Last mile is the hardest: What today’s inflation numbers mean to the Bank of Canada

Inflation ticked up in December — economists weigh in on what this means to the Bank of Canada and interest rates

Article content

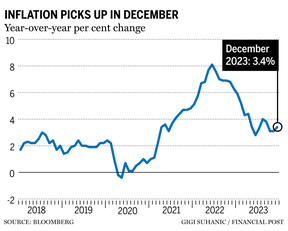

Inflation accelerated 3.4 per cent in December and an unexpected rise in the Bank of Canada‘s preferred measures could complicate its decision on when to make the first cut to interest rates, economists say.

December’s headline inflation was faster than November’s rate of 3.1 per cent, Statistics Canada said Jan. 16, but the increase was mainly attributed to base effects from a plunge in gas prices in 2022.

Advertisement 2

Story continues below

Article content

Article content

What might trouble the Bank of Canada, however, is the rise in core inflation that filters out more volatile price movements.

“The much more worrying development is that the CPI-trim and CPI-median core measures both rose by a larger 0.4 per cent month over month,” said Stephen Brown, deputy chief North America economist with Capital Economics.

The central bank makes its next rate decision on Jan. 24. Here’s what economists say policymakers might take from the inflation data.

Katherine Judge, CIBC Economics

“The Bank of Canada’s preferred core measures, CPI-trim and CPI-median failed to fall, with trim accelerating by two ticks to 3.7 per cent and median remaining at 3.6 per cent (from an upwardly revised prior month reading that was previously 3.4 per cent). Those measures also accelerated in three-month and six-month annualized change terms, measures that the Bank of Canada will need to see more progress in before considering rate cuts.”

Stephen Brown, Capital Economics

“Although the rise in headline inflation in December was mainly due to gasoline price base effects, the much more worrying development is that the CPI-trim and CPI-median core measures both rose by a larger 0.4 per cent month over month. The pick-up in underlying inflation pressures raises the risk that the Bank of Canada will need to keep interest rates higher for longer than markets are now pricing in, with the economy suffering further as a result.

Article content

Advertisement 3

Story continues below

Article content

“As the bank pays more attention to those core measures (CPI-trim and median) than the CPI excluding food and energy, those larger increases mean the bank is likely to maintain a hawkish tone at its meeting next week and reduce the chance of it cutting interest rates any time soon.”

Douglas Porter, BMO Economics

“While the higher headline was little surprise, and precisely mimicked the U.S. inflation experience in December, the slightly more unsettling news is the persistence of core in the mid-3s. That sticky theme was echoed in yesterday’s BOS (Business Outlook Survey), and suggests that the last mile (or kilometre) of the inflation fight may prove to be the most challenging — bringing underlying inflation sustainably back below three per cent. Given that wage trends are also stuck in the four per cent to five per cent range, and now even housing may be showing a pulse, suggests that the Bank of Canada will doggedly maintain a cautious stance at next week’s rate decision and MPR (Monetary Policy Report). We are comfortable with our call of a first rate cut at the June meeting, even as the market leans in earlier.”

Advertisement 4

Story continues below

Article content

Tu Nguyen, RSM Canada

“December’s consumer price index (CPI) report shows just how challenging it is to conquer the last mile in the path toward price stability.

“The Bank of Canada will hold the policy rate at five per cent next week. That said, the Bank should begin slashing interest rates as early as April. Given that the economy has slowed to a crawl and that inflation at this point is mostly driven by shelter, keeping the rates higher for longer will not help. Shelter inflation occurs due to two factors: high rent growth due to the housing shortage and rising mortgage interest payments. The Bank of Canada cannot fix the former: housing shortage is a structural problem that will take many years to address. The latter, high mortgage interest payments, is directly caused by monetary policy.

“In addition, inflation in 2023 mainly stems from price growth in services. Now that the labour market is more balanced, price pressures on services will ease in the upcoming months.”

Recommended from Editorial

Advertisement 5

Story continues below

Article content

Leslie Preston, TD Economics

“If you are looking for data to signal a rate cut is imminent, this isn’t it. December’s inflation report underscores that the last mile of getting inflation all the way back to two per cent is the hardest. It took about a year for inflation to drop from its peak of eight per cent to around three per cent, but over the past six months further headway has been halting. This leaves the Bank of Canada cautious as it considers when it will be appropriate to cut interest rates.

“Despite December’s report, we expect inflation, and the economy, will have cooled sufficiently by the spring for the Bank of Canada (BoC) to make its first interest rate cut in April. That said, inflation is unlikely to be quite at two per cent. As governor (Tiff) Macklem pointed out in December, the BoC doesn’t need to see two per cent to begin normalizing monetary policy, but rather be confident it is getting there.”

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments