Is Nvidia Stock a Buy Ahead of Earnings? Morgan Stanley Weighs In

In just a little over three weeks, Nvidia (NVDA) is due to report its Q1 2022 earnings. Perhaps in preparation for that big event, investment bank Morgan Stanley announced it is resuming coverage of the semiconductors giant — and provided a few thoughts on the company ahead of earnings.

“Nvidia,” writes Morgan Stanley analyst Joseph Moore, “remains one of the best growth names in the semis space [and] is a core holding.” For this reason, the analyst says Morgan Stanley’s approach will be “to at least maintain a market weighting in the stock, and look for spots for an overweight.” In other words, Moore appears to be saying here that under no circumstances would Morgan Stanley consider rating Nvidia a Sell.

Moore notes that Nvidia has built “a strong, differentiated cloud [artificial intelligence / machine learning] business and leading position in gaming.” That being said, the gaming business does pose some concerns.

Near term gaming numbers look “solid,” says Moore, and over the long term as well, the analyst says he’s bullish on Nvidia’s “prospects and market positioning.” However, he does predict a deceleration in gaming revenues “that should result in a modestly challenging 2023” — helped only partially by Nvidia’s strength in selling server chips to data centers.

So much for the business. Now let’s consider the stock price. Nvidia continues to grow both sales and earnings for now, but even so, “earnings growth will likely be partially offset by multiple compression,” especially as inflation and interest rates rise and investors become less willing to pay large price tags for earnings far in the future. This could prove a problem for Nvidia stock, which sells for “a meaningful premium to everything else.”

By Moore’s calculation, Nvidia stock sells for 38 times current year earnings and 32 times forecasts for earnings in 2023. (Valued on trailing earnings, the stock has an even higher P/E of 48). Even the most generous measurement of earnings, therefore, would require Nvidia to achieve and maintain 32% long-term earnings growth to maintain a PEG ratio of 1.0 — and 32% long-term growth could be problematic.

In part it’s because these multiples are already so high that “the stock has traded sideways since the broader high-growth tech selloff that we saw to start the year.” But a second reason for Nvidia’s failure to outperform of late is because the gaming business is expected to decelerate this year.

As the pandemic winds down, government handouts dry up, and Americans head back to the office to work, there’s going to be less time, and less money available to spend on gaming and on gaming hardware, depressing sales of the GPUs that have always been Nvidia’s forte. Additionally, recent weakness in crypto prices is hurting demand for Nvidia GPUs that have been repurposed for cryptocurrency mining, putting at risk “about $800 mm per quarter [in sales of graphics chips] across the industry.”

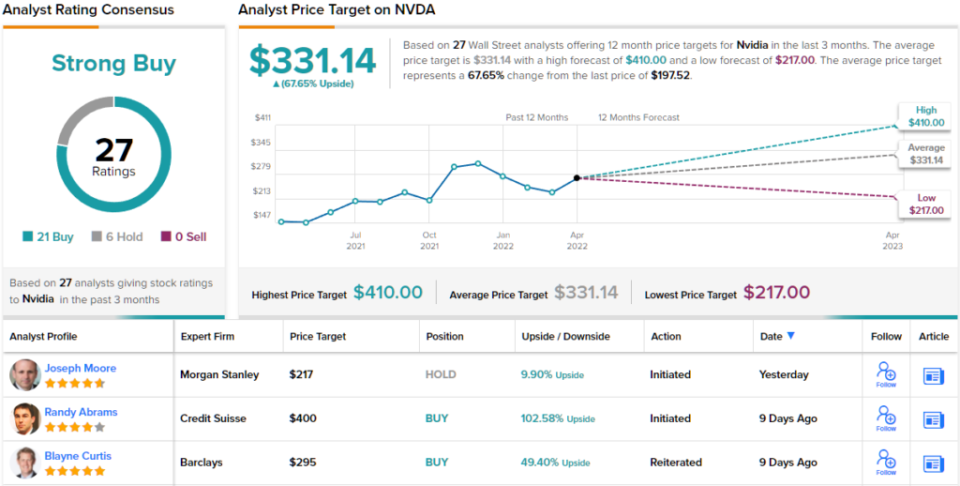

With these concerns in mind, Moore assigns Nvidia an equal-weight (i.e. Hold) rating for now, and a $217 price target. By the analyst’s own admission, however, “equal-weight” is about as low a rating as Morgan Stanley is prepared to ever assign Nvidia. (To watch Moore’s track record, click here)

The rest of the Street is more optimistic than Morgan Stanley. 21 Buys and 6 Holds have been issued in the last three months, making NVDA a Strong Buy. At $331.14, the average price target brings the upside potential to ~68%. (See NVDA stock forecast on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.