Stocks Mixed, Dollar Rises Amid Cautious Mood: Markets Wrap

(Bloomberg) — Stocks were mixed Monday and the dollar gained as worries over high inflation, tightening monetary policy and China’s Covid lockdowns contributed to investor caution.

Most Read from Bloomberg

U.S. futures rose modestly after slumping in April, the worst month since the pandemic roiled markets more than two years ago. Europe’s Stoxx 600 index followed Asian shares lower in sessions affected by holiday closures. Oil fell.

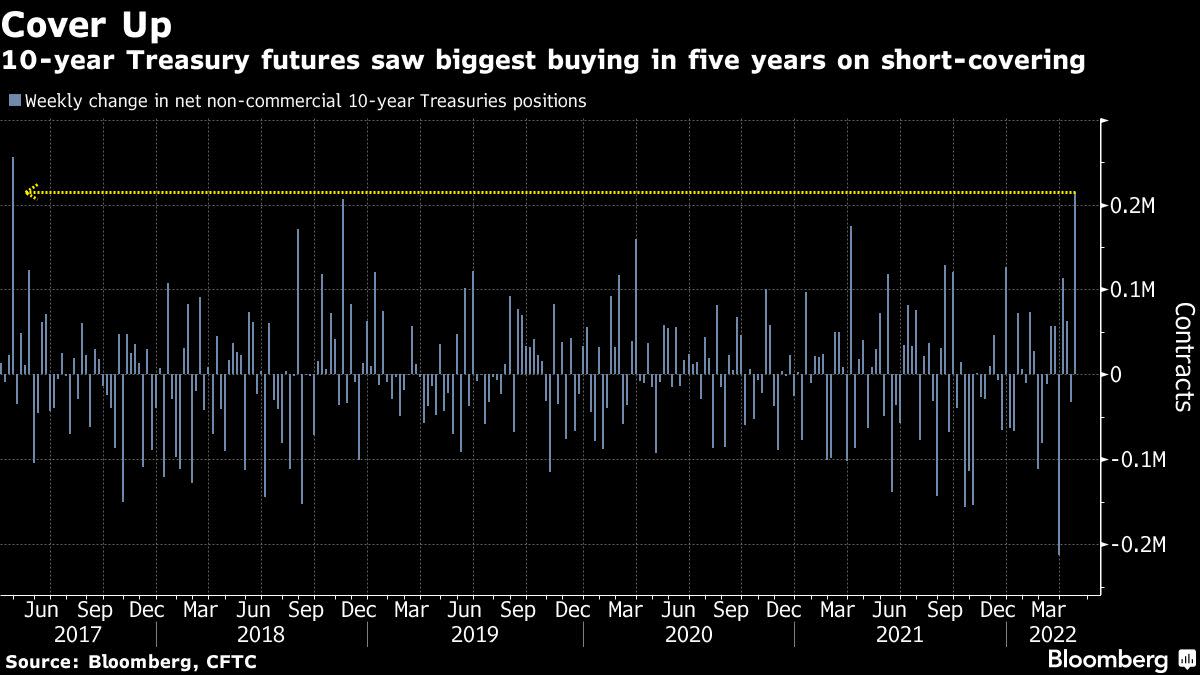

Treasuries advanced after tumbling on Friday and a dollar gauge was around the highest level since 2020 as investors prepare for a week that’s likely to see a global round of central bank tightening.

Confidence in the euro-area economy fell to the lowest in a year as the impact of the war in Ukraine drained overall sentiment from industry to consumers.

Among individuals moves in Europe, Adler Group SA shares plunged after KPMG said it was unable to give an audit opinion and Vestas Wind Systems A/S slumped after forecasting its first loss in a decade.

Dip buyers waded into U.S. markets after Friday’s bruising selloff. Apple Inc., Microsoft Corp and Tesla Inc. advanced in premarket trading. Activision Blizzard Inc. climbed after Warren Buffett snapped up more of the stock in a merger arbitrage bet.

The Federal Reserve is expected to raise rates by 50 basis points on Wednesday, the largest increase since 2000. The question is how high it needs to go to get runaway inflation under control — and whether the aggressive tightening cycle that lies ahead will trigger a recession.

Bond yields may stay “elevated for the foreseeable future” due to inflation and the Fed’s sharp rate hikes allied with balance-sheet reduction, Seema Shah, chief global strategist at Principal Global Investors, wrote in a note.

Japanese institutional managers — known for their legendary U.S. debt buying sprees in recent decades — are now fueling the great bond selloff just as the Federal Reserve pares its $9 trillion balance sheet.

Russia Tension

Price pressures are being stoked by the elevated cost of commodities ranging from fuel to food, in part due to disruptions from Russia’s war in Ukraine.

Those challenges could intensify: the European Union is set to propose a ban on Russian oil by the end of the year, with restrictions on imports introduced gradually until then, according to people familiar with the matter.

Crude fell as traders weighed the escalating tension between Europe and Russia against demand risks from China’s slowdown.

Chinese officials last week promised to scale up economic stimulus, which provided some respite forentiment before a slide on Wall Street on Friday.

The offshore yuan weakened in the wake of data signaling a sharp contraction in Chinese economic activity amid idled factories and snarled supply chains. Japan’s yen was also on the back foot against the greenback.

Key events this week:

-

Earnings include Airbnb, Airbus, BMW, BNP Paribas, BP, Credit Agricole, Hilton, ING Groep, Pfizer, Shell, Starbucks, Uber, VW

-

Reserve Bank of Australia rate decision, Tuesday

-

Fed rate decision, briefing with Chair Jerome Powell, Wednesday

-

EIA crude oil inventory report, Wednesday

-

Bank of England rate decision and briefing, Thursday

-

OPEC+ convenes virtually for a regular meeting, Thursday

-

U.S. April jobs report, Friday

Some of the main moves in markets:

Stocks

-

Futures on the S&P 500 rose 0.4% as of 6:25 a.m. New York time

-

Futures on the Nasdaq 100 rose 0.5%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The Stoxx Europe 600 fell 0.9%

-

The MSCI World index fell 1.8%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.2% to $1.0522

-

The British pound was little changed at $1.2569

-

The Japanese yen fell 0.2% to 130.02 per dollar

Bonds

Commodities

-

West Texas Intermediate crude fell 3% to $101.60 a barrel

-

Gold futures fell 1.7% to $1,878.50 an ounce

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.