Rising nickel prices to support project development – report

Fitch expects this low base effect to thus support growth. In Indonesia, the maintaining of nickel ore export ban had significantly hampered domestic opportunities for miners to sell their product, leading to a decline in production. Fitch expects mineral production to pick up in Indonesia as the country ramps up its nickel smelting and refining capacity. Fitch notes upside risk to its nickel mining growth forecasts depending on how quickly Indonesia will be able to ramp up its downstream capacity.

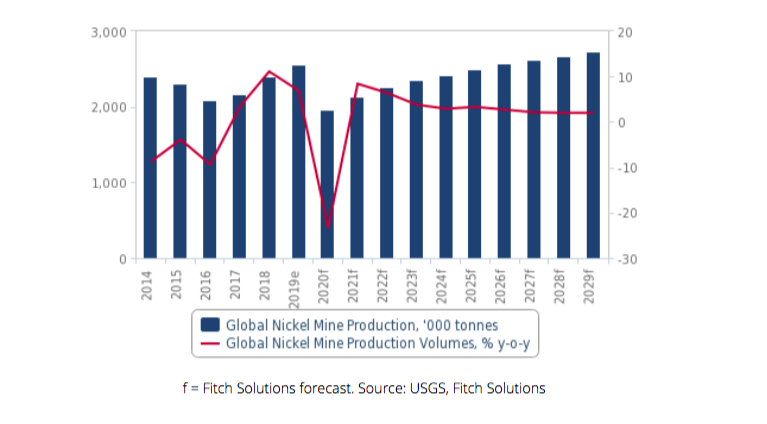

In the longer term, Fitch forecasts global nickel mine production to grow by an annual average rate of 3.7% y-o-y over 2021-2029, a significant slowdown from the 5.9% y-o-y average achieved over 2010-2019, which was boosted by higher nickel prices at the time and strong Indonesian output before another export ban in 2014.

By 2029, Fitch expects global annual nickel production to reach 2.7mnt, up from 2.0mnt in 2020. Indonesia surpassed the Philippines as the largest global producer in 2017 following the introduction of stringent environmental regulations in the latter.

Philippines to regain its spot as the largest global producer

But Fitch believes the tables will turn in 2020 onwards as the Philippines is set to regain its spot as the largest global producer due to a restriction on nickel ore exports in Indonesia leading to a halt to mining operations. The other best-performing major producer will be Australia, which maintains a stable regulatory environment and solid project pipeline. Finally, Russian nickel production will grow at the slowest rate of the top five major producing countries in the coming years as few new projects come online.

Australian nickel production growth will also remain positive over the coming years, due to a healthy project pipeline. Its nickel sector will increasingly gain investor attention as the rising battery trend prompts miners to develop projects in stable operating environments. A more positive price outlook for nickel, underpinned by solid demand growth, will support this view.

In the long run, Fitch forecasts, rising nickel prices will support project development as the economics of nickel mine projects becomes increasingly attractive.