Italy & ECB: Shift of Bonds to Private Investors Underpins Need for Policy Flexibility and Political Stability

Given Italy’s public-finance vulnerabilities – with government debt-to-GDP of around 150%, annual gross financing needs close to 30% of GDP and a government deficit still above 5% of GDP – markets have rapidly repriced risk relevant to Italian government bonds in the absence of full assurance of the ECB’s commitment to containing rates and/or spreads.

Italy’s reliance on the private sector for financing is set to rise over the coming years as its funding needs remain elevated and the ECB concludes net asset purchases. This transition, which sharply contrasts with a 2019-21 period of aggressive ECB balance-sheet expansion, holds important implications and needs to be managed carefully.

The ECB has stated its commitment to preventing fragmentation in the transmission of its monetary policy, and thus announced a flexible reinvestment of principal repayments of securities under the Pandemic Emergency Purchase Programme (PEPP). However, many important details have not been revealed yet.

The ECB could use reinvestments to purchase more securities of certain indebted member states

The ECB’s self-imposed limit of not holding more than 33% of any outstanding bond issue (under the Public Sector Purchase Programme (PSPP)) could imply a lower ability (or willingness) to reinvest maturing bonds of certain jurisdictions.

In the case of Italy where the Eurosystem, via the Banca d’Italia, holds around 25-30% of outstanding debt issues (Figure 1), that additional flexibility could prove especially valuable should the Italian Treasury face continued pressure affecting financing costs, made all the more relevant by the country’s sizeable gross financing needs.

Scope Ratings thus believes that, in line with its stated flexibility, the ECB could use reinvestments to purchase more securities of certain euro-area member states by shifting reinvestments across jurisdictions. It is unclear, however, whether the ECB could also accelerate reinvestments into securities of one member state prior to the maturities of debt securities of that specific jurisdiction.

Figure 1: Eurosystem holdings of debt securities, % of total, end-2021

A clear communication on ECB reinvestment flexibility could smoothen balance-sheet transitions

A clear communication on the extent of the ECB’s reinvestment flexibility could thus help smoothen tightening financial conditions during a forthcoming shift of securities holdings off the Eurosystem balance sheet to private-sector balance sheets. The key question, in our view, is thus how much market volatility will we observe until a new equilibrium is found, in which risk premia again reflect country fundamentals under more “normalised” interest-rate conditions.

We note that even absent reinvestment flexibility, debt securities corresponding to an Italian fiscal deficit of about 2.5% of GDP could be absorbed by the Eurosystem via its reinvestments over the next years, or about EUR 50bn.

Thus, assuming a fiscal deficit of 6.0% in 2022 and 4%-4.5%% in 2023, and deficits of around 2.5% for 2024-27, the volume of annual long-term issuance of the Italian Treasury absorbed by financial markets should remain in line with 2014 levels of EUR 272bn over coming years, partially limiting pressure on financing costs of Italy. Issuance will likely, however, be significantly above volumes observed in recent years, resulting in higher funding costs.

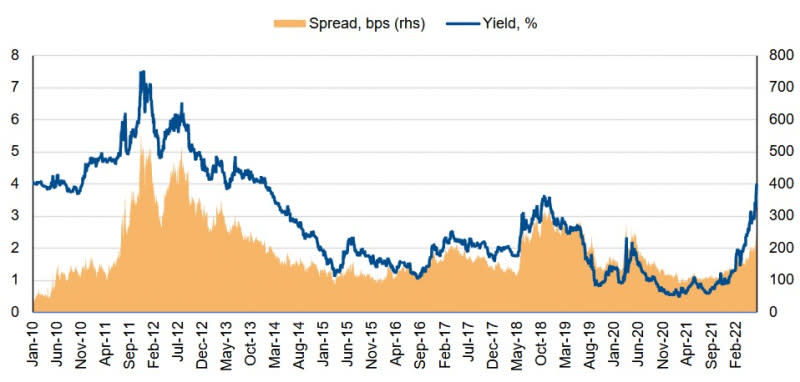

Figure 2: 10-year Italian government bond yield and spread to German Bund

Higher yields could imply an increase of interest payments of around 1.5% of GDP

We note that the immediate impact of a parallel shift of the Italian yield curve of 100bps is estimated by the government at circa 0.5%-0.6% of GDP after three years. If yields were to stay at current elevated levels with the 10-year BTP yielding around 4% (Figure 2), this would correspond to a 300bp shift compared with the start of the year.

A back-of-the-envelope calculation would thus imply an increase of interest payments of around 1.5% of GDP, or about EUR 30bn cumulatively after three years. This compares with total interest expenditure of EUR 60bn in 2021 and EUR 83.6bn back in 2012.

From a policy perspective, we believe such an adverse scenario could probably be mitigated if the ECB clarified its commitment to using reinvestments flexibly across jurisdiction and time. The ECB is expected to further detail a new programme to preventing further interest-rate fragmentation.

Reaching a new interest-rate equilibrium for Italy will require policy flexibility at European level

Reaching a new interest-rate equilibrium for Italy will thus require policy flexibility at European level – as exemplified over the past 15 years via establishment of Outright Monetary Transactions, the European Stability Mechanism and the EU’s Next Generation EU (NGEU) fund – but also require domestic political stability, including after next year’s general elections in Italy, and implementation of reforms in line with those on which NGEU disbursements are conditioned upon.

Given Italian citizens’ strong support for euro-area membership, with 72% supporting the single currency per the latest Eurobarometer, we believe EU policy makers will use existing and, if needed, develop new instruments to ensure broad macro-economic stability across the EU-27.

This is especially the case for Italy, a founding EU member of systemic political and economic importance, which is a key argument underpinning our BBB+/Stable rating. Scope’s next scheduled review for Italy is 29 July.

For a look at all of today’s economic events, check out our economic calendar.

Alvise Lennkh-Yunus is the Deputy Head of Sovereign and Public Sector ratings at Scope Ratings GmbH.

This article was originally posted on FX Empire