Put Traders Bombard IBM Stock Before Earnings

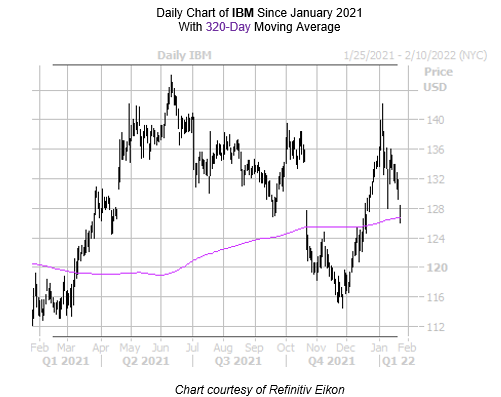

The shares of blue-chip IBM (NYSE:IBM) are down 2.4% this afternoon to trade at $126.30, just ahead of the company’s fourth-quarter earnings report — due out after today’s close. IBM stock holds an 11.8% lead over the last 12 months, but has already shed 5.2% in 2022. IBM is seeing support at the formerly resistant 320-day trendline, which put pressure on the shares for much of the end of 2021. Pacing for its sixth monthly loss in seven, the equity is in desperate need of a positive post-earnings swing.

That may not be in the cards, however, as IBM stock has a history of moving lower after earnings. During the past two years, IBM dipped following quarterly reports five times, averaging a 4.7% move, regardless of direction. This time around, the options market is pricing in a higher-than-usual, 12.7% swing for Tuesday’s trading.

Put activity is ramping up ahead of the event as well. At the midway mark, more than 31,000 puts have exchanged hands, which is quadruple the amount typically see at this point and nearly double the amount of calls traded. New positions are being opened at the most popular contract, the weekly 1/28 100-strike put, indicating these traders see more downside for the stock by the time the contract expires at the end of the week.

A broader look shows puts have been a favorite among options traders. This is per IBM stock’s 10-day put/call volume ratio of at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks in the lofty 94th annual percentile, indicating puts have been purchased over calls at a faster-than-usual clip of late.