This wild stock market rumpus could send the S&P 500 well over 5,000. But set your alarms for mid-2022.

Cryptos are surging, stocks are at record highs, and money just keeps pouring into what looks like a can’t-lose market. Cue the Federal Reserve warning of trouble, even as some argue it supplied the booze for this rager.

In its biannual report released Monday, the central bank cautioned that any shift in animal spirits — notably among a newbie crowd of younger investors and their flashy trading platforms — could send this all tumbling down.

“The real risk is that by the end of 2022, we de-correlate so far from reality in the Growth and Quality style that the balloon collapses on itself,” says Nordea Investments’ senior macro strategist Sebastien Galy, who credits fear of missing out for driving this market higher, even amid a continued worrying mix of growth and inflation.

Onto our calls of the day — we have two. The first is from the founder of asset-management firm Navellier & Associates, Louis Navellier, who is telling clients he expects the S&P 500 to rise 18% to 20% higher from here by January. That would bring it to about 5,600.

Navellier sees markets cruising “very optimistically” into the holiday season, buoyed by consumers eager to spend pockets stuffed with cash, an accommodative Fed, a just-passed infrastructure bill, 10-year Treasury yields under 1.5% and expected strong economic forecasts for the fourth quarter.

“It’s just time to be happy,” he told clients Monday.

Our second call is also doing some crystal-ball gazing into next year’s potential highs. It comes from UBS, which sees the S&P 500 reaching 5,000 by mid-2022, before taking a breather.

Read: ‘Risks of a market bubble are growing,’ warns Morgan Stanley

“We see S&P 500 earnings coming in 9% to 10% above consensus until Q2, which is when we expect the index to reach a peak at 5,000. Subsequent earnings downgrades and higher real rates should make for a derating toward 4,850 by end-22, said a team of strategists led by Keith Parker, in a note to clients on Monday.

Parker and his team are targeting 4,650 for the S&P by end 2021. “The S&P 500 rally has further to run in our view, driven by 1) a 10% + rise in forward earnings over the next six months, 2) still strong growth activity, 3) a continued fall in COVID cases, and 4) a decline in the multiple as real yields rise that is more than offset by higher earnings,” he said.

But then things start to slow on further tightening of financial conditions, continued cost pressures and slowing second-half growth, which all point to a flattening of earnings per share growth to below trend levels and a “more notable derating in H2 ’22.” Thus, weighing on the S&P.

Crunching their valuation numbers, Parker and his team see 10% downside for 12-month forward price/earnings on semiconductors, software and services, along with food and staples and retail. “Insurance and materials are moderately more sheltered from valuation headwinds,” said UBS.

Opinion: AMC’s Adam Aron has a meme stock war chest and he’s not afraid to use it

The buzz

General Electric GE,

Autonomous-vehicle sensor and software company Luminar LAZR,

Panera Bread is headed back to the stock market, helped by a SPAC HUGS.UT,

Palantir PLTR,

PayPal PYPL,

Robinhood HOOD,

Lingerie and swimwear company Naked Brand NAKD,

Retailer Macy’s M,

The latest survey of small-business owners shows them turning even more pessimistic due to labor and supply shortages. Producer prices rose 0.6% for October, in line with forecasts.

The markets

Futures YM00,

Sign up for MarketWatch’s new weekly crypto newsletter here.

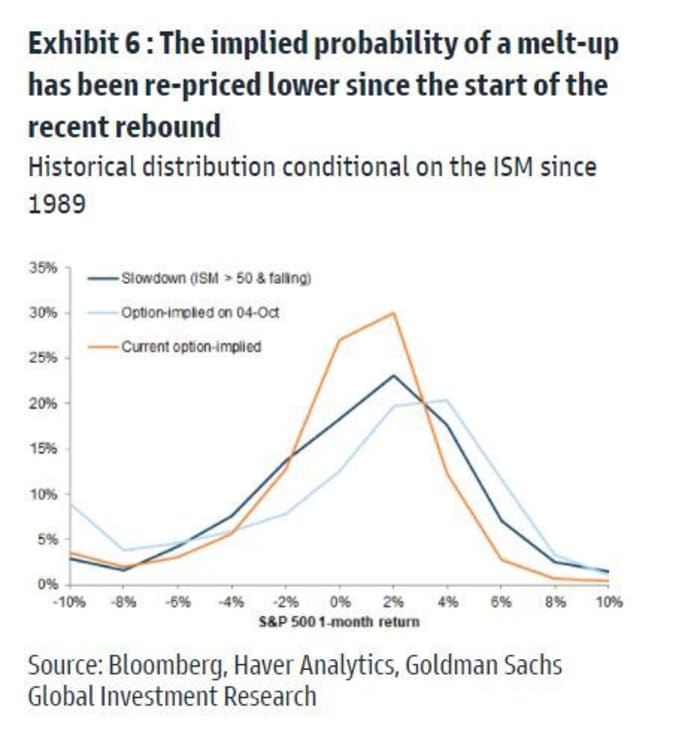

Goldman Sachs is also liking the chances of a stock ‘melt-up.’ In a note to clients, a team led by portfolio strategist Christian Mueller-Glissmann sees positive macro surprises and anchored real yields driving up that possibility.

“With the current pricing and the S&P 500 already at our 4700 YE target, we like getting equity exposure via short-dated calls to hedge the risk of a continued equity melt-up,” he said. Remember, a call option gives the holder the right to buy an asset.

Here is one of his charts showing that probability viewed by options markets as less likely:

Random reads

Redditors swap their toe-curling, worst-ever manager stories.

Want a healthy heart? Be in bed by 10 p.m.

“Squid Game” actors strut Hollywood’s red carpet, adorably.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.