The Fed is going to pivot in 3 stages, author Nomi Prins says

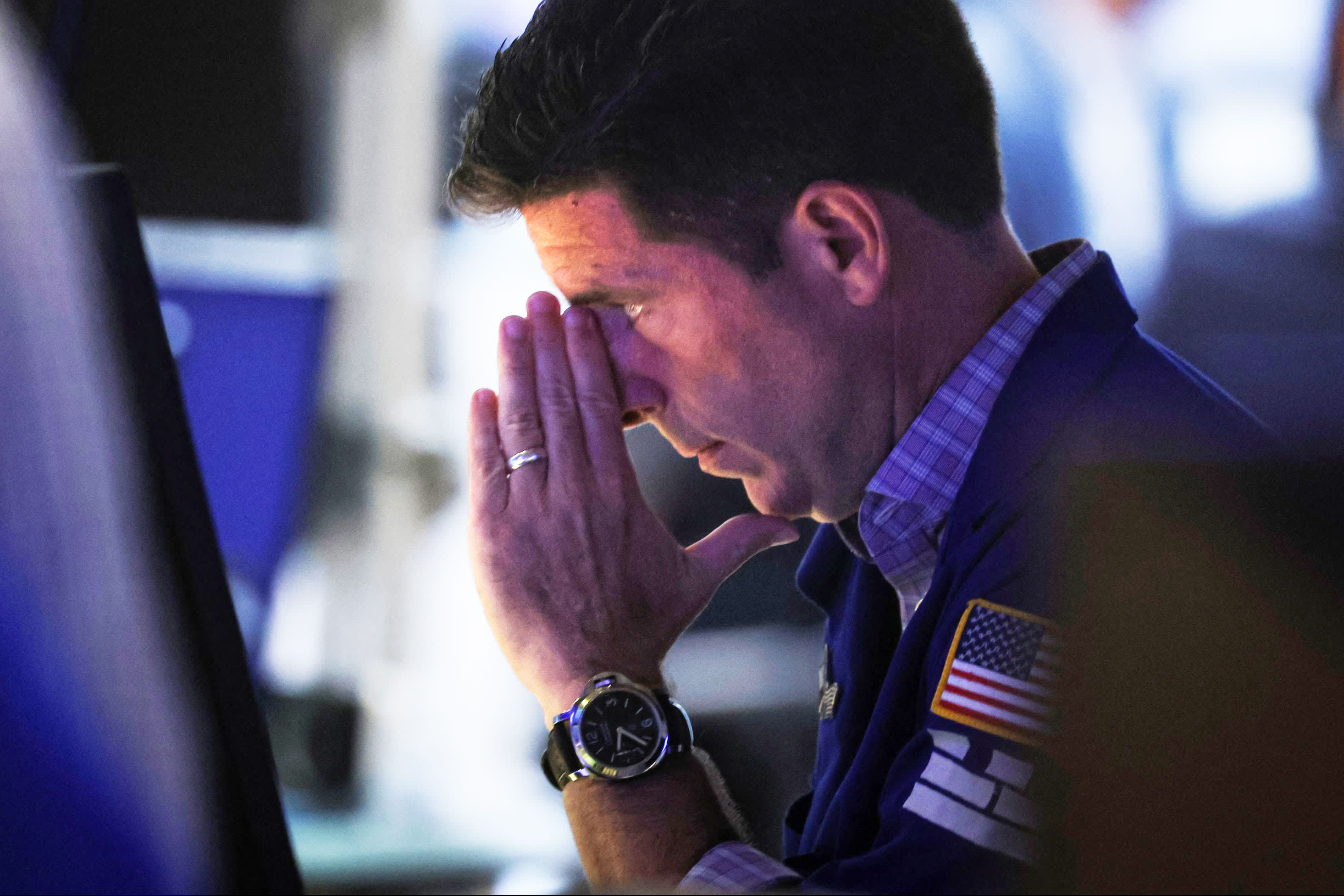

The U.S. Federal Reserve could be forced to pivot away from its path of aggressive interest rate hikes in three stages, according to author Nomi Prins.

Markets expect the central bank to enact a third consecutive 75 basis point hike at its monetary policy meeting later this month, the fastest pace of monetary tightening since policymakers began using the benchmark Fed funds rate as the principal policy tool in the early 1990s.

related investing news

Various Fed officials have reiterated the Federal Open Market Committee’s commitment in recent weeks to reining in inflation, but Prins told CNBC Tuesday that the acceleration of interest rate hikes to soothe the markets was disconnected from the economic reality faced by many.

“This period of accelerating the rate hikes that we’ve seen so far has impacted the real economy because it has squeezed the borrowing costs … for real people, real consumers,” she said.

“Whereas for the Street in general, historically money still remains cheap and leverage still remains high in the system, and the Fed’s book still remains just a touch under $9 trillion, which is double what it was going into the pandemic period, and since the financial crisis of 2008.”

Despite the broad market expectation for further 75 basis point hikes, Prins – a global economist and outspoken advocate for economic reform – said the Fed would likely pivot away from its hawkish trajectory in three stages as the disconnect between wealthy investors and institutions and the “real economy” widens.

Having firstly reduced the pace of rate hikes to 50 basis points and then neutralized policy, Prins expects the Fed to begin reversing course and becoming “accommodative,” with the U.S. already having recorded two consecutive quarters of negative GDP growth.

“Whether that’s to cut rates or to increase the size of its book again, that still remains to be seen,” Prins added.

Inflation worldwide has been driven skyward by supply chain bottlenecks in the aftermath of the Covid-19 pandemic, lingering supply blockages in China due to recurring lockdowns, and Russia’s invasion of Ukraine, which has caused food and energy prices to surge.

Central banks have argued that aggressive action is needed to prevent inflation becoming “entrenched” in their respective economies, and have been particularly wary of consumer price inflation feeding through to wage inflation, which they anticipate could further exacerbate demand and therefore price increases.

At his speech at the Jackson Hole economic symposium in late August, Fed Chairman Jerome Powell responded to market concern about an impending recession caused by tightening monetary conditions by asserting that “some pain” for the economy would be necessary in the fight against inflation.

Prins argued that by targeting wage inflation when wage rises are failing to keep pace with broader inflation was a mistake.

“I think the Fed absolutely is missing this connection between what is going on for real people in the real economy and why, and how that relates to the overall inflation picture, which it has basically positioned itself to fight. There’s just a mismatch here,” she said.

She argued that central banks raising rates as their main tool to fight inflation has caused a “chasm” between the individuals and institutions that were able to leverage themselves into the markets when borrowing costs and prices were considerably lower, and the average consumer.