Gold price slips as investors prepare for another big rate hike

[Click here for an interactive chart of gold prices]

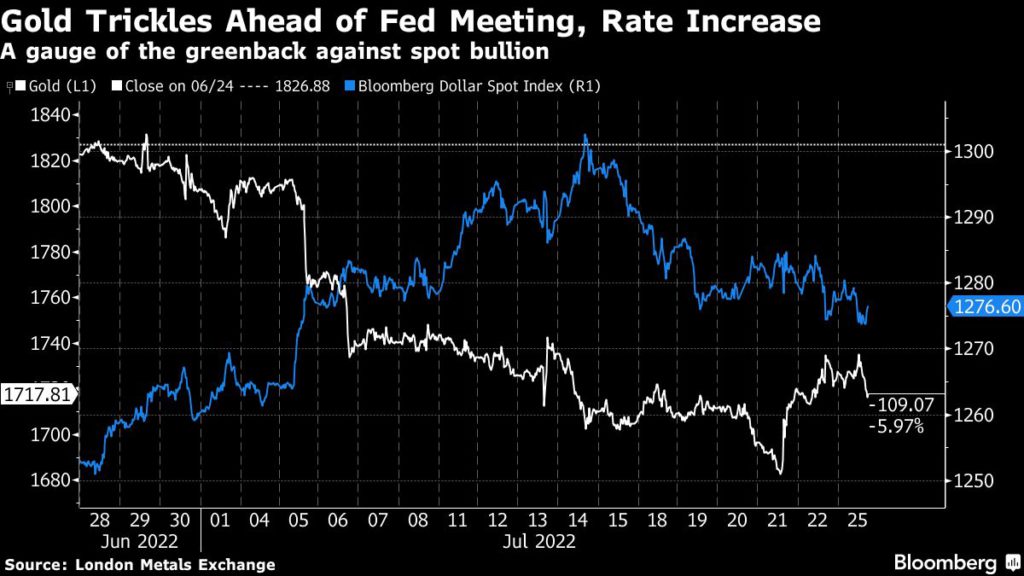

Bullion hit the lowest level since March 2021 last week, only to rebound as Treasury yields eased following poor US economic data.

After raising rates in June by the most since 1994, Federal Reserve policy makers are expected to approve another 75 basis-point hike when they meet July 26-27. Second-quarter GDP data will also indicate whether the US is in a technical recession.

“The biggest factor influencing gold is the anticipation of the Fed meeting, with US second-quarter GDP numbers on Thursday also likely to be a significant driver,” said Daniel Pavilonis, senior market strategist at RJO Futures, in a Reuters note.

“Usually, ahead of the Fed, you see a sell-off in the metals

and that’s just normal,” he added.

As things stand, the precious metal is on its way towards a fourth monthly loss as central bank tightening and a stronger US dollar dimmed its allure as a haven, overshadowing concerns about inflation and an economic slowdown.

Over the weekend, while former Treasury Secretary Lawrence Summers cast doubt on the likelihood of a soft landing for the US, incumbent Janet Yellen said that she doesn’t see any sign the economy is in a broad recession.

Additional downward pressure on gold has come from waning investor interest, with holdings in bullion-backed exchange-traded funds ebbing for a sixth week, according to initial data compiled by Bloomberg.

Hedge funds trading the Comex flipped to being net-short on gold for the first time since 2019, according to data from the Commodity Futures Trading Commission.

(With files from Bloomberg and Reuters)