Virgin Galactic stock dives to a record low after long-time bull cuts rating and slashes price target by two-thirds

Shares of Virgin Galactic Holdings Inc. took a dive Monday to a record low, after Truist analyst Michael Ciarmoli said there are a handful of reasons he’s no longer bullish on the space-tourism company, but mostly because of the postponement of commercial flights.

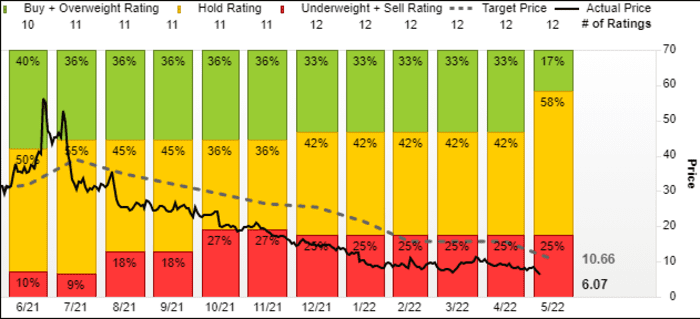

In a research note titled “Not ready for liftoff in 2022,” Ciarmoli said he cut his rating to hold, after being at buy since March 2021. He also chopped his price target down to $8 from $24.

He cited a combination of supply chain delays, timing risk, slide-out of commercial flights to the first-quarter of 2023, a lack of operational catalysts and rising interest rates for the downgrade.

The stock SPCE,

The selloff comes after the stock tumbled 17.7% over the previous two sessions, with the company reporting late Thursday a wider-than-expected loss but revenue that was more than triple what was expected. The highlight of the report, however, was the company said it postponed its first commercial flight to next year, given supply chain and labor constraints.

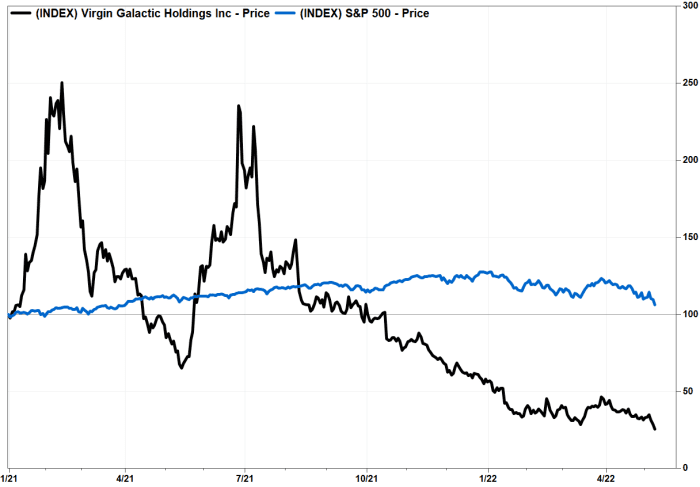

The stock has plunged 54.6% year to date, and has plummeted 89.8% since the Feb. 11, 2021 record close of $59.41. Meanwhile, the S&P 500 index SPX has lost 16.3% this year.

Ciarmoli worries that the commercial flights could be delayed even longer current expectations of the first quarter of 2023.

“We see supply chain and labor tightness potentially leading to additional slippages of commercial operations and believe a return to flight might not materialize until 2Q23 or later,” Ciarmoli wrote in his research note. “Rising interest rates weigh materially on our DCF model considering the majority of our valuation resides in our terminal value assumption.”

With Ciarmoli’s downgrade, that leaves only 2 of 12 analysts surveyed by FactSet bullish on Virgin Galactic’s stock. Of the rest, three are bearish and seven have the equivalent of hold ratings.

On the bright side, Ciarmoli said the company has made good progress with ticket sales, with the order backlog likely to support several years of space flights. And by the end of next year, he believes there is potential for Virgin Galactic to send up three commercial flights a month.

With the company currently having an estimated 800 reservations for flights, he doesn’t expect any trouble with the company reaching its target of 1,000.

“We estimate that, assuming there are not further delays in commencing operations, it would take until about mid-2026 to work through the company’s backlog.