Crypto Market Daily Highlights – June 18 – BTC Visits $17,600

Key Insights:

-

Bitcoin (BTC) and the broader crypto market resumed the current week’s sell-off, with bitcoin visiting $17,600 before finding support.

-

Top ten crypto Solana (SOL) bucked the trend with modest gains as investors grappled with crypto market headwinds.

-

The total market cap fell for the fourth time this week, with $100bn coming off the table before a partial recovery.

It was a mixed session for the crypto market on Saturday. For the broader market, a bitcoin (BTC) slide to a new current-year low of $17,601 highlighted the downside risks.

Late in the week, we saw bitcoin decouple with the NASDAQ, with bitcoin suffering from heavier losses. This trend continued into the weekend, with no news stories to shift investor sentiment.

Crypto Market Cap Tumbles $107bn to a New Current-Year Low

After a brief respite on Thursday and Friday, the total crypto market cap fell to a new current-year low on Saturday.

A $107 billion slump saw the total crypto market cap fall to a new current-year low of $762.83 billion.

It was also the lowest level since January 2021, the beginning of the 2021 bull run, and marked a fourth new current-year low of the week.

Market headwinds continued to weigh on bitcoin and the broader crypto market. Investors have yet to move on from Wednesday’s Fed monetary policy. Fears of a global recession continue to hit investor sentiment.

The extended sell-off, in the wake of the collapse of TerraUSD (UST)and Terra LUNA, also increases the prospect of a material shift in the regulatory landscape.

Looking at the top ten, SOL bucked the trend, rising by 4.2%.

ETH tumbled by 8.5% to sub-$1,000 for the first time since January 2021, with BNB sliding by 8.7%.

BTC (-7.1), ADA (-6.6%), DOGE (-7.0%), and XRP (-4.3%) also saw heavy losses.

From the CoinMarketCap top 100, Polygon (MATIC) and Aave (AAVE) saw the heaviest losses, falling by 13.4% and 13.6%, respectively.

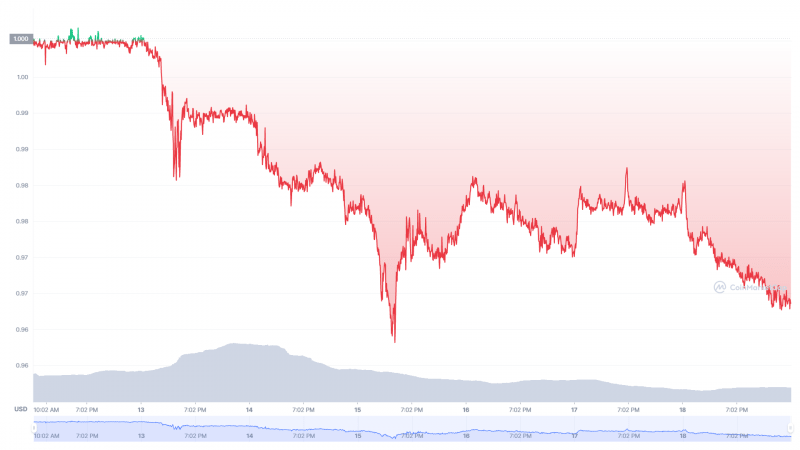

On the stablecoin front, USDD movements were market negative, with a pullback to sub-$0.97 raising further concerns over algorithmic stablecoins.

Despite the USDD pullback, TRON (TRX) held its ground, rising by 1.6%.

While the TRON DAO Reserve assured that the USDD fall to sub-$0.97 does not constitute a de-pegging, regulatory chatter over the instability of stablecoins drew attention.

This week, the Federal Reserve sent a Monetary Policy Report discussing the fragilities of stablecoins. Increased regulatory scrutiny will remain a test for stablecoins and the broader crypto market.

Total Crypto Liquidations Eased Back Following Fed Policy Decision

After improving from Tuesday’s peak of $1 billion, with a fall back to sub-$200 billion, liquidations spiked once more.

Up from $210 million on Saturday morning, total liquidations stood at $567 million this morning.

Over the last 12 hours, total liquidations stood at $325 million and $127 million over 4 hours, reflecting market conditions in Saturday’s afternoon session.

1-hour liquidations reflected improving market conditions, however, reflected in the hourly total market cap chart below.

According to Coinglass, 1-hour liquidations stood at $5.66 million.

While market conditions improved late in the Saturday session, downside risks will likely linger for some time. The markets will need a catalyst to shift the bearish sentiment, which now leaves bitcoin at risk of falling to $15,000.

Crypto Daily News Highlights

-

Ethereum fell to sub-$1,000 for the first time since January 2021.

-

The SEC filed objections as XRP investors await the court ruling on the Hinman speech-related documents.

-

Following Wednesday’s rate hike, the US Federal Reserve raised concerns over the fragility of stablecoins to Congress.

-

Coinbase was in the spotlight, with investors filing a lawsuit over the sale of TerraUSD and Terra LUNA.

This article was originally posted on FX Empire