These 10 cheap stocks are favorites of top investment newsletters, as value keeps pounding growth

Value stocks’ relative strength over growth over the past six months gives value investors a lot to cheer about, but the fact is that relative strength doesn’t necessarily tend to persist.

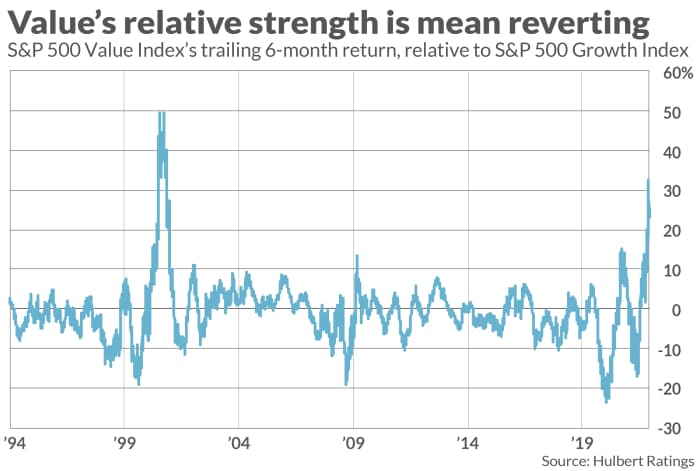

I’ll discuss in a moment the statistics that prove value proponents wrong. But, first, it’s worth acknowledging just how strong value has been relative to growth over the past six months. From the end of November 2021 to the end of May, the S&P 500 Value Index topped the S&P 500 Growth index by 32 percentage points. As you can see from the chart below, this six-month relative performance is the best since after the internet bubble burst in 2000.

As the chart also shows, value’s trailing-six-month relative strength does not tend to persist. If anything, the relative strength line plotted in the chart appears to be more mean-reverting than trend following. That’s why you’re on shaky ground thinking that, just because value has done so well over the last six months, it has increased odds of continuing to do so.

This tendency to mean revert comes as a surprise to many, who have rewritten history to make it seem as though the two years immediately after the bursting of the internet bubble were a period of uninterrupted value dominance. In fact, as the chart makes clear, after surging to record levels in late 2000, value’s six-month relative strength in 2001 fell back in a big way. By the end of 2001, value’s six-month relative strength was so weak that it stood at just the 7th percentile of the historical distribution from 1993 until now.

This doesn’t automatically mean you should now switch to growth stocks. Value’s relative strength can be mean-reverting without oscillating back and forth. In fact, the correlation coefficient between trailing six-month and subsequent six-month relative strength, while negative, is close enough to zero as to be of doubtful statistical significance.

Another reason: The mean to which value’s relative strength tends to revert is itself positive. This is the source of the well-known “value effect.” Since 1927, according to data from Dartmouth College professor Ken French, large-cap value stocks have outperformed large-cap growth issues by more than two percentage points annualized.

A third reason you may want to stick with value: Despite value’s strength over the last six months, the sector remains cheap relative to growth. Cliff Asness, founder of AQR Capital Management, argues that, though the valuation spread between value and growth has narrowed over the past several months, it remains just as extreme as it was at the top of the internet bubble.

My point is that, if you want to give value the benefit of the doubt in coming months, you should do so for reasons other than its trailing six-month relative strength.

With this in mind, I compiled a list of value stocks that currently are highly recommended by the top-performing newsletters my auditing firm monitors. The table below lists the 10 stocks recommended by three or more of such newsletters and which have, per FactSet, the lowest price/book ratios. For comparison, the S&P 500’s SPX,

| Stock | # newsletters recommending | Price/book ratio |

| KEYCORP (KEY) | 3 | 1.23 |

| BERKSHIRE HATHAWAY BRK.A, |

3 | 1.29 |

| JPMORGAN CHASE JPM, |

4 | 1.42 |

| MORGAN STANLEY MS, |

3 | 1.52 |

| CVS HEALTH CORP. CVS, |

4 | 1.62 |

| INTEL CORP INTC, |

4 | 1.68 |

| INTERNATIONAL PAPER IP, |

3 | 1.94 |

| WHIRLPOOL CORP. WHR, |

3 | 2.08 |

| WALT DISNEY DIS, |

3 | 2.17 |

| FEDEX CORP FDX, |

4 | 2.24 |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: This market strategist with a spot-on record sees stocks surging 15% to 25% from their May low