Live news: Ottawa recovers $40 million from defunct Quebec vaccine developer Medicago

The latest business news as it happens

Article content

Today’s top headlines

Article content

1:35 p.m.

Ottawa recovers $40 million from defunct Quebec vaccine developer Medicago

Advertisement 2

Story continues below

Article content

The federal government says it has recovered $40 million from the now-defunct Quebec-based vaccine developer Medicago, and the intellectual property will remain in Canada under a new firm.

The government provided Medicago a $173-million advance in the early days of the COVID-19 pandemic to develop and produce a plant-based vaccine in Quebec City.

The company’s Japanese parent company, Mitsubishi Chemical Group, shut down Medicago’s operations in February as global demand for vaccinations plummeted.

Though Medicago’s vaccine was approved for use in Canada, it was not approved by the World Health Organization due to the company’s ties with tobacco giant Philip Morris.

The agreement between Canada and Mitsubishi Chemical Group will transfer the research, intellectual property and equipment to a new operation: Aramis Biotechnologies.

Aramis Biotechnologies is also based in Quebec City and is led by former Medicago employees.

The Canadian Press

Noon

Midday markets: Fed rate-cut exuberance ebbs after strong U.S. jobs data

United States Treasury yields rose as traders pared expectations for the Federal Reserve to ease monetary policy aggressively next year after a better-than-forecast jobs report.

Advertisement 3

Story continues below

Article content

Benchmark two-year yields, those most closely tied to the outlook for U.S. central-bank policy, rose as much as 13 basis points in the biggest such move in seven weeks.

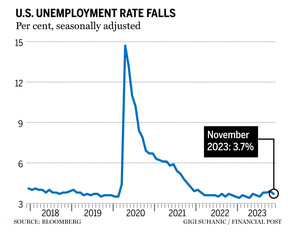

Swaps traders scaled back bets on how much the Fed will cut rates next year, pricing in about 110 basis points of easing, down from more than 120 basis points. The U.S. employment report said non-farm payrolls increased by 199,000 last month vs. economists’ 185,000 median estimate while the unemployment rate unexpectedly fell to 3.7 per cent as workforce participation edged up.

“This is a good report,” Michael Darda, chief economist at Roth MKM said on Bloomberg Television. “The Fed is going to look at it and not really feel compelled at all that they need to embrace these early rate cuts next year that the market has priced in.”

Friday’s re-pricing vindicated strategists who’d said the the bond market was running too far ahead of the central bank by pricing in rate cuts beginning as soon as March.

“The report will stop people from talking about rate cuts,” said Gang Hu, managing partner at Winshore Capital Partners. “The trend of the labour market is weakening, but not as weak as people thought it’d be,” while inflation also doesn’t support easing, Hu said.

Article content

Advertisement 4

Story continues below

Article content

On Wall Street, stocks were treading water with the S&P 500 down 0.01 per cent at 4,585.01. The Dow Jones Industrial Average was down 0.04 per cent at 36,104.44 while the Nasdaq composite was down 0.06 per cent at 14,333.81.

In Toronto, the S&P/TSX composite index was up 0.03 per cent at 20,284.08.

Bloomberg

Bloomberg

10:36 a.m.

Markets open: Stocks rise on strong U.S. economic reports

Stocks rose as solid United States jobs and consumer sentiment data reinforced the soft-landing narrative. Bond yields remained higher on speculation that bets on Federal Reserve cuts next year may have gone too far.

All around Wall Street, the prevailing view is that while economic strength makes investors less apprehensive about a recession — at least for now — it also means the Fed might have to hold rates higher for longer. That’s after a massive dovish repricing that made traders bet the central bank would be able to pivot as early as March. Swap contracts now show a 40 per cent probability of that happening — from over 50 per cent prior to the report.

Following a slew of figures underscoring a slowdown on the jobs front, Friday’s reading showed an unexpected employment pickup. Non-farm payrolls increased 199,000 last month, the unemployment rate fell to 3.7 per cent and monthly wage growth topped estimates. A separate report showed U.S. consumer sentiment rebounded sharply in early December — topping all forecasts — as households dialed back their year-ahead inflation expectations by the most in 22 years.

Advertisement 5

Story continues below

Article content

Softening inflation and employment data in the past month have convinced investors that the Fed is done raising interest rates and ignited bets that cuts of at least 125 basis points of cuts are in store over the next 12 months. Fed officials are observing a self-imposed quiet period ahead of next week’s policy meeting, which also coincides with fresh inflation data.

“Today’s figures may derail hopes that the Fed will cut rates sooner, rather than later,” said Richard Flynn at Charles Schwab UK. “This month’s job’s report does not reflect the cooling that the market is likely hoping for, so it might push the needle in terms of what we can expect from Fed policy in coming months.”

On Wall Street, the S&P 500 was up 0.41 per cent at 36,179.55. The Dow Jones Industrial Average was up 0.20 per cent at 26,190.96 while the Nasdaw composite was up 0.07 per cent at 14,350.36.

In Toronto, the S&P/TSX composite index was up 0.43 per cent at 20,365.26 on incrases in financial and energy stocks.

Bloomberg

9:41 a.m.

