Live news: Federal government’s deficit climbs to $19.1 billion

The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Story continues below

Article content

Article content

Top story

Federal government’s deficit climbs to $19.1 billion from $3.6 billion last year

The federal government posted a deficit of $19.1 billion for the first eight months of its 2023-24 fiscal year.

The result for the April-to-November period compared with a deficit of nearly $3.6 billion reported for the same stretch of its 2022-23 fiscal year.

Government revenues for the eight-month period totalled $281.8 billion, up 2.6 per cent from $274.7 billion in the same period a year earlier.

Program expenses, excluding net actuarial losses, for the April-to-November period totalled nearly $264.9 billion, up 6.3 per cent from nearly $249.2 billion.

Higher interest rates pushed public debt charges up 37.7 per cent to 31.0 billion from $22.5 billion a year earlier.

Net actuarial losses totalled $5.0 billion compared with nearly $6.6 billion in the same period last year.

— The Canadian Press

2:05 p.m.

Court denies environmental group injunction against Northvolt EV battery plant

A Quebec Superior Court judge has refused to grant an injunction to halt tree cutting and other preparatory work at the site of a future electric vehicle facility east of Montreal.

Advertisement 3

Story continues below

Article content

Justice David Collier said Friday that the environmental group and the citizens who were seeking the order did not meet the high bar of evidence to show the province’s Environment Department and a municipality acted unreasonably in granting Northvolt AB a permit.

The Centre quebecois du droit de l’environnement had sought an injunction suspending work on the 170-hectare site, arguing that the province allowed work to begin without proper analysis of the impact on the area’s biodiversity.

They also argued that the town of St-Basile-le-Grand — where the facility is to be partly located — gave a permit to cut down trees based on an “unreasonable interpretation” of rules protecting wetlands.

Collier wrote in his decision that governments have wide discretion when it comes to making decisions, and the court can only invalidate them in very limited circumstances.

He said the plaintiffs failed to demonstrate that the province was abdicating its responsibility or giving Northvolt a “blank cheque” to build the factory without a plan to remediate the environmental impacts.

Article content

Advertisement 4

Story continues below

Article content

— The Canadian Press

1:46 p.m.

Rogers Sugar reaches tentative deal with striking Vancouver refinery workers

Rogers Sugar Inc. says it has reached a tentative agreement with the union representing workers at its Vancouver refinery.

Details of the tentative deal were not immediately available.

The workers are represented by the Public and Private Workers of Canada.

The company says a ratification vote will be held next week.

The Vancouver refinery employs about 140 unionized workers.

The workers have been on strike since Sept. 28, 2023.

The Canadian Press

1:17 p.m.

Tamara Vrooman leaves role as chair of Canada Infrastructure Bank

Tamara Vrooman is leaving her role as chair of the Canada Infrastructure Bank.

Federal Infrastructure Minister Sean Fraser says Vrooman’s departure after three years in the job takes effect tomorrow.

Jane Bird, a member of the CIB board of directors, has been named interim chair until a permanent one is appointed.

Vrooman became chair of the Canada Infrastructure Bank in January 2021.

She is chief executive of the Vancouver Airport Authority.

Advertisement 5

Story continues below

Article content

Fraser thanked Vrooman for her work on the board and wished her the best as she continues her role at the Vancouver airport.

The Canadian Press

1:07 p.m.

BlackBerry stock hits 20-year low after private debt offering

BlackBerry Ltd. shares hit its lowest point in about 20 years this week after the software company offered convertible senior notes in a push to cut down on its debt.

Once a Canadian tech darling, the company’s Toronto-listed shares fell as much as 20 per cent on Wednesday to $3.94, closing the session at its lowest point since May 2003. In the late 2000s, BlackBerry was one the biggest players in the global smartphone market with a peak market value of over $80 billion. Now it’s worth about $2.3 billion.

BlackBerry upsized the convertible note offering to US$175 million from US$160 million on Thursday, and priced its five-year convertible notes at a three per cent coupon and US$3.88 conversion price. The company said in a press release that it plans to use net proceeds from the offering to fund repayment or repurchase of its outstanding US$150 million existing debentures due Feb. 15 and the remainder for general corporate purposes.

