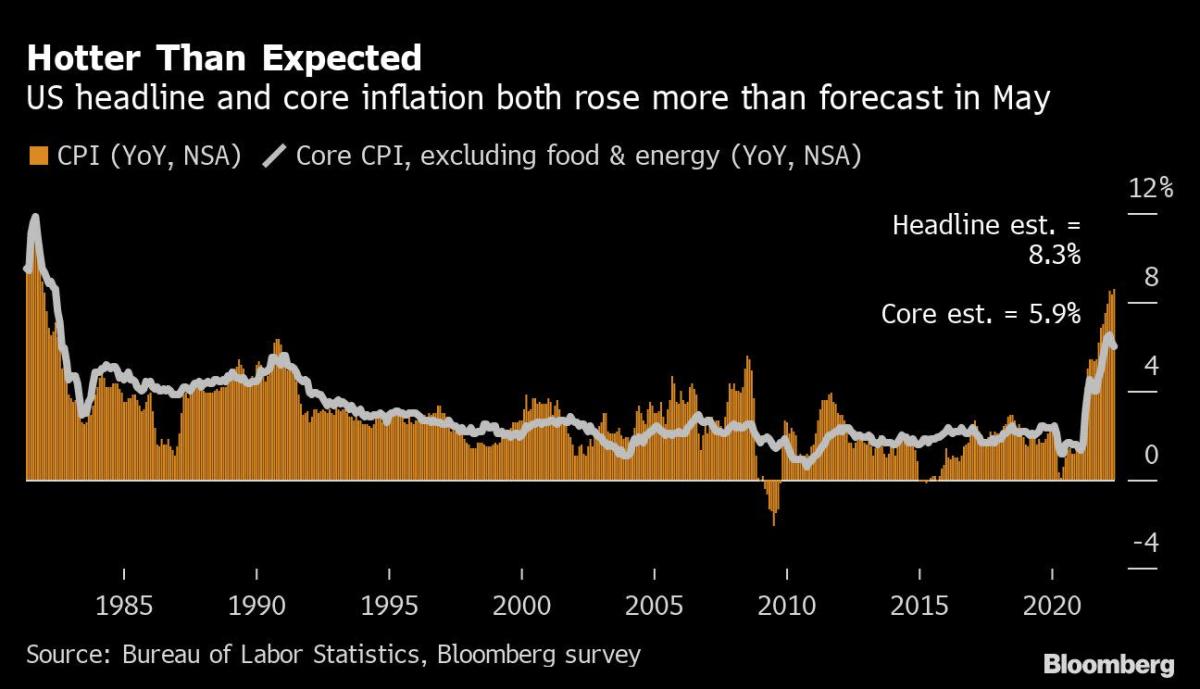

Aggressive Fed Moves Back in Play as Yields Surge on CPI Shock

(Bloomberg) — Investors rushed to price in more aggressive Federal Reserve rate hikes Monday as the US inflation shock continued to reverberate, sending two-year Treasury yields to a 15-year high and strengthening the dollar.

Most Read from Bloomberg

Market participants are awaiting the central bank’s updated projections on the US economy, inflation and interest rates from its policy decision Wednesday, with a 50 basis point hike seen as a given. Traders see 50-50 odds of the Fed raising rates by three-quarters of a percentage point in July, while Barclays Plc became the first major bank to predict such a move could come this week.

The yield on two-year Treasuries climbed as much as 11 basis points to 3.17%, the highest since 2007, after data showed that US May consumer prices exceeded even the highest economist estimate in a Bloomberg survey. The 10-year yield also rose, adding 4 basis points to 3.19%

“Fed Chair Powell may suggest that policy makers won’t rule out a rate hike of more than 50 basis points,” Naokazu Koshimizu, a senior rates strategist at Nomura Securities in Tokyo, wrote in a note on this week’s meeting. “But the upward bias for Treasury yields is at extreme levels, so once the market prices in the probability of a 75-basis-point hike, there’ll be short-covering.”

The deepening sell-off in Treasuries reverberated through Asian markets, with Japan’s 10-year yield at the 0.25% ceiling that the nation’s central bank tolerates. Similar-tenor yields in New Zealand climbed above 4% for the first time since 2014.

Treasuries Dare Fed to Step Up Hikes or Risk Inflation Defeat

Treasuries are also sending a grim message to the Fed that its efforts to catch up with inflation will increase the prospect of a hard landing for the US economy. The signal comes in the form of shrinking gaps between short- and long-maturity yields, including an re-inverted curve between the five- and 30-year yields.

The dollar rose against every peer on Monday on the climb in yields and as investors rushed to buy the haven asset.

All eyes will be on this week’s Fed statement and Chair Jerome Powell’s post-meeting press conference, where policy makers’ characterization of inflation and long-term forecasts for the fed funds target — the so-called dot plot — will be critical.

While he pushed back against a 75 basis-point hike at the May meeting after his St. Louis Fed colleague James Bullard said that might be worth considering, Powell has not taken anything permanently off the table and has stressed the need for policy to be nimble.

Hedge Fund Bond Bears Timed US Inflation Shock to Perfection

Meanwhile, hedge funds timed their bond bets to perfection, turning bears on every single Treasury futures contract tracked by Bloomberg, right before the shock inflation print sent debt markets tumbling. Leveraged fund net positions flipped negative on two-year Treasury futures last week, having done the same for benchmark contracts the week before, according to the latest Commodity Futures Trading Commission data.

(Updates throughout.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.