Best-performing marijuana ETF manager says the industry will be transformed by iconic consumer brands

Tim Seymour, manager of the best-performing marijuana-focused exchange traded fund over the past year, expects branding to transform the cannabis industry into a provider of mainstream and iconic consumer products.

“There will be a Marlboro, there will be a Budweiser, there will even be an Alex the Stroh’s Dog,” he said in an interview Feb. 10.

Seymour is the founder of Seymour Asset Management in New York. He oversees the Amplify Seymour Cannabis ETF CNBS,

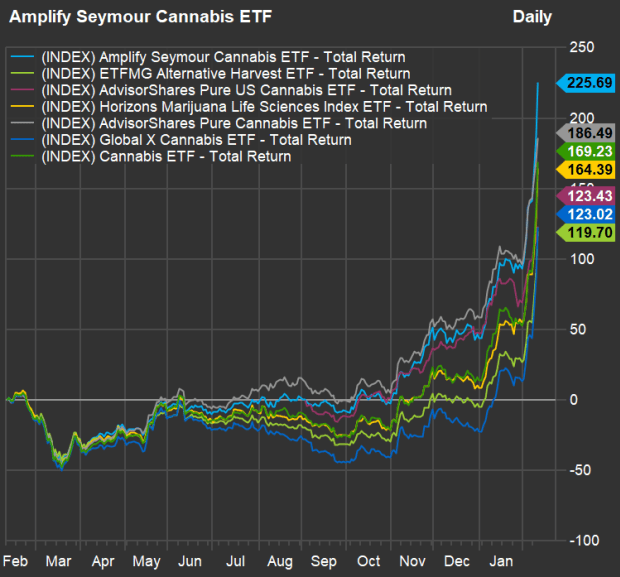

Here’s comparison of its performance over the past year against the six larger ETFs discussed in this story listing analysts’ favorite marijuana stocks published Feb 9:

Among the seven competing ETFs in the chart, only the Amplify Seymour Cannabis ETF, the AdvisorShares Pure US Cannabis ETF MSOS,

“You have had a big run in the space, but we’re early,” as most states haven’t legalized marijuana for recreational use, Seymour said.

Read: Tilray shares soar 29% as Reddit message board sets sights on cannabis sector

The fund manager said the ETF has the advantage of active management, enabling him to make quick adjustments to the portfolio depending on market conditions. Passively managed ETFs track indexes, and rebalancing typically occurs at the end of a quarter.

Seymour has been involved in the marijuana industry for five years. He is a senior member of the investment team at JW Asset Management, a $2 billion hedge fund focused on the cannabis industry. An example of one of the hedge fund’s investments is Gage, which operates retail marijuana stores in Michigan. Gage is privately held.

The investor believes the Democratic sweep in the U.S. elections was the most important factor in the upswing of marijuana companies’ stock prices so far in 2021. The House of Representatives passed the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act in December. The bill would remove marijuana from the Controlled Substances Act of 1970 and lift the federal ban on its recreational use.

It remains to be seen what will happen next on the legislative front. Democrats have control of the U.S. Senate when Vice President Kamala Harris’ tiebreaking vote is included, but 60 votes would be needed if Republicans were to block a vote with a filibuster.

Stock selection

The Amplify Seymour Cannabis ETF holds shares of 25 companies that derive at least half of revenue from marijuana-related products or services. This is in contrast to some of the other ETFs that hold shares in tobacco sellers or companies in other industries that may eventually become important players in the cannabis space.

Seymour said that when selecting socks for the ETF, he focuses on “bottom-up fundamentals,” which include balance-sheet health and free cash flow, positioning in the cannabis industry, liquidity and ownership of the stock and macroeconomic conditions.

The ETF’s largest holding is Canopy Growth Corp. CGC,

Canopy has been cash-flow negative. However, the company is 38.6%-owned by Constellation Brands Inc. STZ,

Seymour said Canopy Growth CEO David Klein, a former CEO at Constellation, “is running the company like a global world-class consumer-products company,” and that Canopy is “well into a U.S. strategy that will give them exposure to the biggest market in the world.”

ETF holdings

Here are the 25 stocks held by the Amplify Seymour Cannabis ETF:

Don’t miss: Here are analysts’ favorite marijuana stocks, which they expect to rise as much as 82% in the next year