‘There’s a shift happening’: McCain and food’s old guard look to the future as climate change threatens crops

A ‘massive amount’ of capital is flooding the agri-food sector to fund new technology

Article content

Among the flurry of futuristic investments that Canadian French fry empire McCain Foods Ltd. has been making, probably the most interesting has been an indoor lettuce farm.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

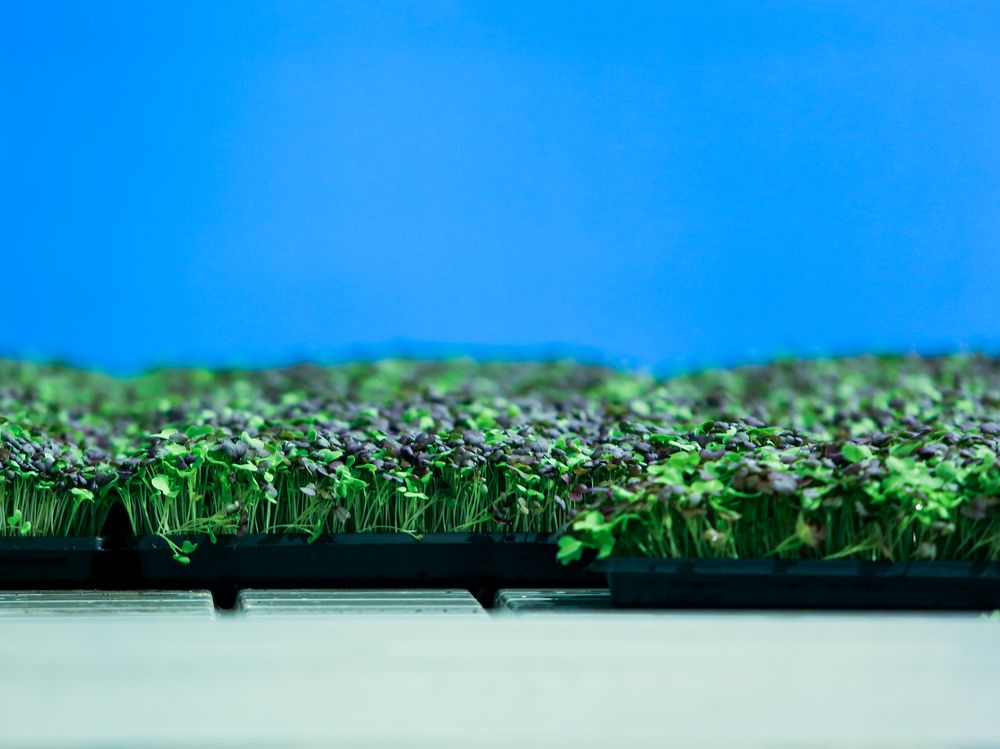

That company, GoodLeaf Farms, has turned heads in the industry by producing commercial quantities of salad greens year-round in a windowless warehouse in Guelph, Ont., without pricing itself out of competition with the outdoor varieties shipped up from California. GoodLeaf’s method of controlled-environment agriculture could help Canada steel itself against impending climate catastrophes that could make that California lettuce less viable. But it can’t grow potatoes.

Well, it could grow potatoes, but they’d cost $20 per pound, rather than the current price of about a $1 per pound, as Lenore Newman at the University of the Fraser Valley in British Columbia once put it . Vertical farms use LED lights and even though advancements have made them less expensive, it’s still a cost-intensive proposition. The quicker the crop grows to market size, the smaller the price tag. Micro greens can be ready in a matter of days; potatoes take months. And McCain needs about 2.3 billion pounds of potatoes annually in Canada, sourced from farmers in New Brunswick, Manitoba and Alberta.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“I remember the first time I walked into one of our potato storages,” McCain’s chief growth and strategy officer, Peter Dawe, said in a recent interview. “It’s a football-field size. The potato pile is 40 feet high and it just goes back forever.”

The indoor farm could actually help with developing new potato varieties, at least some day, but McCain’s $65-million investment to become the single largest shareholder in GoodLeaf isn’t really about potatoes at all. The move has been informed by what Dawe called the “common logic” underlying the hundreds of millions of dollars McCain has funnelled into a series of food startups and tech firms since 2018.

“They all fit a narrative and a view of the world and where we think it’s going,” he said. “There’s a shift happening.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

For McCain, climate change represents two challenges: it’s harder to grow crops and consumers are turning against brands they see as making matters worse. New agriculture technologies have attracted investments from Silicon Valley of late, but industry observers believe that an evolution in agriculture will still depend in large part on the old guard: the big, traditional food companies that can help upstarts achieve scale.

McCain has pledged to use regenerative agriculture techniques on the 370,000 acres it relies on worldwide by 2030, in an effort to make its crops more resistant to the sort of extreme weather that is expected to become more common as climate change progresses. The first of three McCain Farms of the Future is operating in Florenceville, N.B. — the town on the banks of the St. John River where the company built its first French-fry plant in 1957 — to develop new practices and demonstrate their viability.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The company hasn’t disclosed the exact figures but Dawe said the total investment since 2018 is in the “low hundreds of millions” for six main ventures: GoodLeaf; Simulate, a plant-based chicken nugget startup; the Simple Root brand of vegan cheeses and dips derived from the wonkier potatoes unfit for McCain fries; crop management firm Resson that uses satellite and drone imagery; a 49-per-cent stake in Fiddlehead, a data-science company based in New Brunswick; and US$55 million in Strong Roots, an Irish frozen-food brand that makes cauliflower hash browns, root vegetable fries and other starchy alternatives to potatoes.

The McCain investments are part of a “massive amount” of capital flooding the agri-food sector to fund new technology, according to Steven Webb, who heads the Global Institute for Food Security at the University of Saskatchewan. That wave of interest has produced new agtech darlings, but the old food companies still have a role to play.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Webb called them “big incumbents” — McCain, or the poultry giant Maple Leaf Foods Inc., which has moved dramatically into plant-based protein processing. Those large companies have the reach, and the expertise, to fill the gap between emerging technologies and outfits that can help successfully bring them to market.

“It’s not just money,” Webb said. “They bring market knowledge. They bring reach. They bring skill.”

-

The rise of indoor farming is exploding, but Canada is lagging behind

-

Growing up: The next frontier in farming is vertical and it could cut Canada’s reliance on imported food

-

Why processing beans, peas and lentils could solve Canada’s ‘commodity conundrum’

-

Michael McCain whacked a hornet’s nest — and those who know him aren’t surprised

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

McCain, for example, noticed that GoodLeaf’s investor base skewed toward the “the technology world,” Dawe said.

“I think we bring something unique,” he said. “Our goal isn’t to create a food venture fund, as some of our competitors are.”

What McCain can offer, and tech firms can’t, is contacts among the largest restaurant chains in the world. The company’s $10 billion in annual sales skews heavily to the food-service sector, and McCain sales reps have started helping pitch GoodLeaf products to their existing clients in the Toronto area, Dawe said.

That ends up working out for both sides. GoodLeaf gets introductions to major buyers in the industry and McCain gets to branch out from fries and hash browns. “Now we’re also relevant,” he said, “because we can be part of their salad or their garnish.”

Financial Post

• Email: [email protected] | Twitter: jakeedmiston

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.