Shift to less liquid assets raises gold’s investment appeal — report

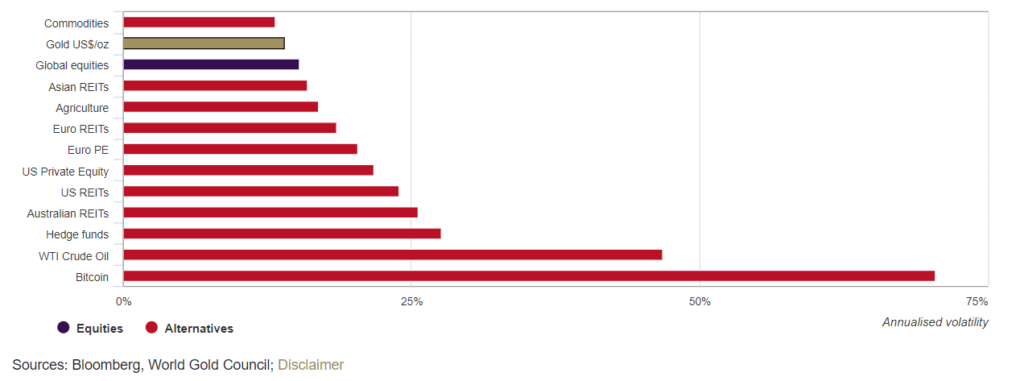

Given its combination as a highly liquid diversifier that can reduce portfolio volatility, the WGC believes that gold’s investment appeal will be strengthened amid the global shift to risker and less liquid assets.

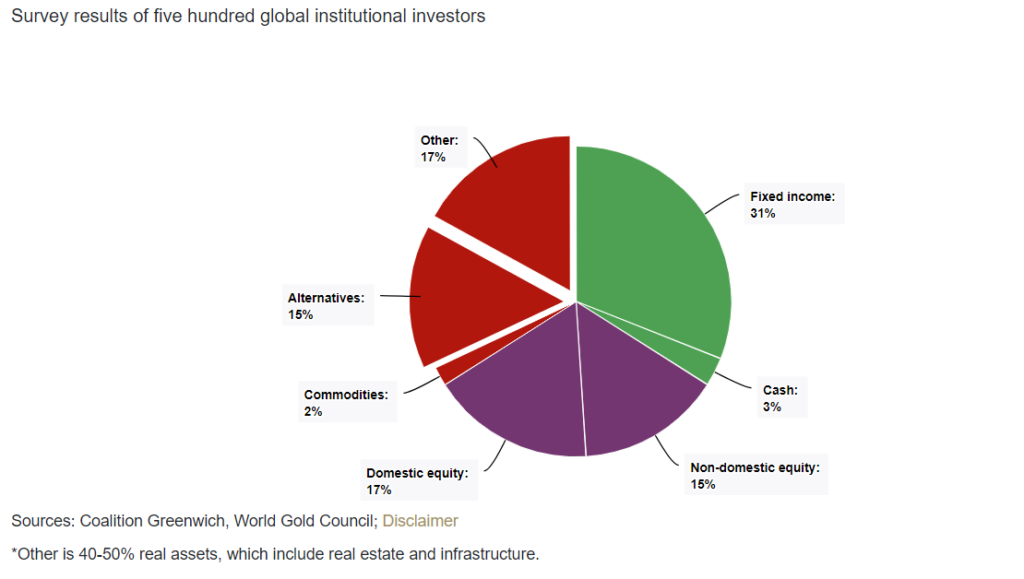

Data from Greenwich Coalition and Mercer, as well as anecdotal evidence from investors and global conferences, suggest that along with this reduction in fixed income, investments in alternatives and ‘other’ assets (such as real assets and infrastructure) have been growing.

Results from a recent market survey conducted in partnership with the Greenwich Coalition respondents noted they are targeting a third of their portfolio in alternatives and other assets over the coming three years. But a key characteristic of these investments that should be considered is liquidity, particularly as the market enters a higher inflationary period, WGC says.

“The reason we highlight the shift to illiquid assets is because gold provides the capital and liquidity needed during a market selloff,” the WGC says.

According to the Council, gold trades between more than $100 billion per day in total, and its most accessible venues – gold-backed ETFs and gold futures – represent $57 billion per day. Gold tends to buffer portfolio drawdowns and is often one of the first assets sourced by investors to increase portfolio capital or, sometimes, to buy distressed securities.

A common question we hear in the early phase of a sharp market sell-off when gold also falls is “Why isn’t gold higher?” In such situations, investors sometimes sell some of their gold position, because of its strong liquidity. However, the gold price historically bounces back quickly, improving the performance of the portfolio, says the Council.

A prime example of this is the covid-19 selloff of March 2020, WGC points out. During the market crash, gold sold off 12% (peak to trough) over seven trading days, yet recovered to finish the month flat. Meanwhile, the S&P 500 finished the month down 13%, global hedge funds lost 6% and listed private equity lost 29%.

In this instance, gold would have decreased overall portfolio volatility. Using gold to build positions in some of the distressed assets would have meaningfully increased 2020 returns; many assets finished the year significantly higher, while gold finished the year up 25% on its own, WGC concludes.