These 2 Oversold Stocks Are Poised for a Rebound, Say Analysts

The last few months, with the exception of some short bullish trading runs, have been brutal for the stock market. The NASDAQ has already entered bear-market territory, with a loss of ~26% so far this year, and the S&P 500 is near the edge, with a year-to-date loss of ~17%.

But investors should remember: even in a bear market, there are going to be opportunities for the risk-friendly. This leads us to the oversold stocks, and their potential to rebound to investors’ benefit.

Oversold stocks are the victims of circumstance, stocks with sound foundations that got caught up in market overreaction, or are driven down by external economic factors. These are the places investor should look for opportunities in today’s market conditions.

With this in mind, we scoured the TipRanks database and picked out two names which have been heading south recently, specifically ones which have been flagged by those in the know as oversold. Not to mention considerable upside potential is on the table here. Let’s take a closer look.

HireRight Holdings (HRT)

We’ll start in the world of human resources. Every company depends on this, giving it effectively an infinite market. HireRight Holdings provides solutions for risk management, compliance, and background screening for new hires, and boasts over 40,000 enterprise customers worldwide. Last year, the company conducted over 110 million such screens, in 29 million reports.

HireRight operates as a holding company, and earlier this month one of its subsidiaries, Backgroundchecks.com, expanded its services to provide background screening in the transport sector. Focusing on small- and medium-sized motor carriers, the subsidiary will offer competitive pricing on the robust checks needed to keep in compliance with Federal-level Transportation Department regulations.

Also this month, HireRight released Q1 earnings showing a 33% increase in the top line year-over-year, to $198.7 million. Operating income jumped even higher, from $5.7 million to $20 million. And, the company’s net income showed similarly impressive gains; y/y, the diluted EPS increased from 12 cents to 37 cents.

All of this comes to a company that only went public this past fall. HireRight held its IPO in October last year, in an event that was somewhat below expectations. The stock was initially priced at $19 per share, against a proposed range of $21 to $24, although HireRight did raise over $421 million from the sale of 22.2 million shares.

Despite the strong earnings results since then, the company’s stock is down 23% this month, caught up in the general market downturn. However, Credit Suisse analyst Kevin McVeigh thinks there’s considerable upside ahead for the stock.

“We expect the HRT stock to continue recovering from its extremely oversold position given an impressive Q1A beat + boosted FY22E guide… The current stock price creates a compelling opportunity for investors to gain exposure to a leading global provider of technology-driven workforce risk management + compliance solutions. Current valuation is much too bearish given margin optionality versus peers amid continued investments in automation and a longer-term model offering ~5-10% organic growth, in our view,” McVeigh wrote.

Unsurprisingly, McVeigh rates HRT an Outperform (i.e. Buy), and his $21 price target implies an upside of 58% for the coming year. (To watch McVeigh’s track record, click here)

This upbeat view of HRT is pretty mainstream, as indicated by the 6 to 1 split favoring Buy reviews over Holds for a Strong Buy analyst consensus on the shares. The average price target of $21.86 indicates room for ~65% growth from the current trading price of $13.28. (See HRT stock forecast on TipRanks)

Copa Holdings (CPA)

The next oversold stock we’re looking at is Copa Holdings, the parent company of Panama-based Copa Airlines and the Colombian domestic carrier Copa Colombia. The airline industry took a heavy hit from the corona pandemic and its travel disruptions, but has been rebounding since it hit bottom in the early part of 2020. Copa, which offers nearly 200 daily scheduled flights to more than 80 destinations in Central America, the Caribbean, South America, and North America, is well situated to gain from the increase in tourist travel.

Copa boasts a 91.3% on-time performance for its flight activities, and completed 99.3% of all scheduled flights; these are solid metrics that position Copa as one of the industry leaders.

Copa reported total revenues in 1Q22 of $571.6 million. This was a far cry from the pandemic-depressed $185.7 million reported in 1Q21. Compared to the last pre-pandemic quarter, 1Q19, Copa’s revenues are down 4%. Included in this result are passenger revenues, which remain at just 83% of the 1Q19 level. The company’s revenue per available seat mile (RASM), a key industry metric, was 10.2 cents in 1Q22, still 3% lower than 1Q19.

On the balance sheet, Copa had $1.2 billion in cash and other liquid assets to end the first quarter, against a total debt of $1.6 billion. The company boasts a strong fleet of Boeing aircraft, totaling 93 planes. This number includes 3 737-700s in storage and one 737-800 air freighter, along with 89 aircraft available for passenger carriage. This compares to 102 planes in action before the pandemic.

Copa shares are down 13% over the past month, and are trading near 12-month lows. According to Seaport analyst Daniel McKenzie the shares are now ‘oversold’ and disconnected from fundamentals.

“First-quarter results were a blowout on better than expected revenue. Looking ahead, we’re modeling the better end of CPA’s 3-5% operating margin guide for 2Q based on underlying demand strength. We’re also concluding that 2Q could easily be another blowout quarter on pent-up demand to the US (from PTY) should the US decide to ease the 24-hr COVID testing requirement (currently impairing int’l demand),” McKenzie opined.

“Net/net, we’re walking away from CPA’s 1Q22 earnings release concluding the airline remains a great recovery story given a ULCC cost structure, premium revenue capability, and a pristine competitive dynamic which are all behind CPA’s industry leading profitability,” the analyst added.

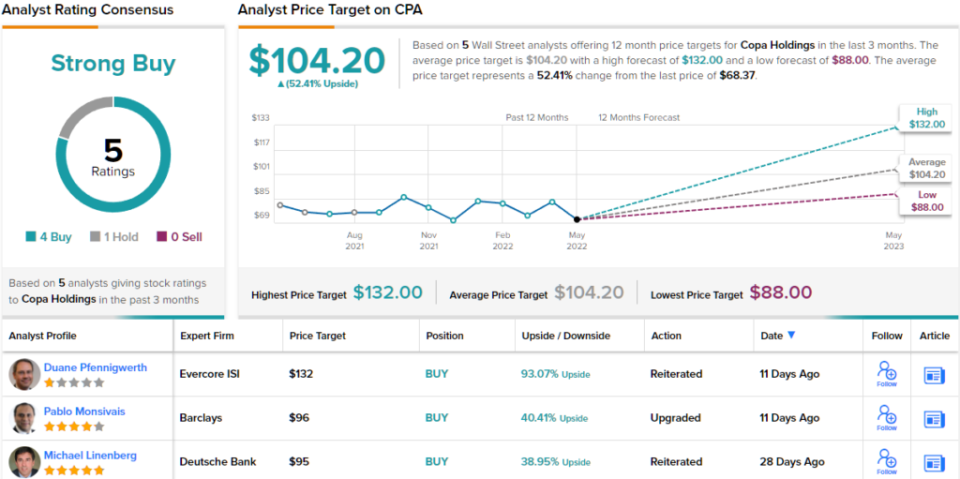

In line with this upbeat outlook, McKenzie rates CPA shares a Buy, with a $108 price target that implies a one-year upside of 58%. (To watch McKenzie’s track record, click here)

Overall, COPA’s Strong Buy consensus rating is backed by 5 recent analyst reviews, which include 4 Buys and 1 Hold. The shares are selling for $68.37 and their $104.20 average price target suggests ~52% upside this year. (See CPA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.