Scotiabank’s Brian Porter to retire, Finning CEO named to take helm

Scott Thomson comes from outside Scotia’s executive team, a rare transition in Canada’s tight-knit banking world

Article content

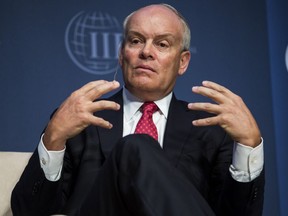

Brian Porter, who helped navigate the Bank of Nova Scotia through the financial crisis as chief risk officer, and then overhauled the bank’s Latin America operations and leapt into digital innovation as CEO, is stepping down at the end of January after nine years in the top job.

Advertisement 2

Story continues below

Article content

His replacement, Scott Thomson, comes from outside Scotia’s executive team, a rare transition in Canada’s tight-knit banking world.

Article content

Thomson, chief executive of equipment dealer Finning International Inc., has been a member of Scotia’s board since 2016. He will initially transition into management of Canada’s third-largest bank by becoming president, effective Dec. 1, with responsibility for the bank’s business lines: Canadian banking, global banking and markets, global wealth management and international banking.

John Aiken, a bank analyst at Barclays, said the non-traditional appointment is not likely to signal a sharp shift in strategy because Thomson helped forge the path as a member of the board.

Advertisement 3

Story continues below

Article content

“The appointment of a Canadian bank CEO from outside of the organization/industry is surprising,” he told clients in a note Monday morning. “That said, with Mr. Thomson’s involvement in the board (and several committees), we do not expect the transition to be jarring.”

The analyst added that Thomson’s experience in Latin America, where Scotia has substantial operations, is “a positive and was likely a component that attracted the search committee.”

After Thomson takes over as CEO, Porter will become a strategic adviser, remaining in that role from Feb. 1, 2023 to April 30, 2023 “to support the transition,” the bank said.

Prior to leading Finning, Thomson was chief financial officer of Talisman Energy Inc. Earlier in his career, he worked at Bell Canada Enterprises and Goldman Sachs Group Inc..

Advertisement 4

Story continues below

Article content

In a statement, Porter said he has always considered banking to be a calling and that working at the 190-year-old Scotia was “the honour of my lifetime.” He said he is confident that Thomson will guide the bank through its next phase of its growth and development because he is “a results-driven and proven leader” whose values are aligned with those of the bank.

“I have every confidence he will lead the bank exceedingly well,” Porter said.

Aaron Regent, chair of Scotia’s board, praised Porter as a forward-looking leader who had made “bold, strategic decisions that have repositioned the bank” while presiding over assets that grew to $1.3 trillion from $744 billion.

“He refocused the bank’s geographic and business priorities and redeployed capital into businesses with greater growth opportunities, while exiting non-core markets,” Regent said, noting that the global wealth management business has more than doubled in size and now ranks number two by assets in the Canadian retail mutual fund industry.

Advertisement 5

Story continues below

Article content

International banking, meanwhile, is now focused on fewer, larger markets that offer higher growth potential.

Thomson, who will retire Nov. 15 from Finning, the largest dealer of Caterpillar equipment and engines in the Americas and Europe, is a “seasoned CEO” whose skills include familiarity with the international market, talent development and digital transformation, said Regent, adding that he has a proven track record of effective capital allocation and strategic investments.

“He successfully led large organizations in challenging and complex macroeconomic environments, including providing tremendous leadership at Finning throughout the COVID-19 pandemic,” Regent said.

“As a board member of Scotiabank since 2016, Scott has a comprehensive understanding of the bank’s strategy, operations, management team, risk appetite, culture and drivers of growth.”

Advertisement 6

Story continues below

Article content

Richard Leblanc, a professor of governance, law and ethics at York University, said it is unusual to combine director and CEO succession.

“They are separate tracks from a governance point of view,” he said. “I have seen this done only a few times.”

It is particularly rare in the Canadian banking world, where CEOs are usually selected from within executives ranks in a grooming period that can be years in the making.

Leblanc said Scotia could be signalling that it wants to shake things up, or there may not have been an obvious choice from within.

“Normally a board goes outside when it wants a major change … A board also may go outside when the internal bench is weak,” he said.

One advantage of the crossover from the boardroom, Leblanc said, is that you get an “insider-outsider” perspective.

Advertisement 7

Story continues below

Article content

“The director-CEO is an insider because he has seen the bank’s business for six years… (and) an outsider because his role has been to supervise management, so he has this independence and lack of loyalty or sticking to the status quo,” he said.

There could be challenges, though, since the CEO reports to the board whereas, as a fellow director, Thomson would have been a peer to other board members.

“The transition may not be easy,” Leblanc said.

“I don’t see this becoming a trend because normally the lanes are very clear (between) board and management.”

Beverly Behan, founder of New York-based Board Advisor LLC, who has consulted with boards of directors in the United States and Canada, including Bank of Montreal, said it is not usual for a board member to step in as CEO in “appropriate” circumstances.

Advertisement 8

Story continues below

Article content

She said a well-known example is when The Hewlett-Packard Co. director Meg Whitman, former chief executive of eBay Inc., was installed as CEO of HP. During her tenure from 2011 to 2015, she oversaw the company’s split into two separate entities: Hewlett Packard Enterprise and HP Inc., which focused on personal computers and printers. She stayed on for another two years as CEO of the former.

In another example, David J. Lesar, a former chief executive of Halliburton Co. and a director at large Chicago-based insurance company Health Care Service Corp. (HCSC), stepped in as CEO of HCSC in 2019 and stayed for nearly a year while the company searched for a permanent successor to the outgoing CEO.

-

New taxes on banks, life insurers can generate $5.3 billion, says PBO

-

Banking watchdog refuses to bow to pressure to loosen mortgage standards as borrowing rates rise

Advertisement 9

Story continues below

Article content

As CEO, Thomson is committed to accelerating the bank’s customer focus, digital capabilities and ESG priorities, Regent said.

Thomson praised Porter for his “long-term vision and strategic investments in people, processes, technology and products,” which will continue to benefit the bank for many years.

“I am incredibly honoured and energized to be joining and leading the bank’s world-class leadership team,” Thomson said in the statement.

“During my six years on Scotiabank’s board, I have had the opportunity to see first-hand the incredible potential of this organization, and the dedication and skill of its people.”

• Email: [email protected] | Twitter: BatPost

Advertisement

Story continues below