Canada Western Bank hikes dividend as profit rises

CWB Financial Group raised its dividend as it reported its fourth-quarter profit rose compared with a year ago.

Advertisement 6

Story continues below

Article content

The Edmonton-based bank says it will pay a quarterly dividend of 34 cents per share, an increase of a penny.

The higher payment to shareholders came as CWB says its common shareholders’ net income totalled $76.8 million or 80 cents per diluted share for the quarter ended Oct. 31, up from $67.7 million or 72 cents per diluted share a year earlier.

Revenue totalled $291.8 million, up from $279.8 million in the same quarter last year.

CWB reported a provision for credit losses of $9.8 million for its fourth quarter compared with $12.2 million in the same quarter a year ago.

On an adjusted basis, CWB says it earned 94 cents per share in its latest quarter, up from an adjusted profit of 88 cents per share a year earlier.

“We expect to maintain strong financial results in fiscal 2024 against continued volatility in economic and market conditions,” CWB chief executive Chris Fowler said in statement.

“Our outlook is supported by an increase in our operational efficiency from the reorganization initiatives we executed late this quarter, which will result in the redeployment of resources to priority activities consistent with our differentiated strategy.”

Advertisement 7

Story continues below

Article content

The Canadian Press

9:03 a.m.

Sturdy U.S. jobs numbers hint at elusive ‘soft landing’

Employers in the United States added a solid 199,000 jobs last month and the unemployment rate fell, fresh signs that the economy could achieve an elusive “soft landing,” in which inflation would return to the U.S. Federal Reserve’s two per cent target without causing a steep recession.

Friday’s report from the U.S. Labor Department showed that the unemployment rate dropped from 3.9 per cent to 3.7 per cent, not far above a five-decade low of 3.4 per cent in April.

The November job gain was a reminder that many employers continue to hire, though last month’s increase was inflated by the return of about 40,000 formerly striking auto workers and actors, who were not at work in October but returned in November.

Still, the job market is gradually decelerating along the lines that Fed officials have wanted to see. The Fed has raised its key short-term rate from near zero to about 5.4 per cent, a 22-year peak, leading to higher borrowing rates for consumers and businesses and lower inflation. Despite that headwind, the economy and the job market are still expanding. Layoffs remain historically low.

Advertisement 8

Story continues below

Article content

When the Fed meets next week, it is considered sure to keep its benchmark rate unchanged for the third straight time in light of the easing inflation pressures.

Most economists and Wall Street traders think the Fed’s next move will be to cut rates, though that might not happen until the second half of 2024.

Even modest hiring helps ensure that consumers, who drive most of the economy’s growth, keep spending. Early reports on holiday shopping showed healthy growth in online sales.

The Associated Press

7:30 a.m.

Lululemon shares slip as guidance disappoints

Lululemon Athletica Inc.’s shares slipped in pre-market trade today after fourth-quarter revenue guidance trailed Wall Street estimates, a rare miss for the retailer whose performance routinely exceeds investor expectations.

Sales growth at the activewear company, while still robust compared with most peers, is slowing as higher-income shoppers spend more on things like travel and entertainment rather than apparel. Lululemon said Thursday that revenue in the holiday quarter is expected to be up 13 per cent to 14 per cent over last year, down from 19 per cent growth seen in the three-month period that just ended.

Advertisement 9

Story continues below

Article content

Shares were down almost 3 per cent in pre-market. The stock’s strong performance this year — more than double the gain of the S&P 500 Index — has increased pressure for the company to keep up its pace of growth.

The retailer forecast fourth-quarter revenue in the range of $3.14 billion to $3.17 billion, while analysts surveyed by Bloomberg were looking for $3.18 billion, on average.

— Bloomberg

Stock markets before the opening bell

Stocks are steady today as trader await the pivotal U.S. jobs report out before the bell. The nonfarm payroll report is crucial for traders evaluating whether bets on Federal Reserve policy easing next year are justified — or have gone too far.

U.S. futures were flat this morning after big tech stock helped lift markets on Thursday. Canada’s S&P/TSX composite index closed up yesterday 4.30 points at 20,278.51.

Oil is rebounding but remains on track for the longest weekly losing streak since 2018. Traders are concerned about a global glut of crude and doubtful that deeper supply cuts by OPEC+ will do the trick. West Texas Intermediate approached US$71 after retreating by 11 per cent over the past six sessions.

Advertisement 10

Story continues below

Article content

What to watch today

- Markets are waiting for the November jobs report from the United States out at 8:30 a.m. ET for clues on where the economy and the Federal Reserve are headed. The report is expected to show that the U.S. gained 172,500 jobs last month, slightly more than October’s gain of 150,000. That number though will be inflated by the return of United Auto Works and Hollywood actors whose strikes ended in October. What investors want to see is evidence that the labour market is cooling fast enough for the Federal Reserve to cut rates in the new year as much as markets expect.

- In Canada, Peter Routledge, superintendent of financial institutions, will make an announcement regarding the level of the Domestic Stability Buffer, the amount of capital Canada’s banks are required to hold as buffer against financial risks.

- In Alberta, finance minister Nate Horner and former provincial treasurer Jim Dinning, chair of a public engagement panel into the possibility of Alberta forming its own pension plan, will hold a news conference.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Article content

Comments