The future for gold – is it brighter than ever?

It’s a funny thing but – our first primary use for gold was turning it into expensive trinkets like jewellery, iconography, and burial adornments. By 3000 BC we were beginning to use it for trading, and by the 600’s BC it was a significant component in our first currencies. Over six and a half thousand years later, more than 90% of the gold mined annually is (still) destined for jewellery, bullion, and coins – collector’s items of considerable value in other words.

Statista informs us that the actual global breakdown of gold use in 2019:

- jewellery: 48.5%,

- investment: 29.19%,

- central banks: 14.84%,

- technology: 7.48%

Very little gold is used for industrial purposes, although this use will likely grow as technology finds new ways to use it. Nevertheless, gold remains at base an investment rather than an industrial commodity. We produce enough of it each year to create investment products, but not enough to flood the market, or enable mass production.

Indeed, when it comes right down to it, much of gold’s remarkably special value has to do with its rarity, versatility, durability, and of course beauty. These qualities historically led humans to put it on a pedestal right from the start and it’s never really come down from those lofty heights.

Gold Today Is Valuable Because:

1. Gold is scarce. The earth’s store of gold is finite, and we’ve already dug most of it up. We also know that accessible reserves on terra firma are dwindling, thus increasing its value. It’s also only been relatively recently that we’ve come to realise we can do something constructive about the commercially significant quantities of gold and other valuable metals that end up in landfill via old mobile phones, computer hard drives and other ‘out of date’ technological gadgetry. Recycling these effectively will help alleviate some of the demand.

Sometimes called the ‘King’ of metals, gold has an atomic number of 79 and is one of the ‘noble metals’

2. Gold mining is akin to digging a needle out of a haystack, albeit with the help of a metal detector. Producing gold is an expensive exercise that requires sifting through tons of waste rock to extract just a few grams of the precious metal. Indeed, from the discovery of those first gold nuggets some 6600 plus years ago right up to today, it’s estimated we’ve likely only mined enough of it to fit on a single footie field to a depth of less than 3 metres. Each year we mine just enough to add less than the equivalent of a layer of paint to the surface.

3. Gold is a highly useful, very versatile, and durable (non-corrosive) metal.

Sometimes called the ‘King’ of metals, gold has an atomic number of 79 and is one of the ‘noble metals’. ‘Atomic number’ refers to the number of protons in the nuclei of atoms in a substance. With metals, the higher the number, the denser or heavier the metal is. As a comparison, uranium is currently the heaviest known natural element with an atomic number of 92. There are heavier elements around, like oganesson, which has an atomic number of 118, but they’re invariably man-made.

Even more significantly, gold sits right at the very top of the list of noble metals so is in effect the ‘Supreme Being’ of noble metals. It’s virtually indestructible when it comes to corrosion and oxidation. That’s why gold artefacts found in ancient graves and tombs still look nearly as pristine and fresh (once they’ve been cleaned off) as the day they were buried many thousands of years ago.

What’s a noble metal? The answer rather depends on whether you’re a physicist, or a chemist.

- In physics, which has the strictest definition of ‘noble metal’, it refers to metals that have completed filled d-bands‘ or ‘d-subshells’ in their atomic structure, making them very stable. Only gold, silver and copper make this exclusive list of noble metals.

- In chemistry, noble metals are metals that are intrinsically highly resistant to oxidation and corrosion ie contact with gases and liquids at their surface interface. This list of noble metals is more expansive and generally includes gold, platinum, silver, palladium, rhodium, ruthenium, osmium, and iridium.

- However, it’s not set in concrete so you’ll sometimes see other metals like rhenium, copper, and mercury included. Incidentally, copper only makes the grade here because it develops a thin surface oxide layer when it encounters liquid or air. Sitting pretty at the top of the list is of course gold, the most corrosive and tarnish resistant of them all.

4. Gold is an excellent conductor of both heat and electricity with significant industrial value. Gold is the 3rd best conductor of electricity behind silver (the ‘silver’ standard of electrical conductors with a rank of 100) and copper, which has a rank of 97. Gold has a ranking of 76. It’s also the 3rd best metal for thermal conductivity again behind silver (top) and copper. Interesting side note – diamond is actually the best thermal conductor of all but conversely makes a great electrical insulator because it’s extremely lousy at conducting electricity.

However, where gold trumps both silver and copper for conductivity (both kinds) is in its superior durability (non-corrosive, non-oxidative) qualities, which is why it’s often used in delicate high-performance applications like electronics. If gold was cheaper and less rare, it would probably be used in general conductivity applications a lot more.

A precious metal is not to be confused with a noble metal, although some of the characteristics overlap

5. Gold is very dense and malleable. Gold, with its high atomic number, is very dense. It’s also very malleable and can be spread very thinly. One gram can be worked into 165 metres of non-corrosive, long lasting wire, or a square metre of film 50 nanometers thick. These are both very useful characteristics.

6. Gold is one of the major precious metals (no surprises there!)

According to Wikipedia, a precious metal (not to be confused with a noble metal although some of the characteristics overlap) is a “rare, naturally occurring metallic chemical element of high economic value. Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre.”

The other major precious metals are silver, palladium, and platinum. Until recently, gold was the most expensive of these metals but over the past year, palladium has leapfrogged into that position as demand for the critical catalytic converter component continues to outstrip supply.

7. Gold is a coinage metal. Along with silver and copper, gold is classed as a traditional coinage metal due to its long history of use for this purpose. Throughout history, gold coins and coins with a high component of gold in them were always associated with the highest denominations of currency, and often reserved for high value trading.

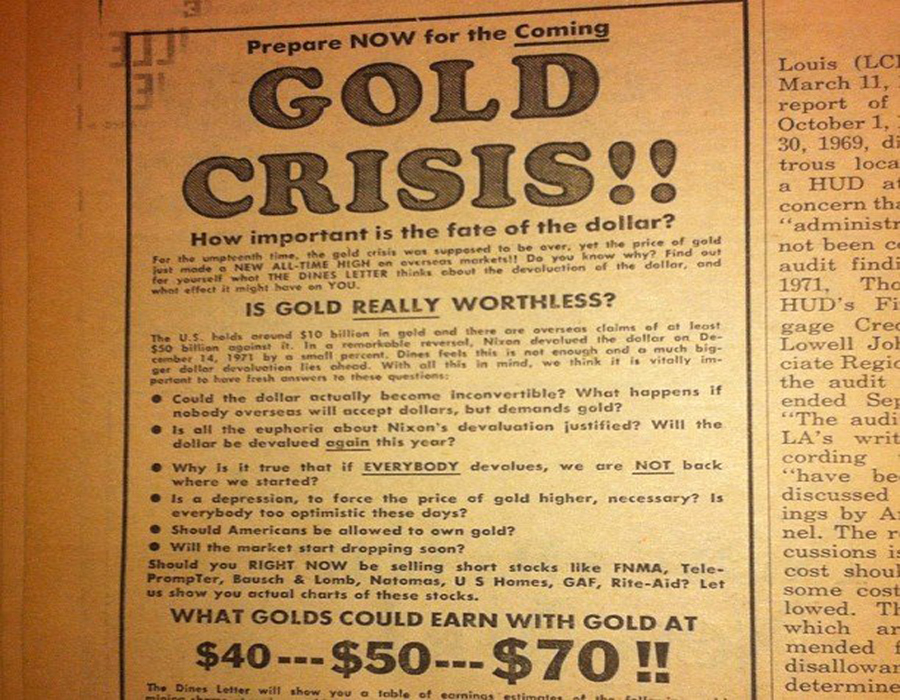

8. Gold traditionally gave the world’s major currencies their value.

When paper money came into being, the ‘thing’ that initially gave it any value was gold – each type of note or bill was backed by an agreed amount of gold. This was the ‘gold standard’, a “monetary system where a country’s currency or paper money has a value directly linked to gold. With the gold standard, countries agreed to convert paper money into a fixed amount of gold. That fixed price is used to determine the value of the currency.”~ (Interesting side note – the Chinese in the Tang Dynasty (618 – 907 AD) were the first to use paper money!)

Throughout the 19th and early 20th centuries, most major currencies around the world based themselves on the gold standard. However, this was largely abandoned in the 1920’s and 30’s in favour of fiat-based systems, although the US retained a link between gold and their currency system until 1971.

9. Gold, despite its ups and downs, remains firmly synonymous with security, stability, and longevity, perhaps to the detriment of unwary investors. Whilst it’s tempting to think of gold as being unswervingly steadfast in value, it’s not. It is subject to the same rises and falls in value as other investments. Two decades ago, it was trading at under $300 an ounce.

Since then, it’s risen to the dizzying heights of $1,917.90 an ounce in August 2011, plunged back down to the $1,000 mark in 2016 and risen again to remain relatively stable between $1,200 – $1,400 for the last few years. It took off again in mid-2019 and, apart from a bit of a correction in March 2020, has continued rising ever since to finally crack the $2,000 spot price mark in early August 2020.

There’s an interesting truth about the price of gold

Campbell Harvey is a Duke University economist and an adviser to investment strategy company Research Affiliates. He has a keen interest in gold and its relationship to pivotal economic cogs. Notably, his research on the metal’s value throughout the ages from this angle has turned up some interesting information.

One of the things he researched was how much Roman army bigwigs were paid back in the day (around 2000 years ago). According to the meticulous Roman records of the time, their centurions were paid in coins, and the value of the gold in those coins at the time translates more or less equally into the $ value salary of a modern day US army captain. This, along with various other examples, indicates that “the same amount of gold had the same value relative to household expenses in the Roman Empire as it does now. …. That means over all those centuries, the rise in the price of gold has equalled the rise in overall prices.”

What causes gold to rise, and inevitably fall, in price?

Ask a dozen different ‘experts’ and you’ll likely get around a dozen different theories. Traditionally, there has been a belief that the gold price inversely follows the fortunes of the US dollar. When that is weak, and consumer confidence in it and the US economy generally is low, the price of gold rises and vice versa. However, many believe that’s an overly simplistic view, and not always entirely supported by history. There have been times when the USD has risen but so has the price of gold. And vice versa.

Campbell Harvey believes that, long term, gold more or less follows natural inflation and reflects consumer and cost of living price indices. This makes sense given that ever since we started using the metal as a trading commodity, we’ve fundamentally given it a value in terms of ‘how much a set amount of it will buy in the way of goods and services’ (the age old ‘gold standard’).

There’s plenty of evidence to back up Harvey’s view. His (and other) research shows that for almost the last half century, the average inflation adjusted price of gold, or its long-term price, has been fluctuating by a fairly consistent multiple that is around 3.5 of the CPI. This ‘price to CPI’ multiple functions something like the price-to-earnings ratio and serves as a pretty accurate benchmark or baseline of gold’s true value in relation to consumer confidence and spending.

What goes up inevitably comes back down again

Every so often extraordinary market forces push gold well above (like now – gold is trading around 7.5 times above the CPI, which is not sustainable long term) or below this benchmark. It may simmer along like this for a while but eventually, as happens with company stocks when they go up and up, prices reach a point where investors are no longer prepared to pay ‘that much’ for their share of a corporate dollar earned, or an ounce of gold. When that happens investors sell whilst the going is good, grab their profit, and run, which forces prices back down towards the ‘benchmark’ again. Conversely, gold can remain below the benchmark for extended periods too, which is when the savvy (and patient) investors will buy!

Pertinent market forces behind gold’s current meteoric rise

Currently, the US Government and its Federal Reserve System is printing money almost ad hoc, has entered into huge bail out packages for its citizens, kept interest rates at just under 1%, and there is currency debasement happening as well. They’re not alone in doing this by any means but for global economic purposes, it’s the US that ‘matters’ the most. Then there is the deteriorating relationship between the US and China, the looming US Presidential election, the unprecedented slow down of most economies around the world, and the uncertainty about the future brought on by the global health pandemic.

Colloquially referred to as ‘massive passives’, ETFs specialise in passive aka ‘buy-and-hold’ investment portfolios that generate profits over the long term

From an investment viewpoint, current low interest rates across much of the developed world right now means keeping money invested in the banking system isn’t the most profitable of investment options. Back in April, the Bank of America tipped gold to reach US$3,000 an ounce before the end of 2021 largely because interest rates are likely going to stay low for at least that long, and perhaps longer.

Bringing out the gold bug

It’s certainly unprecedented and uncertain times for the modern world and people are panicking – about their health, job security, finances, the economy … Historically we’ve seen over and over that uncertain times bring out the gold bug in investors, generating speculative investor frenzies that (unsustainably) drive its price up. Goldman Sach analysts in fact recommended in March, during that brief correction period, that ‘now is the time to be buying gold’ because it’s a ‘safe haven during the current economic turmoil’.

The current gold price spike though has a few added factors that differ from past spikes. We looked at the rise of the megalith superannuation funds in a previous article and their growing dominance of the world’s stock exchanges. These funds exercise enormous investment powers, and if they all go after gold at the same time, that’s going to affect the market in a big way.

Likewise, authorities like Campbell Harvey point to the rise of gold exchange traded funds (ETFs) that have made it much easier for the ‘average Joe Blow’ to ‘get into gold ownership’. That helps fuel investor driven spikes like the one happening now. Colloquially referred to as ‘massive passives’, these large funds specialise in passive aka ‘buy-and-hold’ investment portfolios that generate profits over the long term. Indeed, superannuation funds often offer eligible members the option of investing in gold via ETFs and other managed funds. Currently, it seems many involved in these ETFs believe gold’s momentum will continue rolling smoothly upwards for some time yet, which is fuelling the fire.

“People Create Their Own Truth”

They could well be right. Well known business entrepreneur Warren Buffett likes to use the phrase ‘bandwagon effect’ to describe the snowball-like momentum that happens when people start buying up big in a particular commodity. The more they buy, the more demand they create, which drives up the price. This confirms (to them) that their investment is on the money and so the momentum continues to build. Currently, the more that investors continue to plough their money into gold as a way of hedging against future uncertainties, the higher it is likely to go. At least that is until that other age old economic principle swings into action – what goes up must surely come down again, and so ‘the bubble bursts’.

When that will happen is the $64,000 question!

Could it be happening already? After hitting those euphoric $2,000+ highs in mid-August, we saw another mild correction with prices plummeting back below $1,940 again.

Gold ETFs have also reported consecutive days of outflows so clearly some investors are cashing in their gold and bailing. The price has also steadied since, mostly hovering between $1,920 and $1,950 with one short lived spike that took it back up over $1,960.

Experts though believe this cycle of rallies and minor corrections will continue for at least as long as global interest rates remain exceptionally low, currency is being debased, governments are printing money and funding massive stimulus packages.

(This article first appeared in Mining International Inc.)