The Fed vowed to crush inflation with higher rates. Then the stock market rallied. Here’s why. (It’s not good news.)

‘‘We are now at levels broadly in line with our estimates of neutral interest rates, and after front-loading our hiking cycle until now we will be much more data-dependent going forward.’’

— Jerome Powell, July 2022 FOMC press conference

The Federal Reserve on Wednesday raised interest rates by another 75 basis points despite acknowledging that economic growth is clearly slowing. The central bank, under Powell, reiterated that the path of least resistance is well-represented by the so-called dot plot: More hikes ahead — all the way to a fed funds rate of 3.75%!

And yet, the stock market has staged a humongous rally, led by the most valuation-sensitive and risk-sentiment-driven asset classes: Nasdaq stocks COMP,

So … what the heck?!

It all boils down to how one single sentence was able to affect the probability distributions that investors were projecting for different asset classes.

Does it sound complicated? Bear with me: it’s not!

In this article, we will:

- Break down the FOMC meeting, and in particular discuss why that ‘‘one single sentence’’ spurred such a crazy rally.

- Assess where this leaves us now: Is the music changing?

Why did stocks rally?

When the FOMC’s press release was published, it looked like business as usual: A well-telegraphed 75-bp hike with the only small surprise represented by an unanimous vote despite clear acknowledgment that economic growth is softening.

But not even 15 minutes into the press conference, the fireworks went off!

In particular, when Powell said: ‘‘We are now at levels broadly in line with our estimates of neutral interest rates, and after front-loading our hiking cycle until now we will be much more data-dependent going forward.’’

This is very important for several reasons.

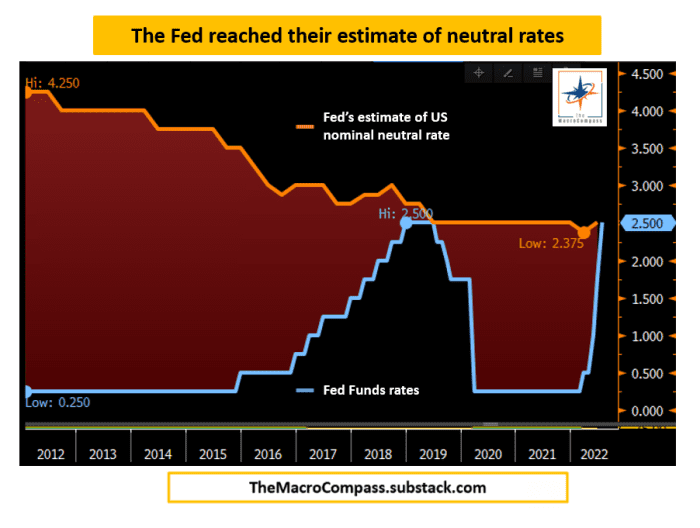

The neutral rate is the prevailing rate at which the economy delivers its potential GDP growth rate — without overheating or excessively cooling down. With this 75-bp hike, Powell told us the Fed just reached its estimate of a neutral rate and, hence, from here they aren’t contributing to economic overheating anymore.

But that also means any further increases are going to put the Fed in an actively restrictive territory.

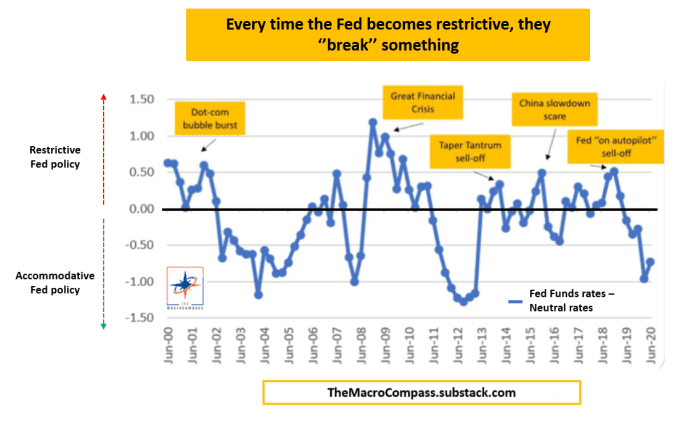

And the bond market knows that every time the Fed became restrictive in the past, they ended up breaking something.

Until Wednesday, you could be completely sure that the Fed would have just pressed on the accelerator — inflation must come down; no space for nuance.

So journalists asked questions to find out something about the ‘‘new’’ forward guidance. It went roughly like this:

Journalist: ‘‘Mr. Powell, the bond market is pricing you to cut rates starting in early 2023 already. What are your comments?’’

Powell: ‘‘Hard to predict rates six months from now. We will be fully data-dependent.’’

Journalist: ‘‘Mr. Powell, due to the recent bond and equity market rally, financial conditions have eased quite a lot. What’s your take?’’

Powell: ‘‘The appropriate level of financial conditions will be reflected in the economy with a lag, and it’s hard to predict. We will be fully data dependent.’’

