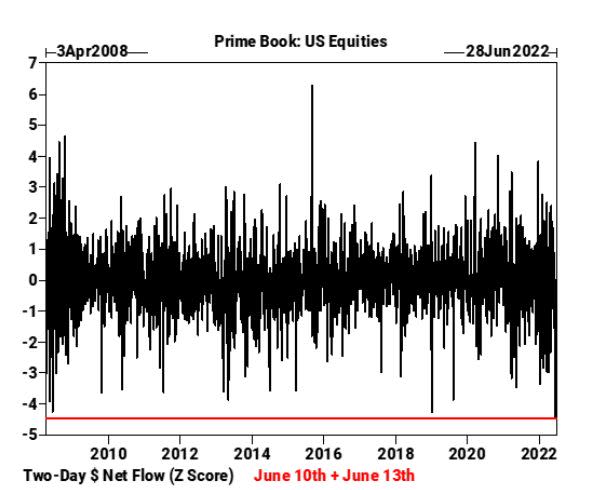

Hedge Fund Selling Was Never More Furious Than in Last Two Days

(Bloomberg) — The smart money dumped stocks at the fastest pace on record as a vicious selloff sent the S&P 500 into a bear market.

Most Read from Bloomberg

Hedge funds tracked by Goldman Sachs Group Inc. offloaded US equities for a seventh straight day Monday, with the dollar amount of selling over the last two sessions exploding to levels not seen since the firm’s prime broker began tracking the data in April 2008.

The exodus came as the equity rout worsened amid concerns that the Federal Reserve will need to hasten its inflation-fighting campaign at the risk of causing an economic recession. As stocks careened and Treasury yields spiked, the fast money rushed to double down on bearish wagers.

In the note published Tuesday, Goldman said short sales at its hedge-fund clients climbed “aggressively,” with broad-based investing strategies — or macro products — like exchange-traded funds dominating the flows.

“They’re saying the market’s going down further,” Benjamin Dunn, president of Alpha Theory Advisors, said by phone. “Sentiment is just pretty much in the toilet.”

Read more: Influencer-Approved Bull Market Sputters to End on Hawkish Fed

The equity selloff picked up pace after Friday’s hotter-than-expected reading in consumer prices dashed any hopes that inflation has peaked. With the Fed scheduled to announce its monetary policy decision Wednesday, traders have amped up wagers on a 75 basis-point rate hike.

Alongside the 2022 carnage, hedge funds have slashed their equity exposure. A gauge of their risk appetite that takes into account both bullish and bearish bets — known as gross leverage — sat near five-year lows, Goldman data show.

At Monday’s close, the S&P 500 tumbled more than 20% from its January peak, entering a bear market for a second time in as many years. The benchmark index slipped 0.3% as of 11:20 a.m. in New York.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.