Chinese Stocks May Extend Gains as Delistings Talks Progress

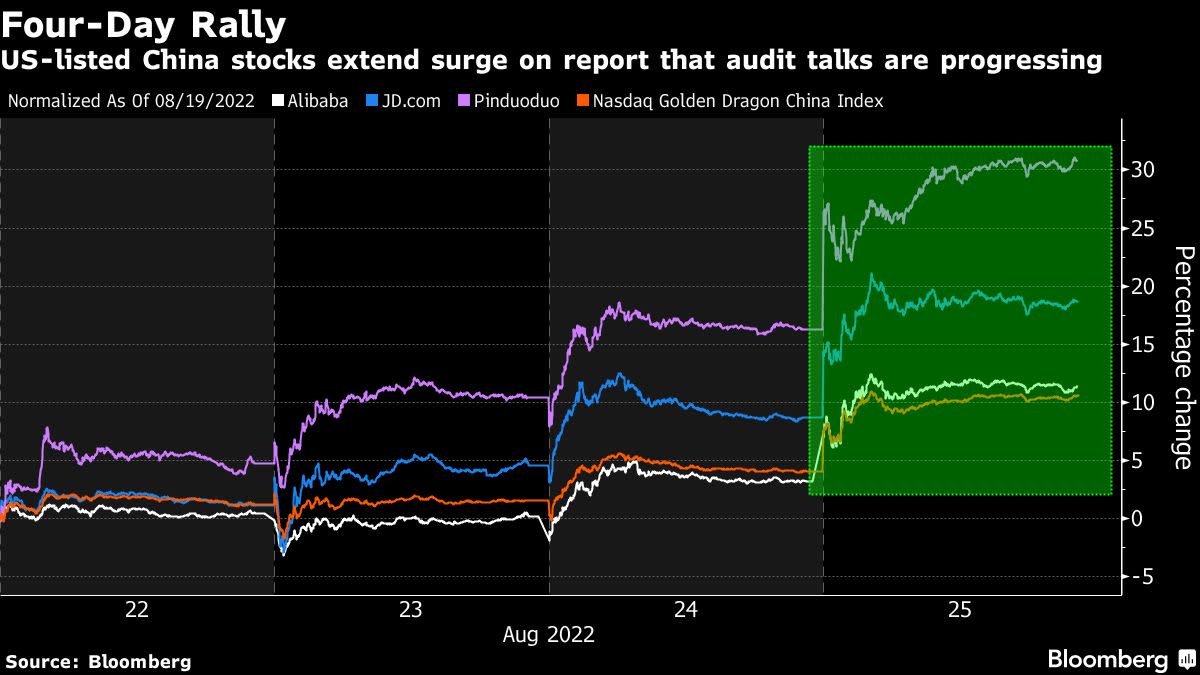

(Bloomberg) — Chinese equities may extend gains on Friday after news that regulators were progressing in talks to avoid the delisting of companies in New York gathered momentum.

Most Read from Bloomberg

The Nasdaq Golden Dragon China Index jumped 6.3% overnight, the most since June, with shares of Alibaba Group Holding Ltd. and JD.com Inc. both gaining at least 8%. China regulators have instructed major accounting firms to prepare to bring audit work papers of US-listed Chinese companies to Hong Kong, where they can be reviewed by US officials, according to a person familiar.

Congress imposed a 2024 deadline for kicking off businesses that don’t comply with US exchange listing rules and investors have remained wary over the fate of the more than 200 Chinese firms with American Depositary Receipts. The conversations, which remain ongoing, may result in a positive step forward in the years-long standoff.

“This is a fascinating development,” said Ed Moya, senior market analyst at Oanda Corp. “An official confirmation is needed but expectations were growing that this would get done as both countries are dealing with economic fragility,” he added.

Read more: US-China Talks on Delistings Advance With Hong Kong Inspections

Concern that an audit dispute may trigger a mass, forced exit of Chinese names from US markets has weighed on the shares for more than a year. Earlier this month, China Life Insurance Co., PetroChina Co. and China Petroleum & Chemical Corp. were among a group of state-owned companies that announced plans to delist from American exchanges.

As a result, the prospect of a resolution is a boon for embattled Chinese stocks.

The rally in US trading followed what was the best day in nearly four months for Hong Kong’s Hang Seng Tech Index, which rose 6% on Thursday. It helped lead the city’s benchmark Hang Seng Index to a 3.6% gain, making it the best performer among Asia’s major equity gauges.

In addition to the Chinese government’s 1 trillion yuan ($146 billion) of support for the economy, traders cited short covering and an adjustment of positions ahead of Jackson Hole.

“Whether or not the rumor on an audit deal is true, Hong Kong shorts have pressed their bets in a light summer tape,” said Brendan Ahern, chief investment officer at Krane Fund Advisors LLC. “We have been setting up for an epic short squeeze that is contributing to today’s move.”

Stocks in Hong Kong had slumped to the lowest in months this week, as global risk-off sentiment spread ahead of the Federal Reserve’s Jackson Hole symposium. Concerns over China’s economic growth, with a deepening property crisis and power shortages spurred by a severe drought, had added to the gloom.

Following three days of losses, the Hang Seng Index was also looking ripe for a rebound to some market watchers based on various technical indicators.

The gauge was near “oversold” levels on monthly measures of the relative strength index, approaching the 30-threshold that’s never been reached in data going back to 1972. Morgan Stanley strategist Gilbert Wong said “the risk of short squeeze in China and Hong Kong equities is rising.”

Even as talks progress, some are staying cautiously optimistic. “At this point it appears details are lacking but if a deal between U.S. and Chinese regulators comes to a fruition, it would be a very good sign for investors in U.S. listed Chinese ADRs,” said Michael O’Rourke, chief market strategist at JonesTrading.

“Considering the fact that some Chinese companies have commenced the U.S. delisting process, it is a positive sign to see the situation stabilize,” he added.

(Updates first three paragraphs with background)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.