He did it. He totally ditched forward guidance.

And what happens when you do so? You give markets the green light to freely design their probability distributions across all asset classes without any anchor — and that explains the gigantic risk rally — as well as the jump in the broader S&P 500 SPX,

Let’s see why.

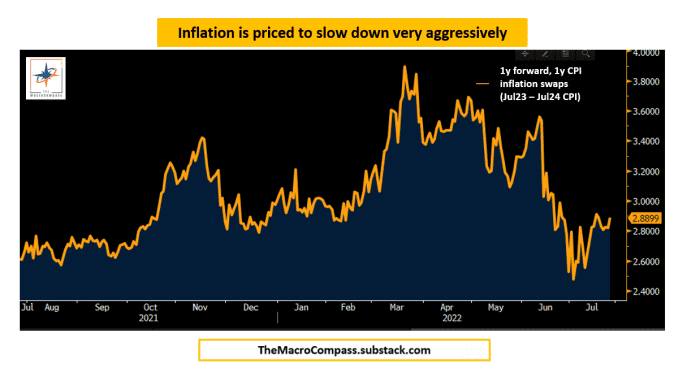

If the Fed is so data-dependent, and there is basically one data they care about, it all boils down to how inflation will evolve in the near future — and the bond market has a very strong opinion about that.

Using CPI inflation swaps, I calculated the one-year forward, one-year inflation break-evens — basically, the expected inflation between July 2023 and July 2024, which is represented in the chart above and sits at 2.9%.

Remember that the Fed targets (core) PCE, which tends to historically be 30-40 bps below (core) CPI: Essentially, the bond market expects inflation to slow very aggressively and roughly hit the Fed’s target in the second half of 2023 already!

So if the Fed is not nearly on autopilot anymore, and markets have a strong opinion on inflation and growth collapsing, then they can also price all other asset classes around this base case scenario. It starts to be more clear now, right?

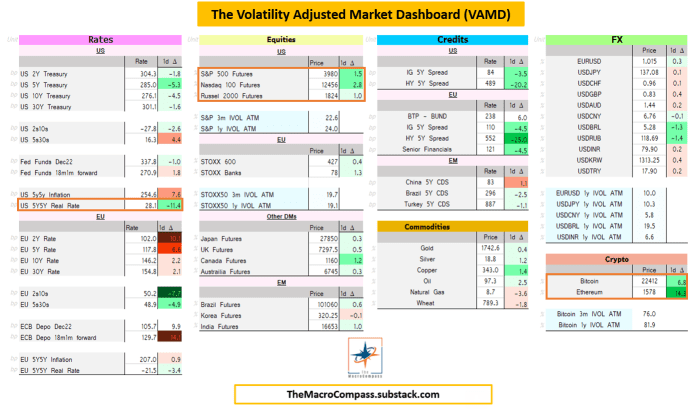

This is what my Volatility Adjusted Market Dashboard (VAMD — here’s a short explainer) showed soon after Powell enunciated that one single sentence.

Reminder: The darker the color, the bigger the move in volatility-adjusted terms.

Notice how I highlighted three movers, but let’s start from U.S. real rates.

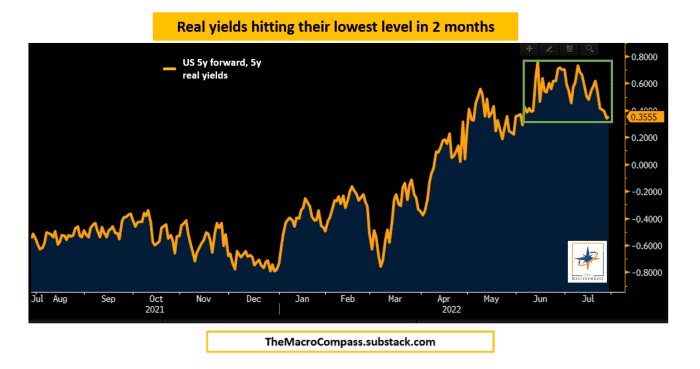

If the Fed isn’t going to blindly keep hiking rates but be more data-dependent, contingent on their view that CPI will quickly come down, traders have a green light to price a more nuanced tightening cycle and, hence, still expect restrictive real yields but less so than before.

And, indeed, five-year forward, five-year U.S. real yields rallied 11 bps and hit their lowest level in over two months.

When real yields decline, valuation-sensitive and risk-sentiment-driven asset classes generally tend to outperform.

That’s because the marginal inflation-adjusted return for owning cash USDs (risk-free real yields) becomes less attractive and the (real) discounting rate for long-term cash flows becomes much less punitive.

Thus, the incentive to chase risk assets is larger — actually, following this narrative one could argue that ‘‘the riskier, the better.”

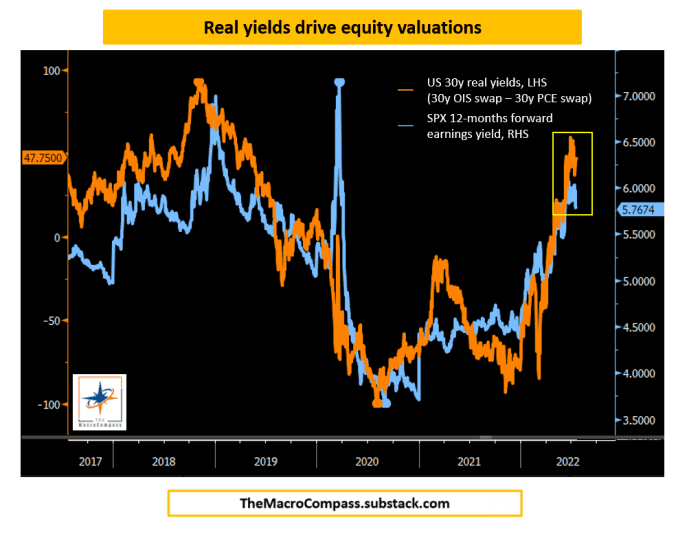

Here is a chart showing the very tight relationship between real yields and equity market valuations.

So guess who the two main characters of the crazy market rally were? U.S. tech and crypto.

But let’s now answer the real question: In this giant puzzle called global macro, are all the pieces falling into the right place to fully support this narrative?

Hold your crazy horses

In short, the crazy market rally was spurred by Powell ditching the Fed’s forward guidance and kickstarting ‘‘full data-dependency’’ season. Given the bond market’s strong opinion on inflation going forward and no autopilot by the Fed on a tightening cycle, investors went ahead and repriced all other asset classes accordingly.

If the Fed isn’t going to blindly hike us into a recession, and contingent on inflation slowing quickly as priced in, then:

- Fewer hikes now, fewer cuts later (curve steepening)

- Lower real yields (Fed won’t keep policy ultra-tight for too long)

- Risk-sentiment-driven asset classes can rally

So does the new narrative pass the global macro consistency test?

Not really. Not yet.

And for two main reasons.

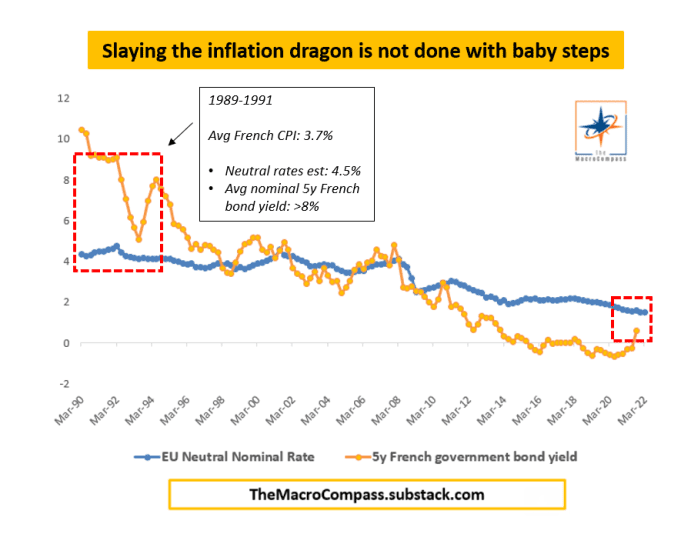

1. This is the most important inflation fight that central bankers have engaged in over 35 years, and history suggests a ‘‘mildly’’ restrictive stance won’t be enough.

Slaying the inflation dragon is generally not done with baby steps, and that’s been true across different jurisdictions and historical circumstances.

For instance: The last time inflation was stubbornly high in France, the central bank had to bring nominal yields (orange) all the way to 8% and keep them there for years to bring down CPI — way above my estimate of the prevailing neutral rate (blue) at 4.5%.

Assuming the Fed will be able to engineer significantly lower inflation while already taking the foot off the gas pedal seems very optimistic.

2. Ditching forward guidance increases volatility in bond markets even further, and a volatile bond market is an enemy for risk assets.

Let’s assume the next inflation print is worse than expected in absolute terms, momentum and composition.

A fully data-dependent Fed will have to consider a 100-bp hike in September: Very likely to generate mayhem in markets all over again.

While ditching forward guidance might be the right monetary policy strategy amid these uncertain times, when there is no anchor for bond markets, implied volatility will have a hard time falling.

And higher volatility in one of the biggest, most liquid markets in the world generally requires higher (not lower) risk premia everywhere else.

To sum it all up: The Fed can’t, and won’t, stop until the job is done. And the job will be done only when inflation has been killed — with likely big collateral damage inflicted on the labor market and the broad economy too.

So: Hold your horses.

Alfonso Peccatiello writes The Macro Compass, a free newsletter on financial education, macro insights and investment ideas. He was head of investments at ING Germany. Follow him on Twitter.