Nvidia is about to make a big announcement during a difficult time

Nvidia Corp. faces a much more troublesome environment from the last time it launched a new chip architecture as it approaches a new launch.

Nvidia NVDA,

Ahead of the event, though, Nvidia has landed in a tough sport, with pandemic-era demand plunging its stock price by half so far this year. The company recently took a $1.22 billion inventory charge as it seeks to clear out old inventory prior to the launch.

Read: Nvidia sales forecast falls about $1 billion short of expectations, stock falls

Ampere was unveiled about two-months into the COVID-19 pandemic amid strong demand for gaming cards that sent the stock to a 122% gain in 2020, compared with a 51% gain on the PHLX Semiconductor Index SOX,

It was that sharp decline in demand and supply-chain problems that helped propel the data-center to be Nvidia’s largest unit with a $3.81 billion quarterly revenue contribution, a gain of 61% year over year, versus a 33% fall in gaming sales to $2.04 billion from a year ago, according to the company’s most recent earnings report.

Read: Nvidia’s big reset has analysts wondering whether company is now in the clear

“Following the July quarter report and recent disclosures around China licensing restrictions for the latest AI compute platforms, sentiment around Nvidia was not surprisingly fairly cautious,” Raymond James analyst Melissa Fairbanks wrote in a recent note.

“In particular, the inventory clearing of 3000-series GPUs continues to impact order rates severely, and may carry forward to the 4000-series launch,” Fairbanks said. “Suppliers indicate the actual volume ramp will be somewhat more muted as compared to a normal launch.

Citi Research analyst Atif Malik, who has a buy rating on Nvidia, said he expects October availability for the Lovelace-based gaming chips, which are purportedly twice as fast as Ampere gaming cards.

Read: Nvidia’s ‘China Syndrome’: Is the stock melting down?

As for data-center, Malik said Wall Street expects a slowdown in data-center growth through the April-ending quarter. Recently, Tom’s Hardware pointed out that Nvidia’s “Hopper” H100 GPU tested as being more than 4.5 times faster than its own A100, citing data from machine-learning benchmark group MLCommons.

While Malik does not expect further financial updates, he expects gaming sales for the October-ending quarter to be modestly above the Street consensus of $1.45 billion and in-line with the $3.85 billion consensus for data center sales.

Malik also said he will be looking out for the “trajectory of gaming sales recovery, and update on the potential loss of $400 million in forecast revenue because of China COVID restrictions.”

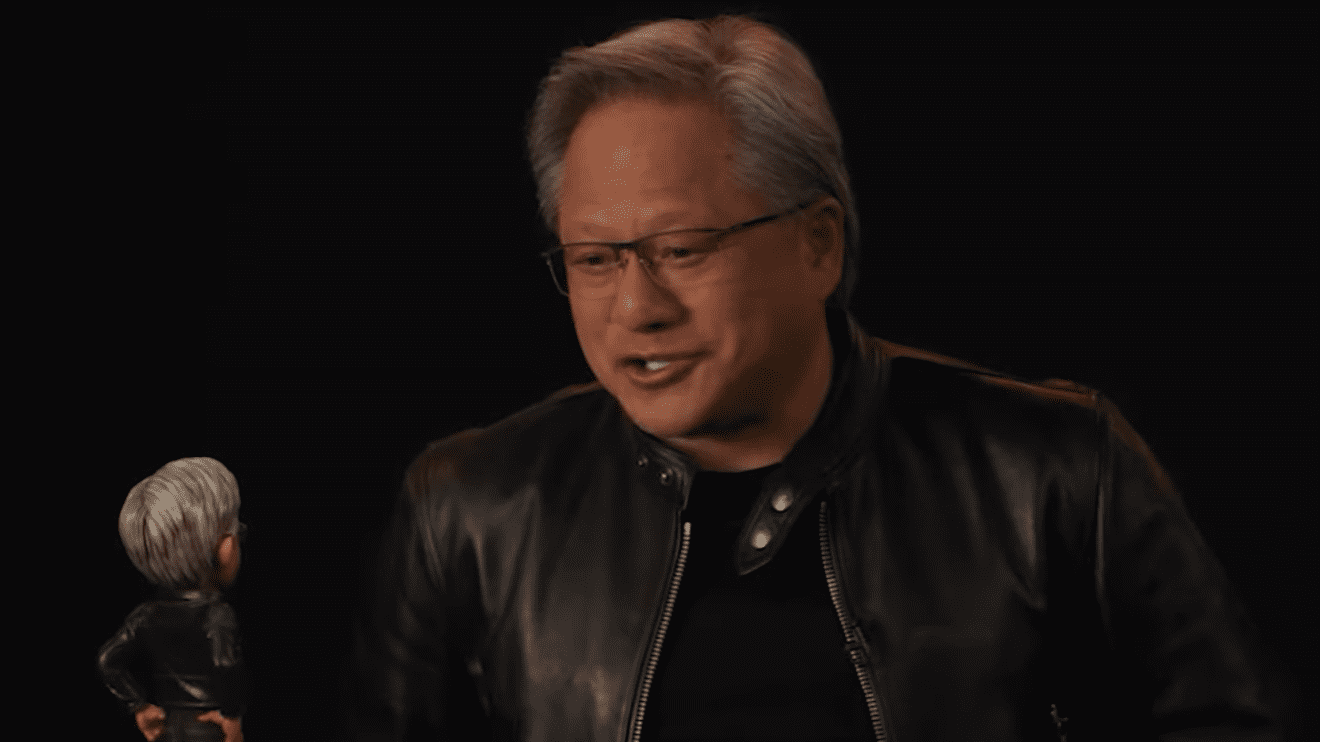

At last year’s fall GTC keynote, Huang introduced new tools to expand Nvidia’s Omniverse platform to include interactive AI avatars and data engines to train deep neural networks. This year’s conference lasts until Thursday and is open to the public online.