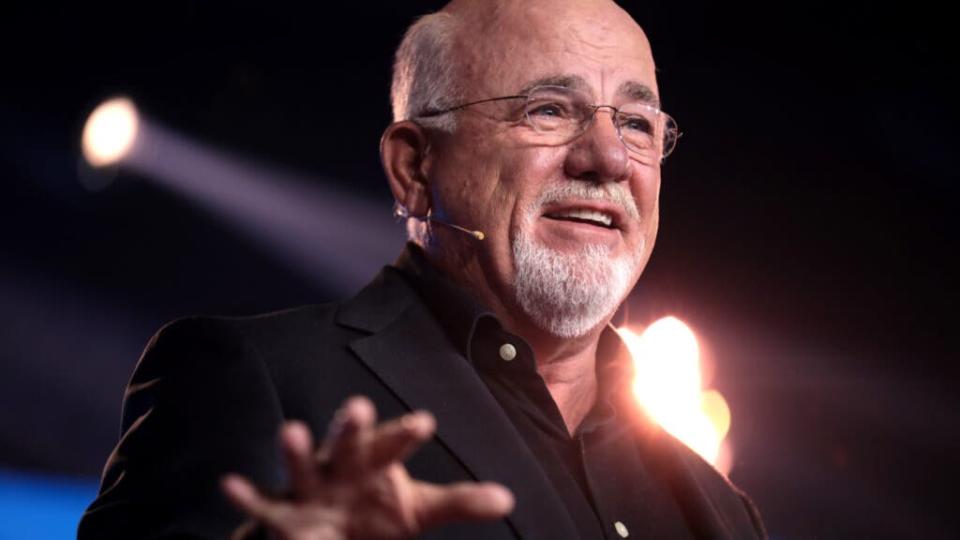

New Mom Tells Dave Ramsey Her Husband Makes $950K But Won’t Let Her Stay Home â ‘I Think You Can Probably Freaking Struggle Through’

Renowned personal finance guru Dave Ramsey tackled a dilemma that transcends dollars and cents. Toronto caller Mercedes, a new mother on maternity leave wanted to embrace the role of a full-time, stay-at-home mom but was unsure how to “ask her husband.”

With her husband’s annual income of $975,000 — a figure that places him not only within the top 1% of earners in Canada but significantly above the average for this elite group, which hovers around $512,000 per year — the financial considerations seemed negligible. However, Ramsey astutely recognized that Mercedes’ hesitation stemmed from a deeper well of emotions and societal expectations.

Don’t Miss

Ramsey acknowledged the family’s financial security, saying, “With a salary of $975,000 a year, I think you could probably freaking struggle through.”

While Mercedes’s annual income of $90,000 is nothing to scoff at, combined with her husband’s earnings, it becomes clear that finances wouldn’t be a major obstacle to her decision.

Mercedes explained that her husband worries she’ll “never want to go back to work.” She explained how his mother worked three jobs and that she thinks he has the same expectations of her, but Ramsey cut her off to emphasize that he makes nearly $1 million per year.

Drawing from his own experience, Ramsey recounted how his wife, Sharon, chose to become a full-time mother over three decades ago, a decision he holds in the highest regard.

“This is not just about the money,” he said. “It’s about what you want your life and family to look like.”

With these words, Ramsey reframed the conversation, elevating it beyond the finances and into personal values and familial aspirations.

In a society that often equates a woman’s worth with her career accomplishments, the concept of “mom guilt” looms large. Ramsey acknowledged this insidious phenomenon, where mothers face judgment and self-doubt regardless of their choice to work or stay home. This sentiment reflects a broader cultural debate on the value placed on career versus home life and the ever-evolving expectations surrounding parenting roles.

Trending: Around 56% of Americans feel behind on saving for retirement -— how much does somebody need to stay on track?

Ramsey’s advice to Mercedes was as pragmatic as it was compassionate. He urged her to engage in an open and heartfelt dialogue with her husband, laying bare her desires and apprehensions. Only through honest communication and mutual understanding, he said, could they navigate this emotional landscape and align their personal goals with their shared vision for their family’s future.

Real wealth isn’t just about the numbers in a bank account; it’s also about the value of time with family and the decisions that align with personal values and happiness. Regardless of how you feel, not everyone is in a position to stay home with their kids financially.

According to a report by the Center for American Progress, the financial burden of child care on American families is substantial, particularly for those with infants. On average, the cost of child care for a family with an infant is just over $1,300 per month. This amounts to nearly $16,000 annually, representing approximately 21% of the U.S. median income for a family of three. Such expenses are especially challenging for families to manage, occurring at a time when their financial flexibility is often most limited.

A recent study by the Pew Research Center, analyzing U.S. Census Bureau data, reveals that in 2021, 18% of parents remained out of the workforce, a figure consistent with 2016 numbers.

For families grappling with decisions about returning to work amid steep daycare expenses or contemplating the shift to one income to care for children at home, seeking advice from a financial adviser can be a wise move. A financial adviser can offer insights and strategies tailored to individual or family circumstances, helping to navigate the financial implications of such life changes. Engaging with a professional can ensure that the decision to adjust work for family care is not only emotionally and practically sound but also financially viable.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article New Mom Tells Dave Ramsey Her Husband Makes $950K But Won’t Let Her Stay Home — ‘I Think You Can Probably Freaking Struggle Through’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.