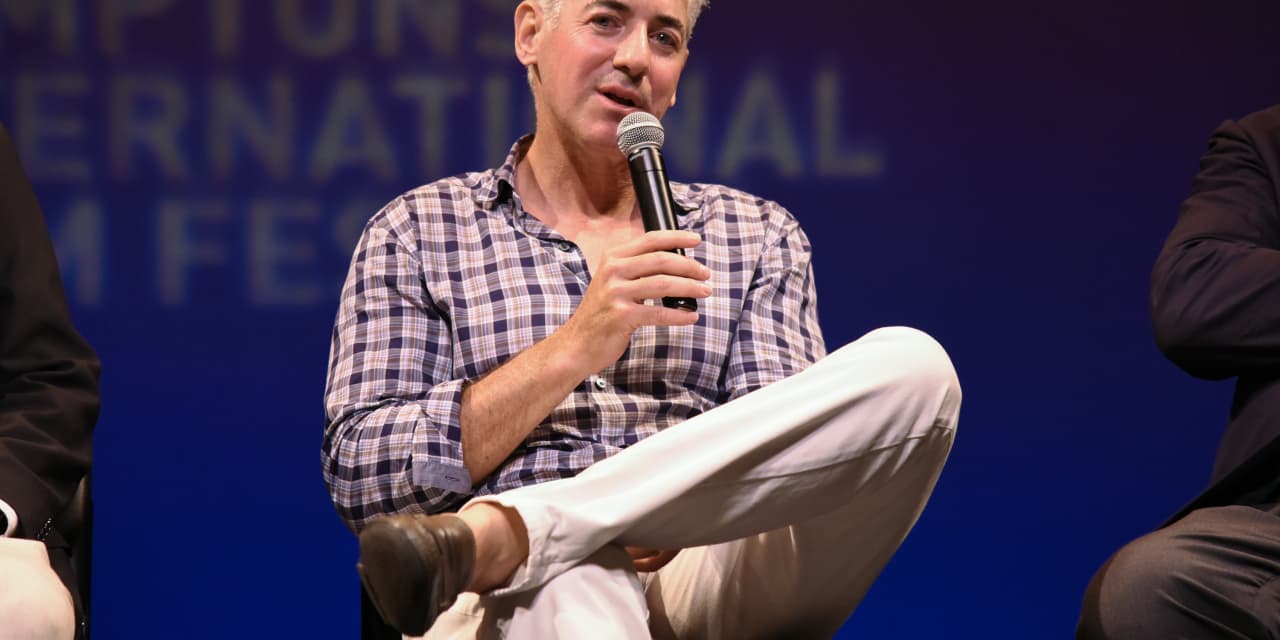

One example here is Pershing Square Tontine Holdings Ltd. PSTH,

SPAC tactic No. 4: Favor SPACs managed by former CEOs or top executives at successful companies.

The SPAC experts from Stanford and NYU mentioned above also define “quality” SPACs as those led by former CEOs or top executives at big companies.

A good example here is the telecom and tech SPAC Colicity Inc. COLIU,

Another one that checks the box here is Social Capital Hedosophia Holdings Corp. IV IPOD,

SPAC tactic No. 5: Dodge the flood of warrant dilution.

As I mentioned in my column on hidden risks in SPACs, an important problem with SPACs is that initial investors, such as hedge funds and Wall Street insiders, can get one warrant for each share they buy on the IPO. That creates big dilution if the stock does well. Warrants are a right to buy a share at a preset price — typically $11.50 for SPACs that come public at $10. When people exercise warrants, new shares are created, which means lots of dilution for other shareholders.

The simple way around this is to avoid SPACs that offer a warrant for each share in a 1:1 ratio. Not only do you avoid dilution, but to me, the use of few or zero warrants is a bullish investing signal. It suggests the SPAC sponsors have a decent reputation since they didn’t have to stretch to attract investors — by offering all those free warrants.

An example here is the telecom and tech SPAC Colicity mentioned above. It offered one-fifth a warrant exercisable at $11.50 when it launched its IPO this week, instead of one warrant per share of stock. Another one called FinTech Acquisition VI, which filed on Wednesday, offers one-fourth of a warrant exercisable at $11.50. (It will trade under the ticker FTVIU.)

Better yet, just go with SPACs that offer zero warrants. Two examples, already mentioned above because they checked the boxes for other tactics, are Foresite Capital’s FS Development Corp II and Perceptive Advisors’ SPAC ARYA Sciences Acquisition IV.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned EOSE and RILY. Brush has suggested EOSE RILY GS JEF FB in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.