Advertisement 6

Story continues below

Article content

“The pricing appears better than feared,” RBC Dominion Securities analyst Paul Treiber wrote in a note.

The offering comes a month after the company’s newly minted chief executive John Giamatteo backed away from plans to spin off its internet of things business, reversing plans made by John Chen, who held the chief executive helm for nearly a decade.

Bloomberg

12:35 p.m.

Canadian energy producers dismayed by Biden’s move to pause U.S. LNG approvals

Canada’s energy industry is reacting with dismay to U.S. president Joe Biden’s move to pause approvals of new liquefied natural gas (LNG) export terminals in that country.

Biden’s decision is being viewed as a win by environmentalists who fear an increase in North American LNG exports will lock in greenhouse gas emissions for the long-term and make it impossible for countries to meet their climate commitments.

But the Canadian Association of Petroleum Producers said Friday it is disappointed by the decision, adding it sees LNG as a lower-emission source of secure energy that can help countries get off coal.

The industry group added that LNG facilities on the U.S. Gulf Coast also offer Canadian natural gas producers an opportunity to export their product globally.

Advertisement 7

Story continues below

Article content

The U.S. is the largest exporter of LNG in the world, while Canada does not yet have its own LNG export capacity.

Canadian natural gas producers have been eagerly anticipating the startup of the massive LNG Canada export terminal being built near Kitimat, B.C., which is 90 per cent complete and expected to be operational later this year.

The Canadian Press

Noon

Midday markets: Technology stocks boost TSX

Strength in technology stocks helped keep Canada’s main stock index in the green in late-morning trading, while stock markets on Wall Street also moved higher.

The S&P/TSX composite index was up 0.03 per cent at 21,106.43.

In New York, the Dow Jones industrial average was up 0.31 per cent at 38,168.79. The S&P 500 index was up 0.18 per cent at 4,902.91, while the Nasdaq composite was up 0.15 per cent at 15,533.54.

The Canadian dollar traded for 74.30 cents US compared with 74.10 cents US on Thursday.

The March crude oil contract was down 1.27 per cent to US$76.38 per barrel and the March natural gas contract was down six cents at US$2.12 per mmBTU.

The February gold contract up 0.02 per cent at US$2,018.20 an ounce and the March copper contract up less than a penny at US$3.87 a pound.

Advertisement 8

Story continues below

Article content

The Canadian Press

11:28 a.m.

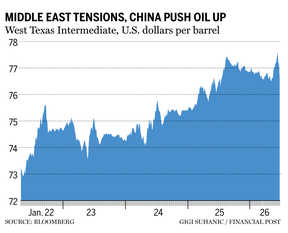

Oil set to rise 5% this week

Oil headed for the biggest weekly gain since October as lower United States stockpiles and the prospect of more government stimulus in China helped propel crude out of the range it had been stuck in for months.

West Texas Intermediate edged above US$77 a barrel on Friday, and was on pace for a weekly gain of more than five per cent, its biggest since the week following the start of the Israel-Hamas war. Crude jumped on Thursday in a rally ignited by positive fundamental news and extended by trading algorithms.

Crude’s advance has been underpinned by elevated tensions in the Middle East, with the U.S. striking Iran-backed Houthi rebels in Yemen to force them to halt attacks on commercial shipping. Elsewhere, drone attacks on refineries in Russia endangered crude flows as the war in Ukraine drags on.

Oil has gained more than eight per cent in January, with additional support from an unexpectedly large drawdown in U.S. inventories and efforts by Chinese policymakers to shore up the economy. Still, many traders remain cautious given prospects for robust supplies from non-OPEC producers, as well as slower demand growth in major importers, including India.

Advertisement 9

Story continues below

Article content

— Bloomberg

10:06 a.m.

Wall Street poised to close out another winning week

U.S. stocks are hanging near their record heights Friday as Wall Street heads toward the close of its 12th winning week in the last 13.

The S&P 500 was down 0.09 per cent in early trading after setting a record high for five straight days. The Dow Jones Industrial Average was up 0.1 per cent, and the Nasdaq composite was 0.31 per cent lower.

Intel Corp.’s drop of 11.2 per cent was dragging on the market after its forecasts for revenue and profit for the start of 2024 fell short of Wall Street’s estimates.

