Posthaste: 5 charts that show how Canadians are and aren’t coping with higher interest rates

Household wealth rises but financial data from Statistics Canada show ‘pressures will remain intense’

Article content

Canadians are wealthier thanks to stock and bond markets — or at least some of them.

Article content

Total household net worth rose 1.8 per cent to $16.4 trillion “driven by strength in financial markets as both bonds and equities rallied,” Statistics Canada said in its release of data on household finances for the fourth quarter — adding the caveat that “most wealth is held by relatively few households in Canada.”

Advertisement 2

Story continues below

Article content

But digging deeper into the Statistics Canada numbers suggests another financial reality, one where higher interest rates continue to take a toll on people’s wallets and shape consumer behaviour.

“Pressures will remain intense for many Canadian households still grappling with the delayed impact of previous interest rate hikes,” Carrie Freestone, an economist with Royal Bank of Canada, said in a note on the data.

The following five charts tell some of the tale of where household finances stand and what they could look like in the quarters ahead.

Debt to income

Canada’s household debt-to-income ratio fell to 178.7 per cent in the fourth quarter from 179.2 per cent in the third. That means that for every $1 of disposable income, Canadians owe $1.79.

Growth in income, up 1.3 per cent from the quarter before, exceeded growth in debt, which was up 1 per cent.

Statistics Canada cited “relatively slow mortgage borrowing” for the slower pace, and some economists expect that to continue in the near term.

“We anticipate that mortgage demand will remain soft, supporting further improvements in debt metrics, until rates begin to fall around the middle of the year,” Shelly Kaushik, an economist at Bank of Montreal, said in a note.

Advertisement 3

Story continues below

Article content

Debt service ratio

The debt service ratio, measured as payments of principal and interest on debt as a share of household disposable income, edged up to 15 per cent in the fourth quarter, pulled by rising interest rates.

In the fourth quarter, mortgage interest made up 66.2 per cent of total mortgage debt payments, up from 45.8 per cent in the fourth quarter of 2021, Statistics Canada said.

Mortgage principal payments declined steadily through 2022 before stabilizing in the second half of 2023. They came in at $12.4 billion, unchanged from the third quarter.

“On the bright side, these relative measures of mortgage debt service cost broadly stabilized in Q4 for the first time since the Bank (of Canada) kicked off the current rate hiking cycle,” Randall Bartlett, senior director of Canadian economics at Desjardins Group, said in a note.

The debt-service ratio has barely moved over the last three quarters, which RBC’s Freestone attributes to higher incomes. But she doesn’t think this will last.

“Moving forward, we do not expect the current pace of income growth to be sustained,” she said. “We continue to expect Canada’s debt-service ratio to rise from recent levels.”

Article content

Advertisement 4

Story continues below

Article content

Credit market debt

Credit market debt increased by $29.5 billion in the fourth quarter, with mortgages mainly accounting for $21.3 billion of that amount.

The remainder of the increase — $8.2 billion — came from “households seeking consumer credit,” Statistics Canada said.

Consumer credit rose for the second straight quarter and the $8.2 billion was “the second-largest net origination of consumer credit since 2009,” said the agency.

That jump in borrowing could spell trouble.

“This is concerning, as it suggests many Canadian households may be increasingly stretched,” Bartlett said.

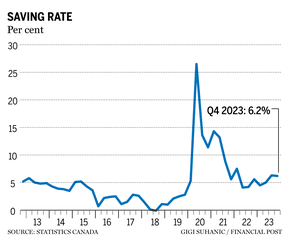

Saving rate

Canada’s saving rate “remains resilient,” Statistics Canada said.

At 6.2 per cent it was “little changed” from the quarter before, but well up from 5.6 per cent at the end of 2022.

It was a “strong” quarter for household holdings of currency and deposits, which increased 2.4 per cent, said the agency.

Bartlett at Desjardins said the reason the saving rate is “still elevated” is because there are still a large number of Canadians who need to renegotiate their mortgages this year.

Advertisement 5

Story continues below

Article content

“We think Canadians are well aware of this looming drag on their household finances,” he said.

Total financial assets

Households ended the year wealthier thanks to stock and bond markets that rallied after falling in the third quarter.

As a result, the value of financial assets rose to a record high of $9.7 trillion, “surpassing the previous record set in the fourth quarter of 2021,” the national data agency said.

Residential real estate, however, continued to drag on household wealth with its value falling to $157.8 billion.

Toronto-Dominion Bank thinks Canadians can expect another quarter of rising wealth to start the year.

“Home prices have been moving higher in the last three months, recovering from last year’s pullback as housing activity snapped back on easier financial conditions and lower mortgage rates,” Maria Solovieva, an economist at TD, said.

She believes equities will continue to rise, especially in the United States, where pessimism regarding the economy is receding.

“Assuming March doesn’t break the trend, we expect Q1 2024 to deliver another quarter of wealth gains, marginally supporting consumer spending,” Solovieva said.

Advertisement 6

Story continues below

Article content

Sign up here to get Posthaste delivered straight to your inbox.

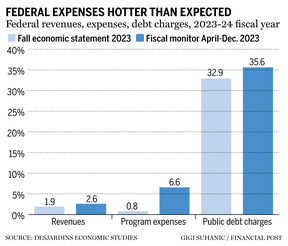

Canada is unlikely to meet its deficit goals unless it makes substantial spending cuts or finds new sources of revenue, according to the country’s largest financial co-operative.

An “outsized pace of spending” means Canada is on course to run a budget shortfall of about $47 billion for the fiscal year that ends March 31, according to estimates released Thursday by Desjardins.

The projection raises more questions about how Finance Minister Chrystia Freeland will meet her pledge to keep the country’s budget shortfall at around $40 billion a year from now until 2026.

“I think it’s going to be an exercise in creative accounting,” Randall Bartlett, Desjardins’ senior director of Canadian economics, who wrote the research note, said in an interview. “They either need to cut spending or increase revenues to make this work.” — Bloomberg

- United States ambassador to Canada David Cohen gives a speech at the Greater Vancouver Board of Trade on cross-border collaboration in life sciences and technology

- Today’s data: Statistics Canada releases data on international securities transactions and wholesale sales; Canada Mortgage and Housing Corporation releases housing starts for January

- Earnings: Aimia Inc., The Keg Royalties Income Fund, EQB Inc., Li-Cycle Holdings Corp., Groupon Inc.

Advertisement 7

Story continues below

Article content

Recommended from Editorial

A taxpayer found out the hard way that ignorance isn’t bliss when the Canada Revenue Agency hit her with a penalty for over-contributing to her Tax Free Savings Account even though she claimed to have been ignorant of the rules. Tax expert Jamie Golombek has all the details here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at [email protected] with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 8

Story continues below

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments