Roxgold receives mining permit approval for Seguela

“It has been an exceptional year in progressing Seguela having grown the total mineral resources to over a million ounces, announcing maiden resources at Koula, Ancien, Agouti and Boulder, completing a preliminary economic assessment, and culminating in the environmental and exploitation permit approvals,” he stated in a press release.

In April 2020, a preliminary economic assessment for Seguela envisioned an open-pit operation with a mine life of eight years

The permit is valid for ten years and there is potential to renew the license as Roxgold grows and expands the project.

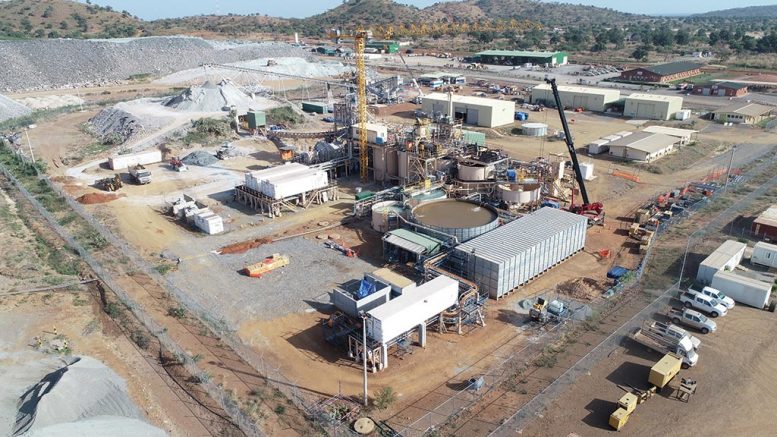

The company has already begun initial work at the project, including upgrades to the access road, building accommodation for workers, and has also started engineering designs for the processing plant.

“In addition to the positive impact Seguela will have on the surrounding communities, the project has the potential to more than double our production for shareholders within a short time frame and without the need for additional equity,” Dorward stated. “The confirmation of the permit and the start of early works is a major accomplishment towards achieving our goal of becoming West Africa’s next multi-asset producer.”

In other news, the company also released its latest resource update for Seguela in mid-December.

The resource estimate for the project has increased total ounces, grown total indicated resources by 97%, and features an initial inferred resource for the Koula deposit.

Indicated resources across the Antenna, Ancien, Agouti, and Boulder deposits now total 12.78 million tonnes grading 2.5 grams gold per tonne for 1 million oz. contained gold. This represents a 97% increase in the contained ounces when compared with the April 2020 estimate, which defined 7.1 million indicated tonnes grading 2.3 grams gold per tonne for 529,000 oz. of gold.

Inferred resources at the four deposits above, plus the Koula deposit 1 km east of Antenna, host 2.4 million tonnes grading 4.8 grams gold for 370,000 oz. of gold. This compares with 5.4 million inferred tonnes grading 2.9 grams gold for 508,000 oz. of gold previously. This 27% ounce decrease is due to the upgrade of prior resources to the inferred category.

The latest resource numbers are constrained by preliminary pits and are based on cut-off grades between 0.3 gram gold per tonne and 0.5 gram gold per tonne. Since the April 2020 update, Roxgold has drilled an additional 56,600 metres (this includes both reverse circulation and diamond core work).

“It has been an exceptional year at Seguela as we have continued to demonstrate the potential for the project to grow in quality and scale,” Dorward said. “The significant increase in indicated mineral resources to over one million ounces provides the foundation for a robust feasibility study which will also include the very high grade Koula deposit with a maiden inferred resource of 281,000 ounces at a remarkable 8.1 grams per tonne giving it the potential to be one of the highest grade open pits in west Africa.”

There are four rigs working at Koula completing infill and exploration work.

In April 2020, a preliminary economic assessment for Seguela envisioned an open-pit operation with a mine life of eight years, producing an average of 103,000 oz. of gold per year at all-in sustaining costs of US$749 per ounce.

Initial capex was pegged at $142 million and the study estimated an after-tax payback of just over two years. The PEA, which used a gold price of $1,450 per oz., forecast an after-tax net present value of $268 million, at a 5% discount rate, with an after-tax internal rate of return of 66%.

The study assumed mining of the Antenna, Ancien, Boulder and Agouti deposits. According to Dorward, Roxgold expects to release the results of the Seguela feasibility study in the first half of 2021, which would be followed by a construction decision ahead of a potential first gold pour in 2022.

“We continue to believe we have only begun to tap the ultimate potential of the Seguela project and are eager to continue to uncover and test the wealth of additional targets present on the property,” Dorward said.

Roxgold also owns and operates the Yaramoko mine complex in Burkina Faso, which is expected to produce 120,000 to 130,000 oz. of gold in 2020.

In a research note on Dec. 16, Raymond James analysts Craig Stanley and William Haynes forecast a target share price of C$2.40 per share. At presstime the company was trading at C$1.77 per share.

(This article first appeared in The Northern Miner)