Visa also sank, down 1.6 per cent, despite reporting better results than expected. Analysts called the figures solid but highlighted how the company described some slowing trends for January so far.

The U.S. stock market is nevertheless closing out another winning week as reports keep suggesting inflation is cooling while the economy continues to power higher. The unexpected backdrop has hopes high that Wall Street’s dream scenario can come true: one where a resilient economy drives profits higher for companies, while inflation moderates enough to convince the United States Federal Reserve to cut interest rates many times this year.

Advertisement 10

Story continues below

Article content

The latest report on Friday showed the measure of inflation the Fed prefers to use behaved just about exactly as expected in December. Overall inflation by that measure was 2.6 per cent during the month, matching November’s rate.

The Fed pays more attention to the inflation figure after ignoring prices for food and fuel, which can zigzag sharply month to month. That figure cooled to 2.9 per cent from 3.2 per cent and was a bit better than economists expected.

In Canada, the S&P/TSX composite index was up 0.07 per cent on strength in energy and information technology stocks.

— The Associated Press, Financial Post

7:30 a.m.

Canada, U.K. blame each other as trade talks fall apart

The United Kingdom paused talks to strike a free-trade deal with Canada, with each side accusing the other of obstructing progress.

The two countries have been negotiating for almost two years on replacing an interim deal put in place following Britain’s departure from the European Union. The breakdown in talks effectively leaves the U.K. at risk of being in a worse position than it was as a member of the bloc when it comes to Canada trade.

Advertisement 11

Story continues below

Article content

A major sticking point was on agriculture. The U.K. was pushing to extend a temporary arrangement — which expired Dec. 31 — allowing exports of British cheese to Canada under low tariffs, similar to those enjoyed by E.U. members. Canada, for its part, had hoped to secure U.K. access for its beef and pork.

But those do not currently meet British regulatory standards, and Prime Minister Rishi Sunak’s administration has come under intense pressure from U.K. farmers not to allow, in particular, hormone-treated beef into the country.

“We had to take a strong line on this,” Minette Batters, president of the National Farmers’ Union of England and Wales, told the BBC. “It would lead to a two-tier food market in this country. There is no need to compromise on it.”

Explaining the decision to stall talks, a U.K. government spokesperson said late Jan. 25 Britain will only negotiate trade deals that “deliver” for its people.

“We remain open to restoring talks with Canada in the future to build a stronger trading relationship that benefits businesses and consumers on both sides of the Atlantic,” the spokesperson said in a post published by Susannah Goshko, British High Commissioner to Canada, on X, formerly Twitter.

Advertisement 12

Story continues below

Article content

The U.K. is Canada’s third-largest, single-country trading partner at over $46 billion a year, according to the Canadian government. The U.K. ranks Canada as its 18th-largest trading partner.

Laura Dhillon Kane and Brian Platt, Bloomberg

7:30 a.m.

Stock markets before the opening bell

European stocks rose on Friday, lifted by a raft of forecast-beating earnings and expectations that euro-area interest rates will start falling from April.

The Stoxx 600 index rose 0.9 per cent.

Contracts on the S&P 500 and the Nasdaq 100, on the other hand, signalled a halt to six days of dizzying gains that propelled Wall Street stocks to records. Intel Corp. fell more than 11 per cent in premarket trading after a bleak forecast that also pressured technology stocks including Advanced Micro Devices Inc. and Nvidia Corp.

The S&P/TSX composite index closed up 0.36 per cent on Thursday.

— Bloomberg

What to watch today

The Department of Finance Canada will publish financial results for November 2023 this morning.

The 35th Annual Economic Outlook Forum, presented by Scotiabank, takes place in Vancvouer today. The event aims to provide some answers on what businesses in the Greater Vancouver region can expect from the local and national economy in the year ahead. Panellists will include economists, industry experts and political commentators. Keynotes will be presented by Jean-Francois Perrault, chief economist, Scotiabank; Jobs Minister Brenda Bailey and Housing Minister Ravi Kahlon.

American Express Co. and Colgate-Palmolive Co. will report earnings today.

Recommended from Editorial

Need a refresher on yesterday’s top headlines? Get caught up here.

— Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments