Surprise? How the stock market has reacted on day of each Fed rate hike in 2022

The Federal Reserve’s strategy of supersize interest rate hikes gets much of the blame for triggering a bear market in stocks in 2022, but investors might be surprised by a look back at how equites have performed on the days this year when policy makers have slammed on the metaphorical monetary-policy brakes.

The S&P 500 SPX,

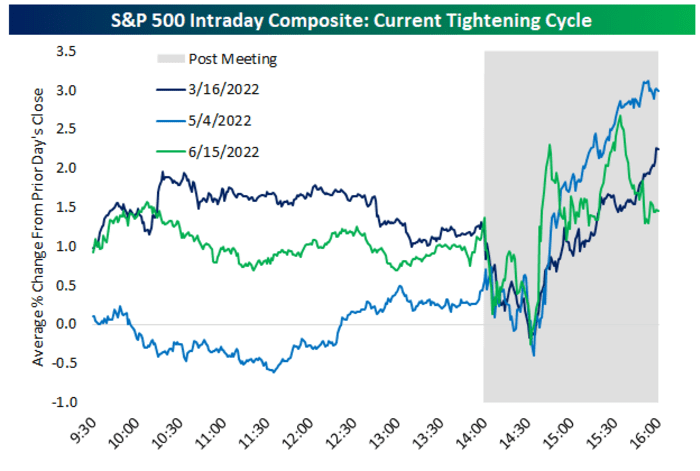

But the index, they observed, has rallied at least 1.5% on each of the three previous Fed meeting days during this period.

The large-cap benchmark gained 2.2% on March 16 after Powell’s first rate hike of 25 basis points, or a quarter of a percentage point. On May 4, the S&P rose 3% after Powell’s second hike of 50 basis points, which was the largest such move since 2002. And at the last meeting on June 15, the S&P 500 gained 1.4% on the day following a rate hike of 75 basis points, the largest move since 1994 (see chart below).

“You can see that an initial drop occurred right after the 2 PM ET rate decision all three times, but then stocks rallied hard for the remainder of the day once Powell’s press conference began,” the analysts wrote.

U.S. stocks held on to gains Wednesday after the Fed delivered another 75 basis point hike. The S&P 500 was up 1.4%, while the Dow Jones Industrial Average DJIA,

Since a 75 basis point move had looked like pretty much a done deal, the market reaction was likely to be driven by Powell’s messaging, according to Deutsche Bank macro strategist Alan Ruskin.

And messaging is where “it gets a whole lot trickier, because on both inflation and growth there will be some dual tacks taken, that might even sound contradictory, but are reflective of the macro complexities of the day,” he said in a Tuesday note.

Indeed, investors are poised to hear what Powell has to say about growing fears the economy is slipping toward or has already slipped into recession. Some market watchers are baying for Powell to push back on market-based expectations the Fed could begin cutting interest rates again as early as next year and that the fed-funds rate is likely to top out beforehand near 3.5%.

Key Words: Here’s what Bill Ackman says Powell should tell traders about Fed rate-hike plans

Powell will attempt to avoid contradicting the Biden administration’s denials that the economy is in recession and note that they are often hard to recognize in real time, Ruskin said, while observing that the slowing seen so far doesn’t look like a typical recession given the strength of the labor market so far.

Rex Nutting: Everything you need to know about the economic recession that we are definitely not in right now

Ruskin expects much of the reaction to the Fed decision to be driven directly by the signaling for the September meeting.

While investors will focus on the question of a 50- versus a 75-basis-point rate hike at the next meeting, the market has priced in a cumulative 136 basis points of tightening for July and September, Ruskin said, “which looks reasonable, and, is not something the Fed will go out of their way to fine-tune.”

A desire not to be explicit and shift short-term rates means that the July meeting won’t feature a “differentiating sentence from Powell that sets the tone for all markets,” Ruskin said. “What Powell will be able to say is that the Fed is still homing in on a policy rate that is moderately tight relative to their neutral rate, and the higher the level of rates, the more incremental rate changes can be smaller than 75bps.”

The dual message on rates will likely be that the Fed is open minded

on a 50- or 75 basis point move in September and that it’s too soon to make that call, Ruskin said, while there may be some pushback on market expectations for a peak rate near 3.4%.