Amazon Stock: Our ‘Best Idea,’ Says J.P. Morgan

Much has been made of the headwinds the ecommerce segment has come up against in recent times. Continued supply chain and inflationary pressures amidst slowing consumer discretionary spending and the impact of the economy’s reopening have all impeded the sector’s growth.

And as was evident in a disappointing Q1 report, Amazon (AMZN) has felt the pinch too.

J.P. Morgan’s Doug Anmuth thinks the macro headwinds will still have a large part to play in Q2 – particularly in the first half – yet as comps ease in the latter half of the year, and Amazon makes further headway in “key under-penetrated categories” such as grocery, CPG, apparel & accessories, & furniture/appliances/equipment, revenue growth should also pick up steam in 2H22.

There is also another element to consider when evaluating Amazon’s near-term prospects. The company has invested heavily over the past couple of years; the workforce has almost doubled to 1.6 million, while the fulfillment network is now twice as large. But the company now appears to have too much capacity – both in the workforce and infrastructure wise.

That said, Amazon has already claimed this year’s fulfillment capex would be lower than last year, while transport capex should also come in “flat to slightly down.” The result should be an overall reduction of ~55% of the total capex spend compared to last year.

The slowdown in spending should also prove beneficial to OI margins, which Anmuth expects will improve as the year progresses.

“Macro factors will take longer to play out,” added the 5-star analyst, “but the company has raised Prime prices & introduced a fuel surcharge to offset, & we expect AMZN to grow into its upfront spending more in 2H22.”

Elsewhere, AWS saw out Q1 with a backlog of $88.9 billion – its biggest ever – while growth accelerated to 68% year-over-year. Anmuth thinks 30%+ AWS revenue growth is “sustainable” in 2022, and as comps ease, Advertising should also see a significant uptick.

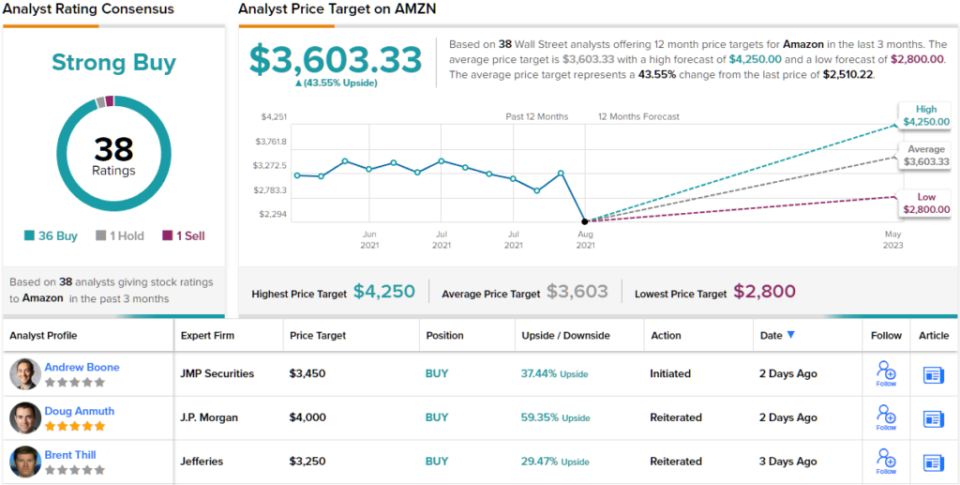

All in all, Anmuth calls Amazon his “Best Idea,” and reiterated an Overweight (i.e., Buy) rating along with a $4,000 price target. The implication for investors? Upside of 59%. (To watch Anmuth’s track record, click here)

The Street’s cadre of analysts almost unanimously agree; of the 38 reviews on file, 36 are to Buy, making the consensus view on this stock a Strong Buy. Going by the average target of $3,603 and change, shares are anticipated to climb ~44% higher in the year ahead. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.