Bigger stimulus? Here’s why now may be seen as the ‘peak of this bubble,’ warns strategist

As the first full trading week of 2021 winds down, investors have pulled off no mean feat, driving stocks higher amid a deadly riot at the U.S. Capitol and the relentless COVID-19 pandemic.

One bright note for some is a new political dawn in the White House, with Democrats set to take control of both the House and Senate. That is albeit a thin margin, perhaps giving President-elect Joe Biden less power to spook markets with tax ambitions.

Helping fuel Friday’s gains is a report that Biden is considering a two-prong COVID-19 stimulus plan — $1,400 payments to Americans, adding to the $600 already agreed, followed by a $3 trillion tax and infrastructure plan.

That brings us to our call of the day, from JonesTrading’s chief market strategist Mike O’Rourke, who warns we may have reached a tipping point for all that investor enthusiasm.

“The expectation of $2,000 stimulus checks as part of an additional $1 trillion fiscal stimulus from the Biden administration has only fueled the incredibly exuberant animal spirits in the financial markets. Don’t be surprised if this latest (and what should be the last) bout of fiscal stimulus marks the peak of this bubble,” O’Rourke said in a note to clients.

“These developments are responsible for sending U.S. equities to new all-time highs the past couple of days including a 6% rally in the Russell 2000 RUT,

Bitcoin BTCUSD,

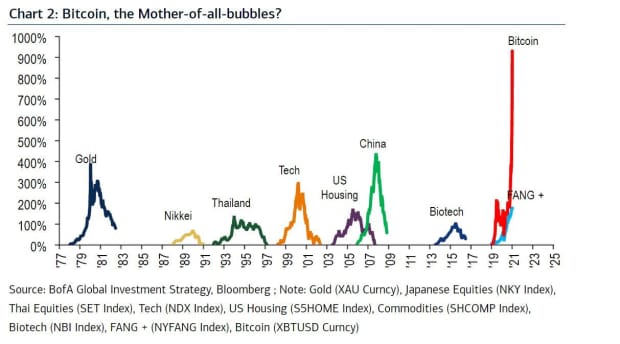

And Bank of America’s chief investment strategist Michael Hartnett told clients in a note on Friday to “sell the vaccine” news. That is as he noted “violent inflationary price action” over the last two months for assets like bitcoin.

Bubble warnings have also been heard this week from Jeremy Grantham, co-founder and chief investment strategist at Boston-based money manager Grantham, Mayo, Van Otterloo & Co.

But some have been going the other way. Credit Suisse’s U.S. equity strategist Jonathan Golub lifted his S&P 500 SPX,

The markets

Stock futures YM00,

The buzz

December U.S. jobs data are ahead, with a slim gain of 50,000 expected, though some economists warn that may be optimistic amid the COVID-19 pandemic fallout.

The COVID-19 vaccine from U.S. drug company Pfizer PFE,

Amid calls for his ouster, President Donald Trump condemned Wednesday’s violence by a mob of his supporters, as he returned to Twitter TWTR,

Shares of Hyundai Motor 005380,

Shares of Micron MU,

Boeing BA,

Chinese officials have locked down the capital of North China’s Hebei province, a city of 11 million, in a bid to stop a fresh COVID-19 outbreak.

Random reads

2020 competes with 2016 for warmest year ever.

Identical twins aren’t so identical after all.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.